Quick take:

- ApeCoin swang to record highs before plunging to end the week lower after launching the Otherside metaverse land sale.

- The STEPN utility token $GMT spiked sharply on Friday before pulling back slightly during the weekend.

- Both the metaverse and NFTs & Collectibles token ended the week lower from the previous week.

In this edition of the token boom report, the metaverse and NFTs and Collectibles tokens pulled back significantly to end the week lower from the previous period. Nonetheless, there were still some tokens that ended the week higher, while others spiked earlier in the week before trimming gains towards the end.

From an industry perspective, the leading NFT marketplace OpenSea expanded its addressable market after announcing its acquisition of NFT aggregator platform Gem. Elsewhere, STEPN’s Asics Sneaker NFT drop surged to a transaction volume of more than $15 million within a day, attracting more investors.

Venture capital funding continued to increase after popular soccer app, OneFootball raised $300 million to bring football-themed games to the blockchain, while Dragonfly Capital revamped its Web3 plan with a $650 million third fund to invest in blockchain games and other crypto projects.

Metaverse tokens

Metaverse tokens plummeted to a total market cap of about $23.17 billion down from the previous week’s capitalisation of $27.7 billion. However, interest in the metaverse remains high according to a report by DappRadar for Q1, 2022.

Nonetheless, while tokens related to the metaverse lost value overall, some like the Render $RNDR token had a relatively great week, while others like ApeCoin $APE returned mixed performances after massive swings during the seven day period.

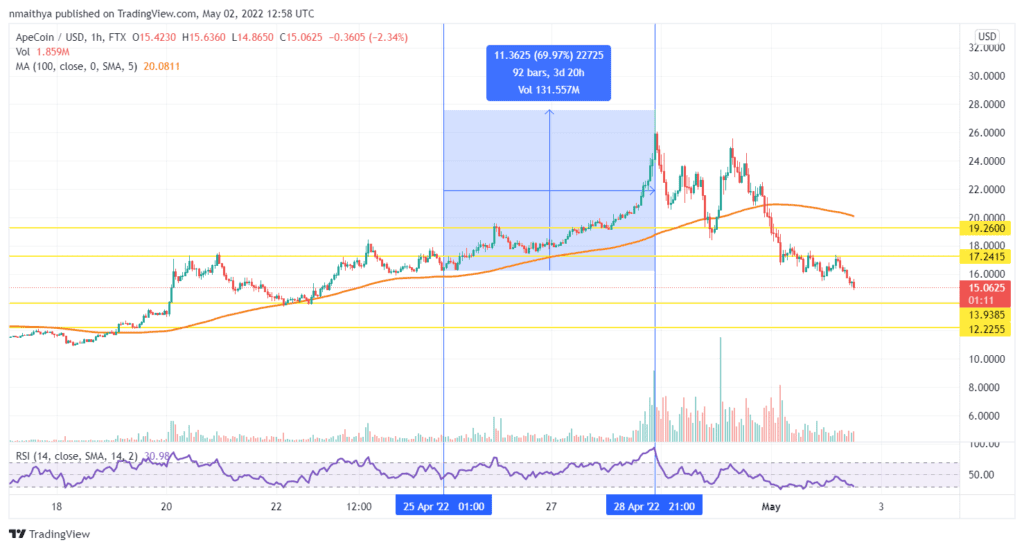

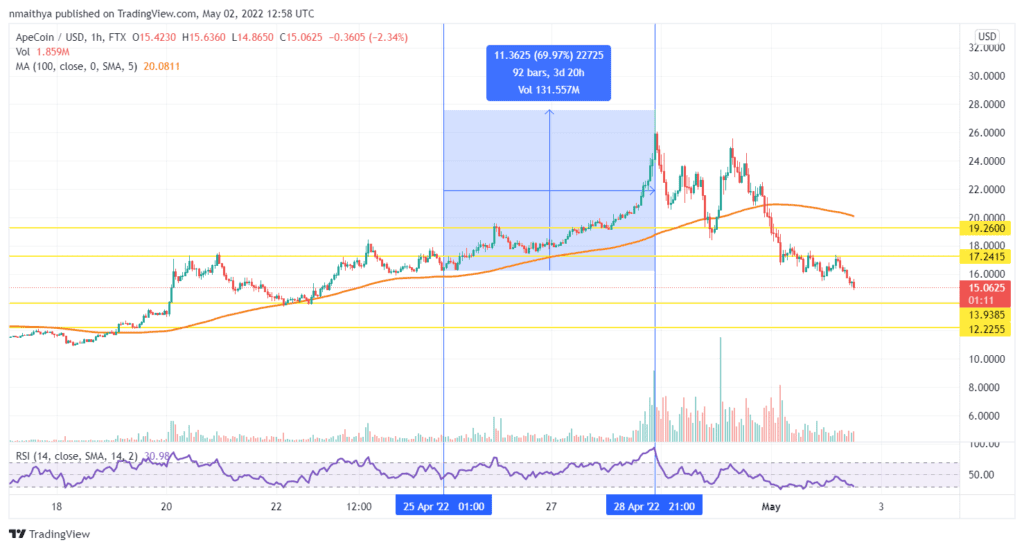

ApeCoin (APE/USD)

ApeCoin was the most popular metaverse token this past week after its price rocketed to a high of about $27 momentarily before pulling back towards the end of the week. The 70% spike in price pushed ApeCoin to the top of the chart for most valuable metaverse tokens, momentarily hitting a market capitalisation of $7 billion.

However, the $APE token price plummeted during the weekend after its highly anticipated Otherside metaverse land sale was oversubscribed, subsequently crushing the Ethereum blockchain.

Technically, the $APE token price seems to have recently declined, creating another opportunity to buy the dip. Therefore, traders could target potential rebound profits at about $17.24, or higher at $19.26.

On the other hand, $13.93 and $12.22 are crucial support zones.

Render Token (RNDR/USD)

Render is distributed graphics processing unit (GPU) used by artists on the network to exchange for GPU compute power from GPU providers (node operators). Its utility token $RNDR is an ERC-20 token used as the base currency for transactions within the ecosystem.

The $RNDR token spiked sharply by nearly 50% over the weekend to trim weekly losses. The token hit a high of about $1.80, eventually closing slightly higher than it opened on Monday.

Technically, traders will be targeting extended gains at about 1.63, or higher at $1.70 following a slight pullback on Monday. On the other hand, $1.47 and $1.39 are crucial support levels.

Mines of Dalarnia (DAR/USD)

Mines of Darlania an action-adventure game with a metaverse real-estate market, where players can mine resources and fight monsters. The play-to-earn game’s ecosystem is powered by the $DAR token, which can be earned by winning battles, selling in-game items or mined resources.

The game launched n Mainnet last week, sparking a 139% rise in the $DAR token price.

However, it has since pulled back to trim the gains after it suffered a downtime towards the end of the week.

Technically, the Mines of Dalarnia $DAR token seems to have pulled back significantly, creating another opportunity for a rebound. Therefore, traders could target potential rebound profits at about $1.34, or higher at $1.49.

On the other hand, $1.11 and $0.95 are crucial support zones.

NFTs and Collectibles tokens

The NFTs and Collectibles tokens also pulled back significantly over the last seven days falling from a total market cap of more than $41 billion to the current level of about $35.6 billion.

This is despite witnessing a significant level of activity both in terms of NFT collection drops and venture capital activity.

STEPN (GMT/USD)

STEPN’s NFT drop debuted to good reception with transaction volume rocketing to $15 million shortly after launch.

As a result, the $GMT token spiked more than 43% before pulling back during the rest of the week to close lower than it opened on Monday.

Technically, the $GMT token price seems to have recently pulled back significantly, falling to trade at about $1.386. Therefore, traders could target potential rebound profits at about $3.566, or higher at $3.895, while $3.292 is a crucial support level.

Telos (TLOS/USD)

Telos is a layer-1 Ethereum Virtual Machine (EVM) offering highly scalable solutions to Ethereum developers. The platform allows project developers to launch NFTs and gaming tokens targeted at the P2E ecosystem.

It also supports smart contracts and DeFi. Telos already supports over 100 distinct applications (dApps) including Taikai, Qudo, Qubicles, Wordproof, and NewLife, among others.

Its native token $TLOS recently launched on HotBit where traders can trade it against the USD Tether. The Telos Foundation also said on Saturday “something big is coming soon,” which helped to drive the $TLOS price higher over the weekend.

Technically, traders can target profits at about $0.80, or higher at $0.83. On the other hand, $0.72 and $0.69 are crucial support zones.

Biswap (BSW/USDT)

Biswap is a decentralised exchange platform for BEP-20 tokens. The platform supports, among other activities, yield farming and NFT marketplaces. The $BSW is part of the BNB Chain, thus promising the lowest transaction fees of any BSC exchange at 0.1%.

The BSW reached $1 billion total value locked (TVL) last week, with the announcement sparking a major pullback in the token price.

The platform had announced its partnership with Exobots game earlier in the week, which sparked a rally o nearly 40%.

Technically, the $BSW token price seems to have pulled back significantly over the last three days, creating another window of opportunity for buyers. Therefore, traders could target potential rebound profits at about $1.15, or higher at $1.22.

On the other hand, $1.05 and $1.00 are crucial support zones.

Stay up to date: