Quick take:

- Apecoin spiked nearly 70% after Yuga Labs revealed the Otherside metaverse will be launching by the end of April.

- Dotmoovs revealed it will be listed on Huobi extending weekly gains to more than 370%.

- STEPN launched the Asics Sneaker NFT drop, sparking a 70% gain in the $GMT token.

In this week’s edition of the token boom report, the metaverse and NFTs & Collectibles tokens gained marginally from last week to end a sequence of weekly declines that dates back to late March. The rebound was triggered by a flurry of positive developments within the NFTs and metaverse segments of the crypto market.

The Moonbirds NFT collection had kicked off things earlier in the week, after making a triumphant debut. The digital owl collectibles spiked to more than $290 million in transaction volume within three days, with the floor price rising to about 26 ETH, from 7.5 ETH. In mid-week, Coinbase NFT added more attention to the space after launching its socialized marketplace in beta.

Elsewhere, the Cricket NFT platform Rario completed a $120 million funding round while Bloomberg reported Animoca Brands’ The Sandbox was planning a $400 million funding round, valuing the metaverse platform at about $4 billion.

Popular crypto exchange Okcoin also announced the launch of its zero-fee NFT marketplace, also becoming the first regulated crypto exchange to offer NFT services with uncapped royalties.

Metaverse tokens

Over the last seven days, the metaverse tokens segment bounced back to reach a market cap of $27.7 billion, up from the previous week’s equivalent of $26.7 billion.

One of the segment’s leading headlines came from Framework ventures, which launched a $400 million fund, committing $200 million to Web3 gaming. The Sandbox was also reported to be planning a $400 million fundraising.

Apecoin and Dotmoovs were among the top gainers, while X World Games also experienced significant gains earlier in the week.

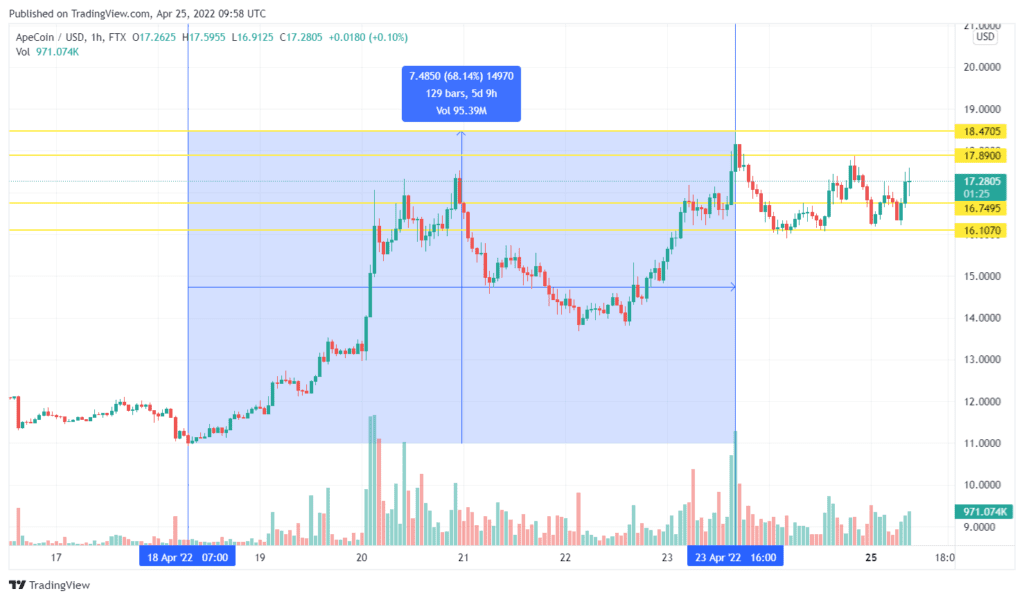

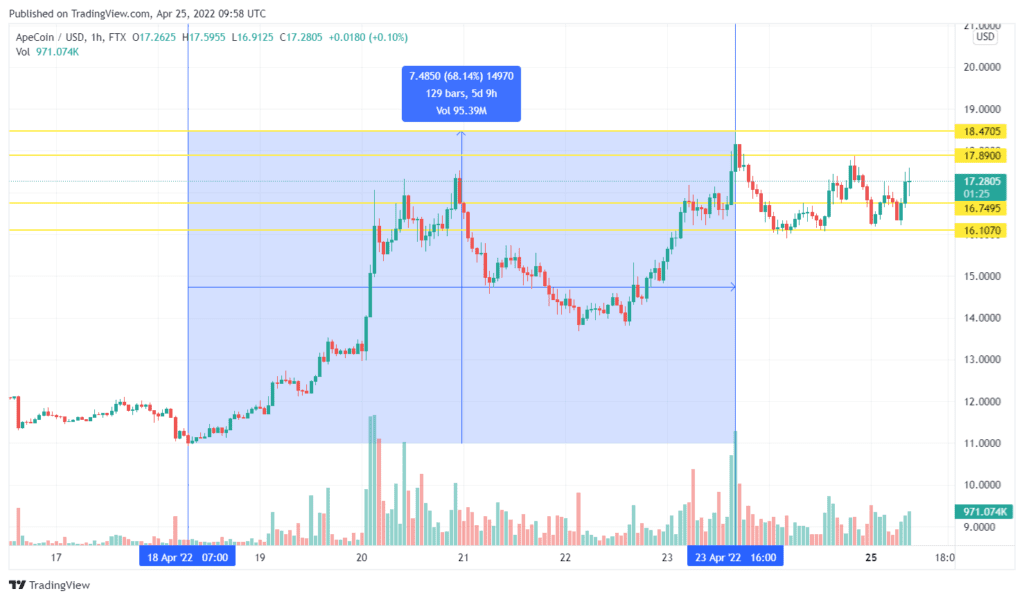

Apecoin (APE/USD)

Apecoin added a significant value to the overall metaverse tokens market cap after rallying nearly 70%. The spike in the $APE price was triggered by the announcement that it will launch the Otherside metaverse by the end of April.

Later in the week, the OthersideMeta, the official Twitter account of Yuga Labs’ metaverse platform tweeted: “The adventure begins. Otherside. 4/30, 12pm ET.”

Technically, the $APE token seems to have slightly pulled back from its weekly highs creating an opportunity for another rebound.

Therefore, traders could target more upward profits at about $17.89, or higher at $18.47. On the other hand, $16.74 and $16.10 are crucial support zones.

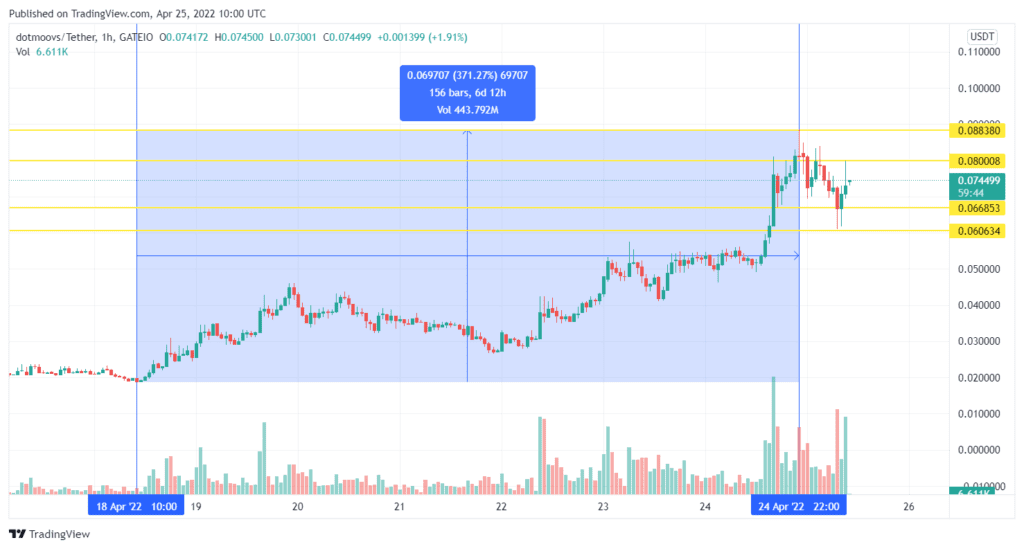

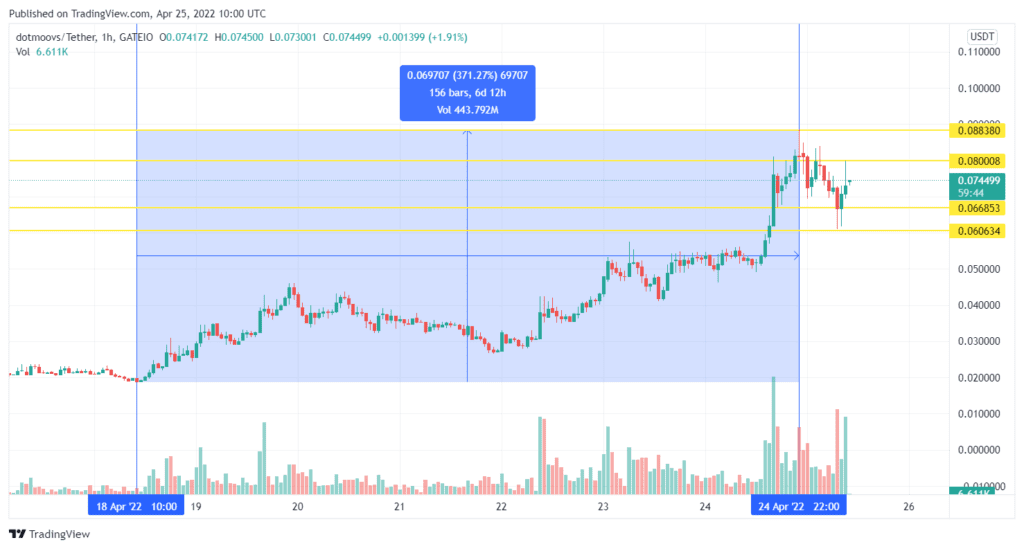

Dotmoovs (MOOV/USDT)

Dotmoovs’ native token $MOOV has rocketed more than 370% after announcing its listing on Huobi. The peer-to-peer sports competition platform announced the listing on Thursday, sparking a huge rally in the $MOOV token price.

However, the price started to pull back late on Sunday ahead of Monday’s launch. The platform has developed an algorithm enabling users to deploy various sports tricks in short video clips.

Technically, the $MOOV token price seems to be bouncing back from Sunday’s pullback. Therefore, traders could target extended rebound profits at about $0.080, or higher at $0.088. On the other hand, $0.066 and $0.060 are crucial support levels.

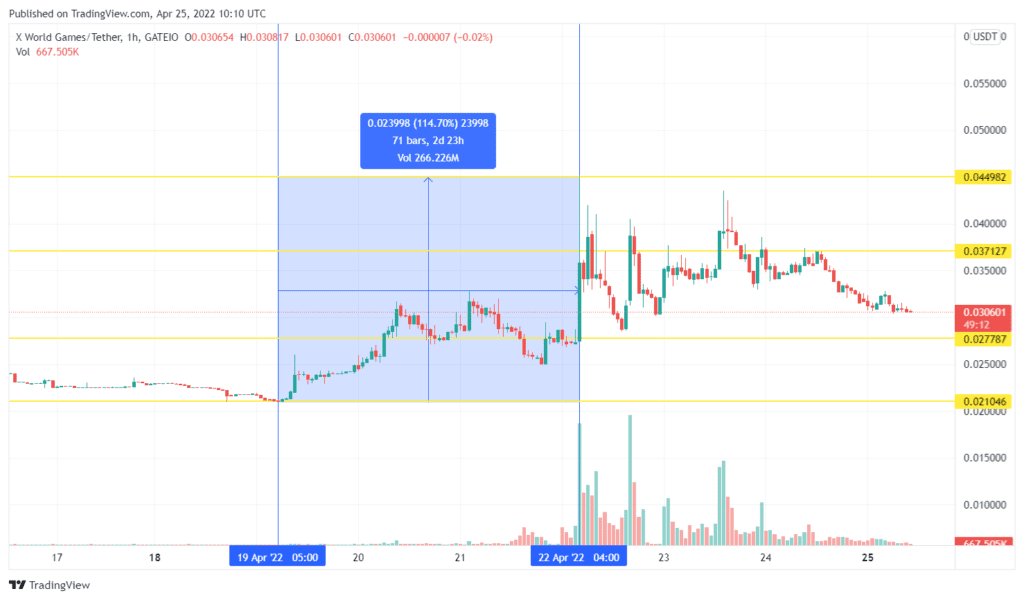

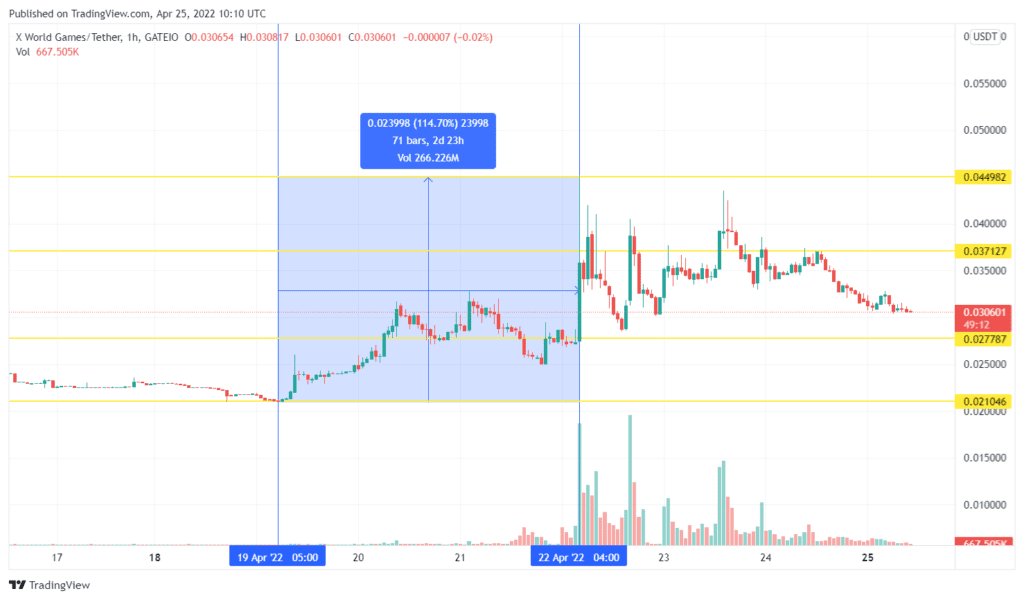

X World Games (XWG/USDT)

X World Games is one of the leading BNB Chain-based gaming ecosystems. The decentralised gaming platform allows members to participate in play-to-earn games inspired by the popular monster hunter extended reality game Pokemon.

The platform is governed using the $XWG token, which the community can use to vote on important matters in a decentralised governance system.

KuCoin recently announced in partnership with X World Games a joint airdrop of 5 million XWG sparking the latest rally in $XWG.

However, the price has since pulled back to trim the gains. The platform has also revealed a series of gaming updates coming this May.

Technically, traders could target potential rebound profits at about $0.037, or higher at $0.045. On the other hand, $0.027 and $0.021 are crucial support zones.

NFTs and Collectibles tokens

The NFTs and Collectibles segment of the crypto market bounced back to a market cap of $41.45 billion up from the previous week’s equivalent of $38.9 billion.

The segment benefitted from a series of major NFT announcements including the Coinbase NFT beta launch and Moonbirds’ bullish debut.

However, leading the trading charts were STEPN, Immutable X and FIO Protocol.

STEPN (GMT/USD)

STEPN is a Web3 lifestyle application with socialised features and a gamified design. The platform offers an in-app marketplace where users can sell their NFT Sneakers. They can upgrade the quality of mintable sneakers depending on the number of $GMT tokens they hold.

Last week, STEPN announced the Asics Mystery Box NFT drop for Asics Sneakers sparking a rally of more than 70% in the price of $GMT.

The NFTs are available on the BNB Chain NFT marketplace. The $GMT price has pulled back slightly since Wednesday last week when it traded at $3.75.

Technically, traders will be targeting potential rebound profits at about $3.38, or higher a $3.75. On the other hand, $3.05 and $2.82 are crucial support zones.

Immutable X (IMX/USD)

Immutable is a layer-2 Ethereum scaling solution created to make minting of ethereum-based NFTs cheaper gas fees whilst making transactions faster. The platform enables users to create and distribute assets like ERC-20 and ERC-721 tokens on a massive scale.

The $IMX token rallied more than 34% earlier in the week before pulling down gradually to eliminate the gains.

Therefore traders could target potential rebound profits at about $1.74, or higher at $1.86. On the other hand, $1.57 is a crucial support level.

Fio Protocol (FIO/USDT)

Fio Protocol is a blockchain ecosystem based on a delegated proof-of-stake (DPoS) mechanism that enables users to send coins and tokens between blockchains. The $FIO token is the native token of the platform that can also be used to vote on various governance matters.

Fio Protocol launched FIO staking last week, giving the stakers an opportunity to earn the greatest rewards by staking before activation.

However, the $FIO token price has since pulled back following Wednesday’s spike, giving traders an opportunity to buy before the next rebound.

Therefore, traders could target potential rebound profits at about $0.101, or higher at $0.106. On the other hand, $0.093 and $0.087 are crucial support zones.

Stay up to date: