Quick take:

- Over the last seven days, ApeCoin spiked more than 40% while Splintershards rallied by $31%.

- Syscoin, Ultra token, Monsta Infinite and Wilder World were also among the top gainers.

- Gutter Clones, Gutter Dogs and Gutter Cat Gang were the highest gainers with a transaction volume of at least 100 ETH.

In this edition of the weekly token boom report, NFTs and metaverse tokens edged slightly lower amid the current market downturn. However, the industry still witnessed a significant inflow in venture capital funding with leading blockchain games and metaverse company Animoca Brands raising $110 million.

Later in the week, Singapore’s Whampoa Group launched a $100 million web3 fund to invest in early-stage startups, while Revolving Games announced the completion of a $25 million funding round led by Pantera Capital.

Elsewhere, leading games retailer GameStop teamed up with FTX US to onboard masses into Web3, while LG launched an integrated NFT marketplace accessible to its smart TVs.

Metaverse tokens

Over the last seven days, metaverse tokens edged lower to a market cap of $12.58 billion amid the crypto market downturn. However, the segment continued to receive significant venture capital funding with Animoca Brands the company leading the campaign for the open metaverse raising $110 million.

Leading sportswear brand Puma also jumped on the web3 train with a new metaverse experience featuring exclusive NFTs, while Crocs teamed up with esports company Gen.G to launch a metaverse experience on Zepeto.

Overall, ApeCoin, Ultra token and Monsta Infinite were among the top gainers in the segment.

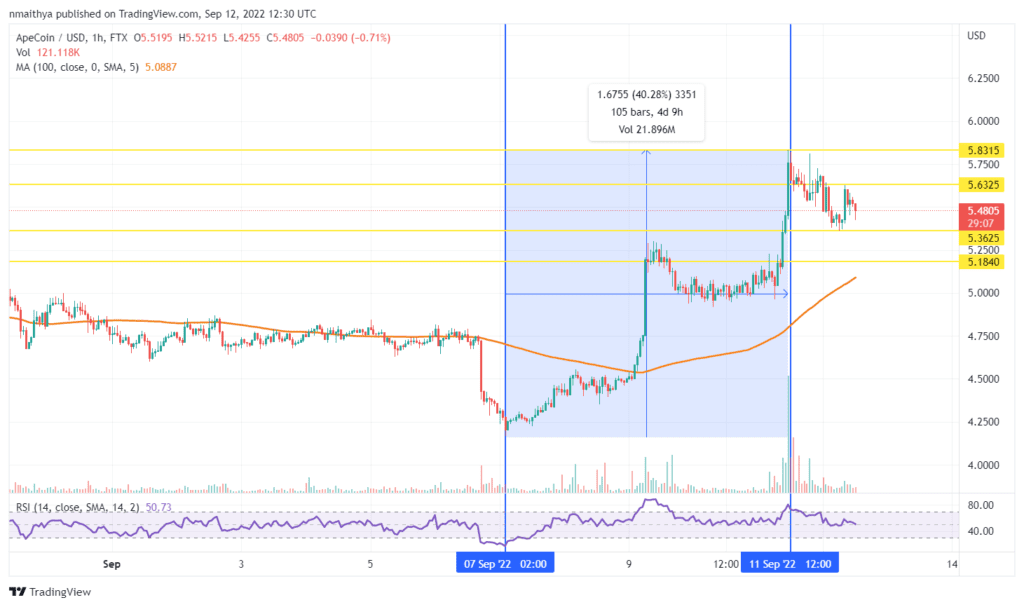

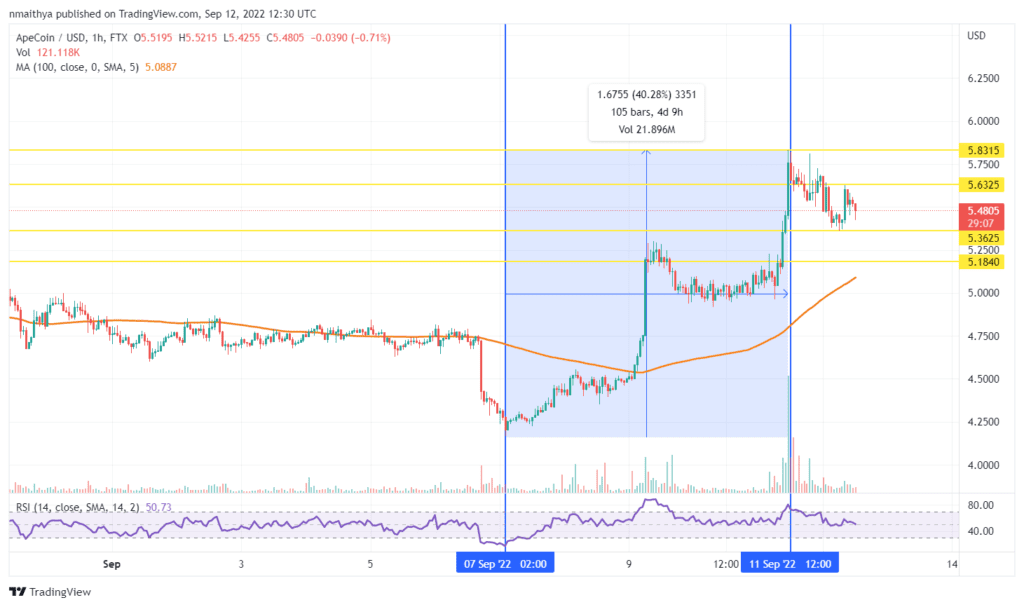

ApeCoin (APE/USD)

ApeCoin is the native token of ApeDAO, the governing community of OtherSide Meta, Otherdeeds and all NFT projects by Yuga Labs.

The $APE token rallied more than 40% between September 7-11 before pulling back on Monday morning.

Technically, traders could target potential rebound profits at about $5.63 or higher at $5.83. On the other hand, if the $APE token price continues to pull back, it could find support at about $5.36 or lower at $5.18.

Ultra token (UOS/USD)

Ultra is a decentralised video game development platform created to empower gaming communities. According to the platform website, Ultra aims to “provide new opportunities to game developers, players, and influencers.”

Last week, Ultra announced its expansion to the broader community including the launch of a Chrome extension that connects to other gaming metaverses like The Sandbox.

The $UOS token rallied more than 50% following the announcement before pulling back slightly on Sunday.

Technically, traders could target an extension of the current rally towards $0.471 or higher to $0.491. On the other hand, if the $UOS token price pulls back, it could find support at about $0.439 or lower at $0.420.

Monsta Infinite token (MONI/USDT)

MONI is the native token of an MMPORG (massively multiplier online roleplaying game) monster battle game developed by Monsta Infinite.

The game initially launched as a fork of the popular NFT game Axie Infinity. However, according to the description on its website, it has grown to address some of the biggest challenges NFT games face.

The $MONI token spiked 140% towards the end of last week following the completion of the token allocation for early investors and venture capital firms.

However, it has since pulled back to create an exciting entry opportunity for investors looking to buy the rebound.

Technically, traders could target potential rebound profits at about $0.119 or higher at $0.128. On the other hand, if the pullback continues, the $MONI token could find support at about $0.100 or lower at $0.090

NFTs and Collectibles tokens

In the past seven days, NFTs and collectibles tokens fell to a market cap of about 9.29 million ETH ~$16.09 billion amid the NFT market downturn. Transaction volume also edged lower by 10% falling to 59.13k ETH ~$102 million.

However, despite the crypto winter, the industry continued to witness huge partnerships and venture capital funding.

FTX US signed a deal with GameStop to onboard millions of gamers into web3 amid the online game retailer’s deepening losses.

Former Meta executives raised $300 million to power the next generation of web3 apps, while BNB Chain followed Polygon with its own version of zero knowledge proof-based scaling solution for web3 apps with zkBNB.

Splintershards, Syscoin and Wilder World were among the top gainers in the category during the week.

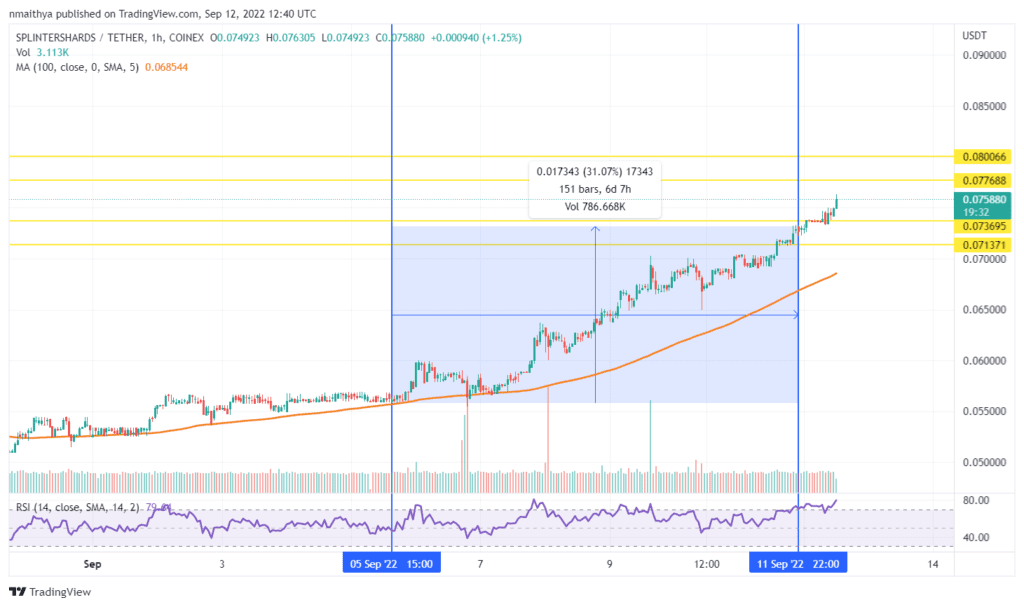

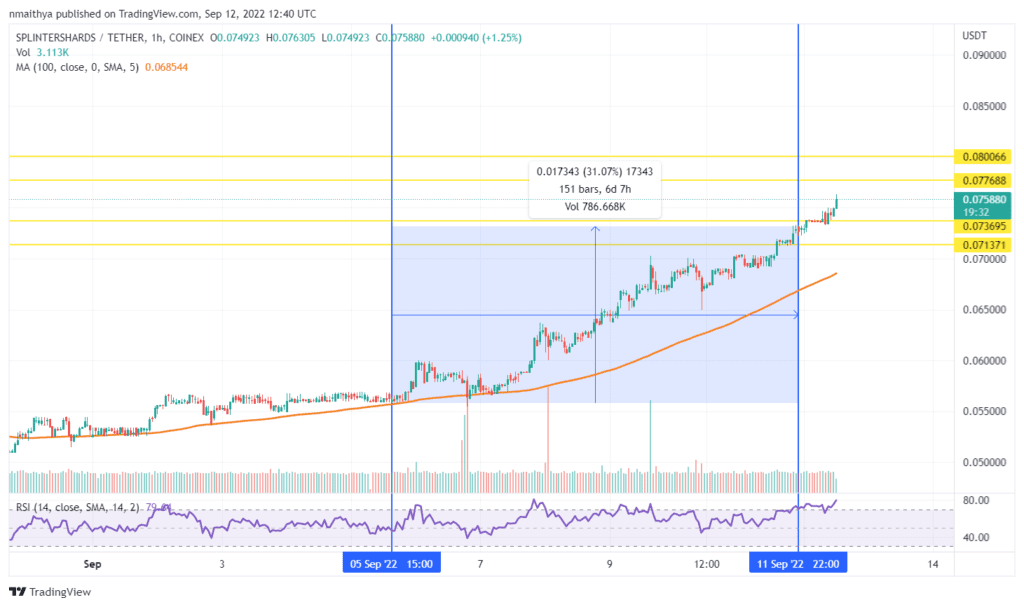

Splintershards token (SPS/USD)

Splinterlands is an NFT-based card game where players collect different cards to battle with other players. The game is inspired by popular physical card games like Magic the Gathering and Hearthstone.

The game’s ecosystem token is Splintershards (SPS), which is used to facilitate transactions for in-game items, purchase of digital card collectibles and staking, among others.

Last week, Splintershards rallied more than 30%before extending gains on Monday.

Therefore, traders could target extended gains at about $0.077 or higher at $0.080. On the other hand, if the $SPS token pulls back, it could find support at about $0.073 or lower at $0.071.

Syscoin token (SYS/USD)

Syscoin is a decentralised blockchain ecosystem that supports the creation of web3 apps with Layer 1 level security and Layer 2 scalability. The platform is among blockchain builders chasing infinite scalability through zero-knowledge rollups.

The bitcoin-based platform supports the deployment of massive projects like non-fungible tokens (NFTs) and decentralised autonomous organisations (DAOs).

Syscoin token $SYS rallied 42% between September 7-11 before extending gains on Monday.

Technically, traders could target extended gains at about $0.196 or higher at $0.206. On the other hand, if the $SYS token pulls back, it could find support at about $0.186 or lower at $0.175.

Wilder World (WILD/USD)

Wilder World is a metaverse gaming ecosystem that wants to bring fully virtual people, places, and things to the metaverse. The $WILD token is the native token of the platform used to facilitate transactions within the ecosystem.

It also acts as a governance token of Wilder DAO through a voting mechanism based on the number of tokens staked by qualifying members.

Last week, the $WILD token price rallied more than 36% before pulling back on Monday.

Therefore, traders could target potential rebound profits at about $0.291 or higher at $0.301. On the other hand, if the pullback continues, the $WILD token could find support at about $0.270 or lower at $0.260.

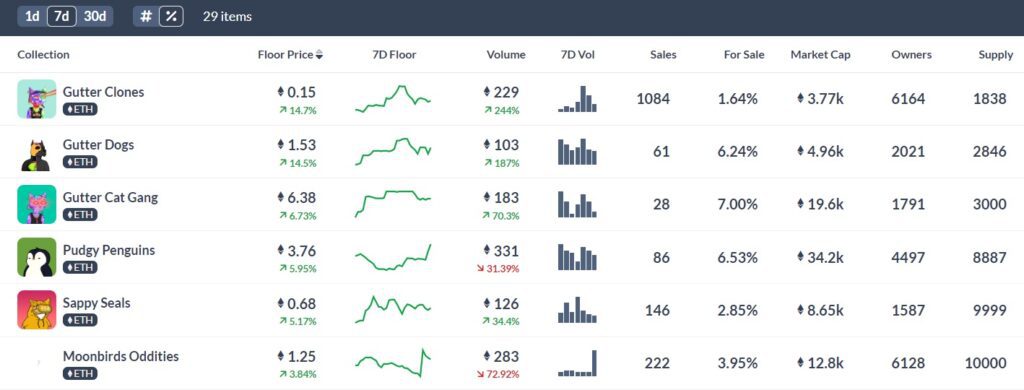

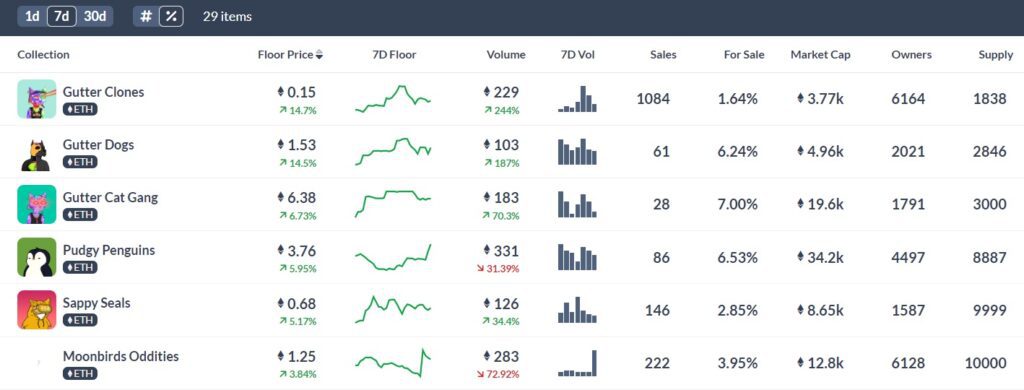

Top Floor Price Gainers – On-Chain NFTs

Over the last seven days, Gutter Clones led On-Chain NFTs with the biggest gain in the floor price for projects with at least 100 ETH in transaction volume, rising $14.7%. Gutter Dogs and Gutter Cat Gang followed closely ins second and third places with 14.5% and 6.73% gains, respectively.

Pudgy Penguins was also among the risers with a 5.95% gain in the floor price, with Sappy Seals and Moonbirds Oddities sealing the top six.

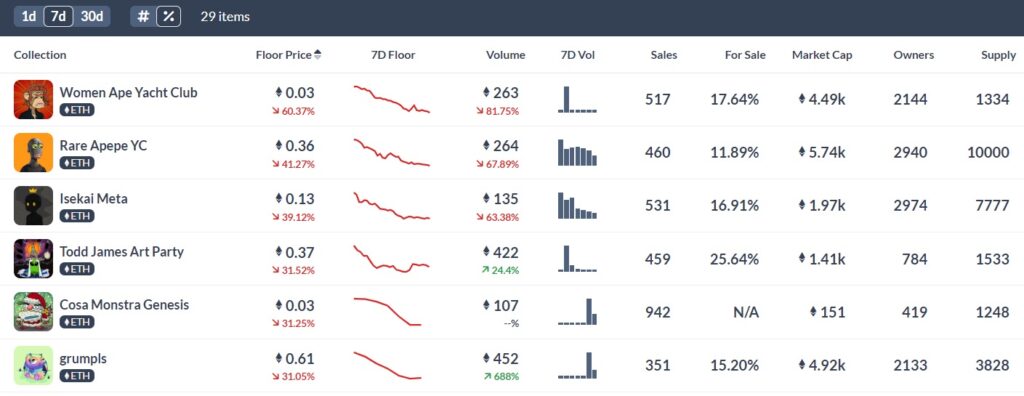

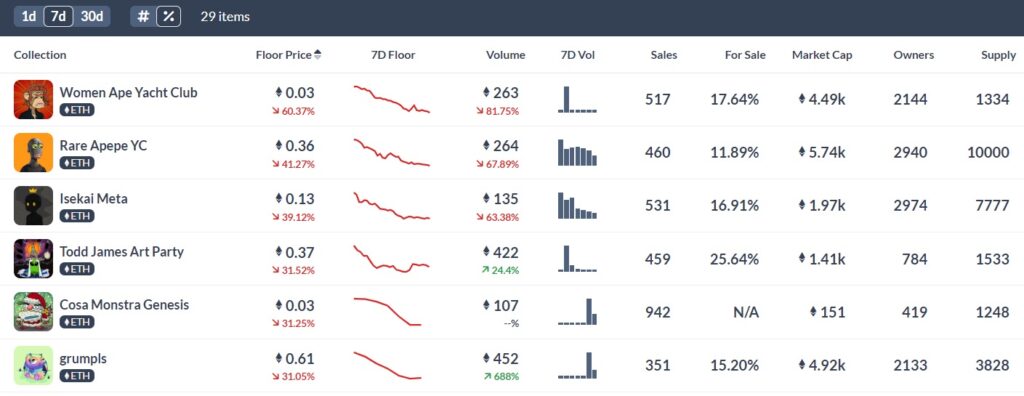

Top Floor Price Decliners – Chain NFTs

While gainers were few and far between, it wasn’t hard to spot the biggest decliners. Women Ape Yacht Club topped the list of collections with at least 100 ETH transaction volume after its floor price fell by more than 60%.

Rare Apepe YC and Isekai Meta followed with declines of 41.27% and 39.12%, respectively.

Todd James Art Party saw its floor price decline by 31.52%, while Cosa Monstra Genesis and Grumpls fell by 31.25% and 31.05% respectively.

Stay up to date: