Quick take:

- Gods Unchained advanced more than 52% late last week before pulling back on Monday.

- Chiliz extended the previous week’s gains before running out of steam towards the end of last week.

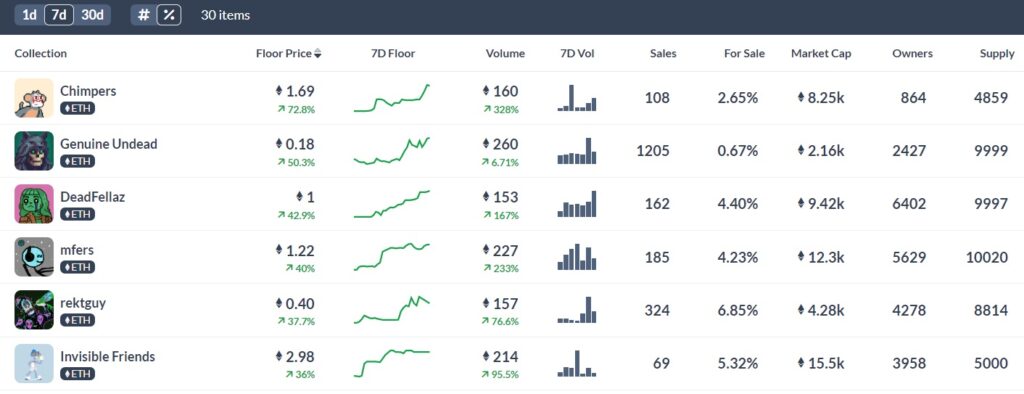

- Chimpers, Genuine Undead and DeadFellaz posted the highest gains in floor prices for NFTs with at least 100 ETH in transaction volume.

In this edition of the weekly token boom report, the metaverse, NFTs and collectibles token prices continued to fall contributing to a significant decline in the market caps of both segments.

However, the industry continued to witness significant inflow in venture funding with Digital Transformation Capital Partners (DTCP) completing the first close of a $300 million fund for Web3, fintech and cybersecurity among other verticals.

Elsewhere Andreessen Horowitz led Sardine’s $51.5 million funding round to build a fraud detection solution for the web3 and fintech companies, while Random Games raised $7.6 million for its Unioverse franchise.

On-Chain data indicates that NFT floor prices continued to recover while the transaction volume rose marginally.

Metaverse tokens

Over the last seven days, metaverse token prices continued to decline, pushing the overall segment market cap to $10.8 billion, down from the previous week’s equivalent of about $11.27 billion.

However, the segment still witnessed significant venture capital activity with Random Games raising $7.6 million to build a gaming ecosystem dubbed Unioverse, while graphics processing unit giant Nvidia launched its revolutionary metaverse builder platform Omniverse in 100 countries.

Overall, Gods Unchained, Somnium Space and Reef Finance were among the few metaverse tokens to end the week on the higher side of the price chart.

Gods Unchained token (GODS/USD)

This free-to-play tactical card game is powered by the $GODS token, the ecosystem coin used to facilitate transactions in the game.

Gods Unchained is a competition-based game, which means players must form strategies in order to rise up the ranks and unlock more rewards and game modes.

The $GOD token trimmed the previous week’s gains early on in the week, before bouncing back to post 52% gains in the last three days of the week.

However, the price has since pulled back, presenting another opportunity to buy.

Technically, traders could target potential rebound profits at about $0.45 or higher at $0.48. On the other hand, if the $GODS token price continues to fall, it could find support at about $0.40 or lower at $0.37.

Reef Finance token (REEF/USD)

REEF is a highly scalable blockchain solution designed for decentralised finance (DeFi) apps, non-fungible token (NFT) projects and blockchain gaming. The platform is powered by the $REEF token, which is used to facilitate transactions for marketplace users. Last week, REEF announced a partnership with Curate Project to unlock higher interoperability.

The announcement sparked a sharp spike in the $REEF token price before pulling back on Sunday.

Technically, traders could target potential rebounds at about $0.00516 or higher at $0.00536. On the other hand, if the decline continues, the $REEF token could find support at $0.00479 or lower at $0.00458.

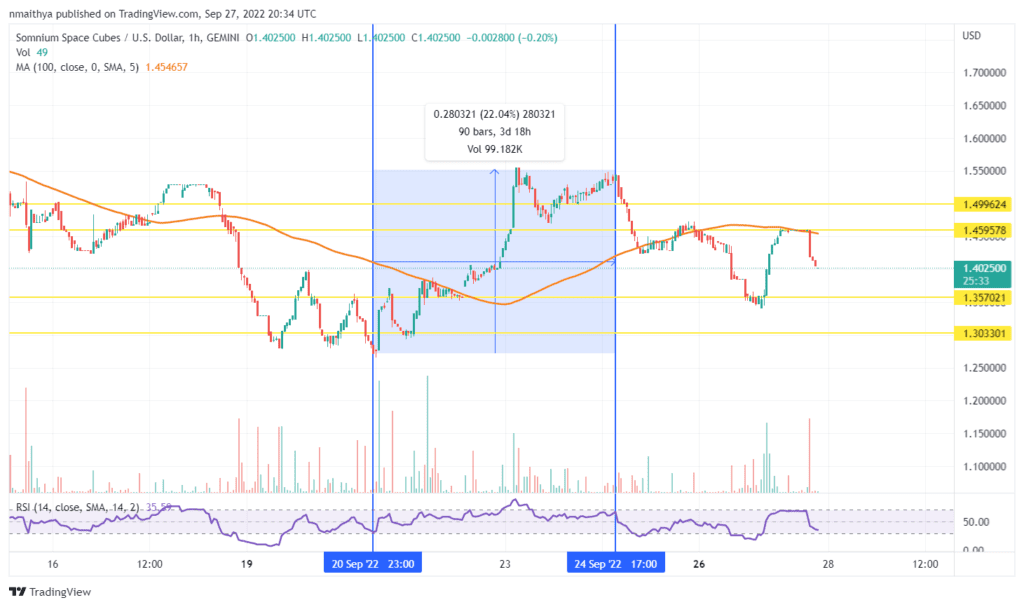

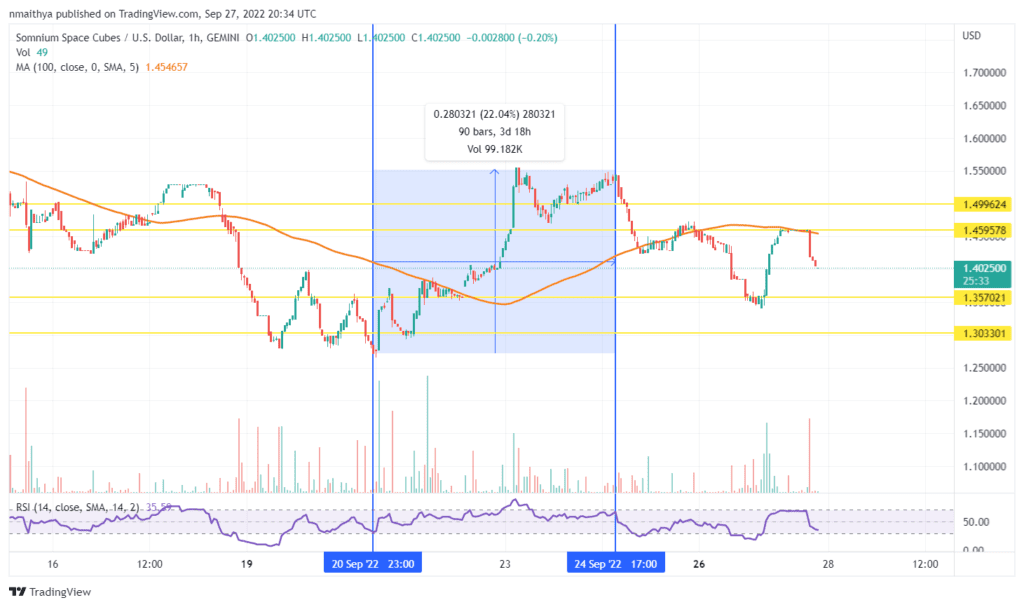

Somnium Space Cubes (CUBE/USD)

Somnium Space Cubes is a blockchain-based metaverse world that allows users to buy NFTs and ERC20 in-game tokens. The platform offers immersive experiences for mainstream industries ranging from education to entertainment.

Last week, Somnium Space launched Somnium Space Web WORLDs, a feature that enhances the accessibility and capability of Somnium Space Cubes, triggering a late surge in the $CUBE token price on Friday.

The token price has since pulled back creating an opportunity for a rebound.

Technically, traders could target potential rebound profits at about $1.46 or higher at $1.50. On the other hand, $1.35 and $1.30 are crucial support zones.

NFTs and collectibles tokens

Over the last seven days, NFTs and collectibles tokens experienced a significant rise in the transaction volume, which increased to $101.19 million up from $91.6 million in the preceding week.

On the other hand, the overall market cap continued to edge slightly higher to $22.09 billion up from $22.08 billion in the previous week despite a relatively bearish crypto market.

Optimism in the market was driven by the continued influx of mainstream companies and venture capital activity.

National Lampoon launched its first web3 studio, also announcing the Poison Pill NFT, while Crypto.com invested in Web3 finance management platform Headquarters’ $5 million raise. Elsewhere, leading NFT marketplace OpenSea added Arbitrum to its list of supported blockchains to accelerate cross-chain interoperability.

Overall, Chiliz, Oasis Network and MagicCraft tokens led gains in NFTs and collectibles tokens.

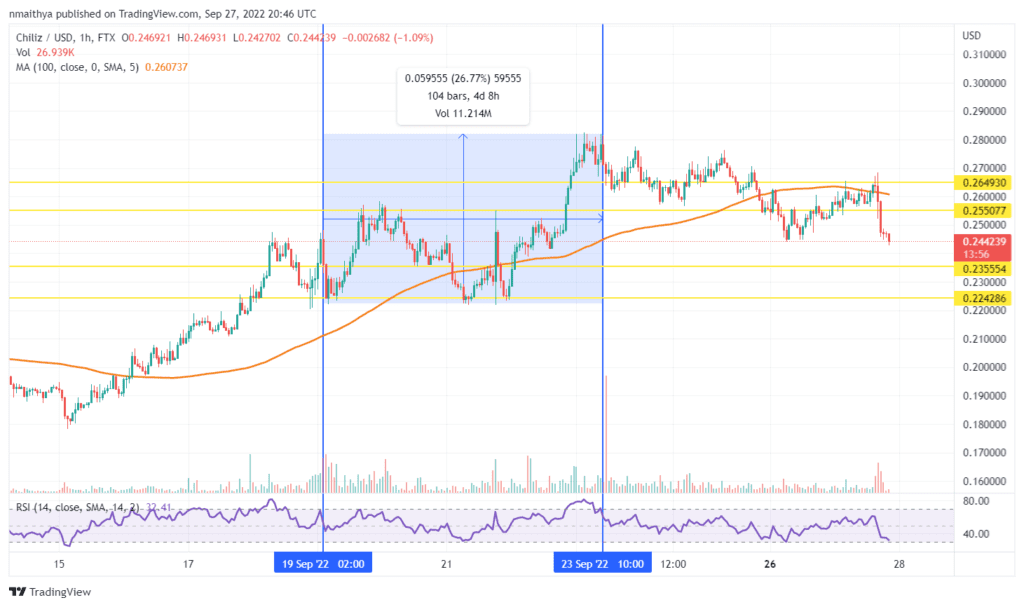

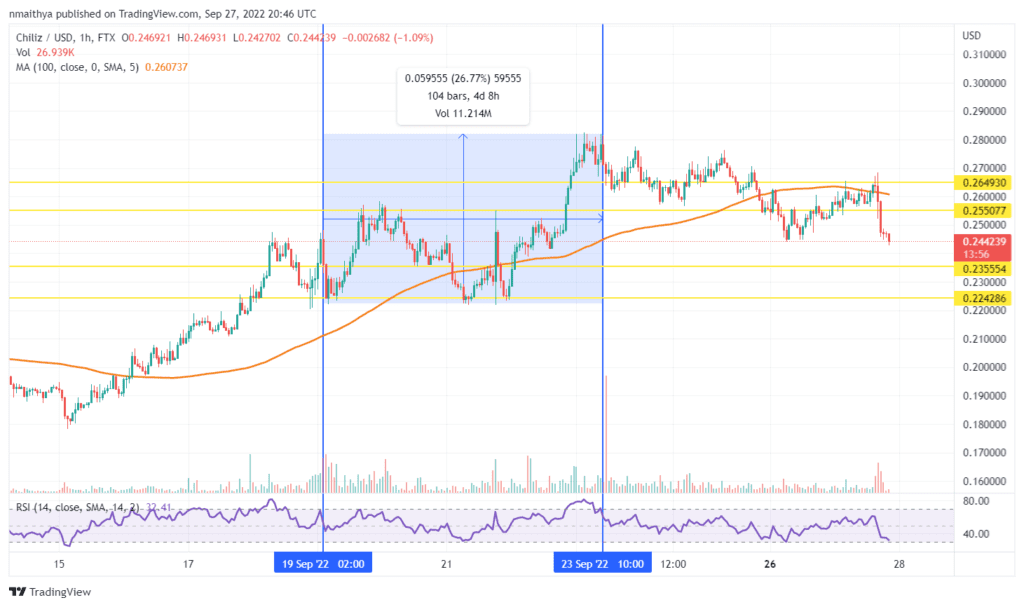

Chiliz token (CHZ/USD)

The $CHZ token is the native token of Chiliz, the company behind the pioneering fan token platform Socios. Last week, the company launched Chain 2.0 an advanced version of its blockchain platform.

On Monday, the company unveiled LiveLike— an audience engagement platform that allows broadcasters to transform streaming into fan-driven interactive experiences— as the first company to be onboarded on Chiliz Chain 2.0.

The token price has since pulled back after running out of steam during the week amid the anticipation of the Chain 2.0 launch.

Technically, the $CHZ token price seems to have created another opportunity to buy with potential take profits positions at $0.255 and $0.265. On the other hand, if the pullback continues, $CHZ could find support at about $0.235 or lower at $0.224.

Oasis Network token (ROSE/USD)

Oasis Network is a privacy-enabled blockchain with layer 1 scalability. The platform combines scalability with low gas fees to provide a next-gen ecosystem for smart contract projects, NFTs, gaming, the metaverse and decentralised autonomous organisations (DAOs).

The $ROSE token price spiked late last week before pulling back over the weekend. It has since extended declines, opening an exciting opportunity for cyclical investors.

Technically, traders could target potential rebound profits at about $0.061 or higher at $0.063. On the other hand, $0.057 and $0.055 are crucial support zones.

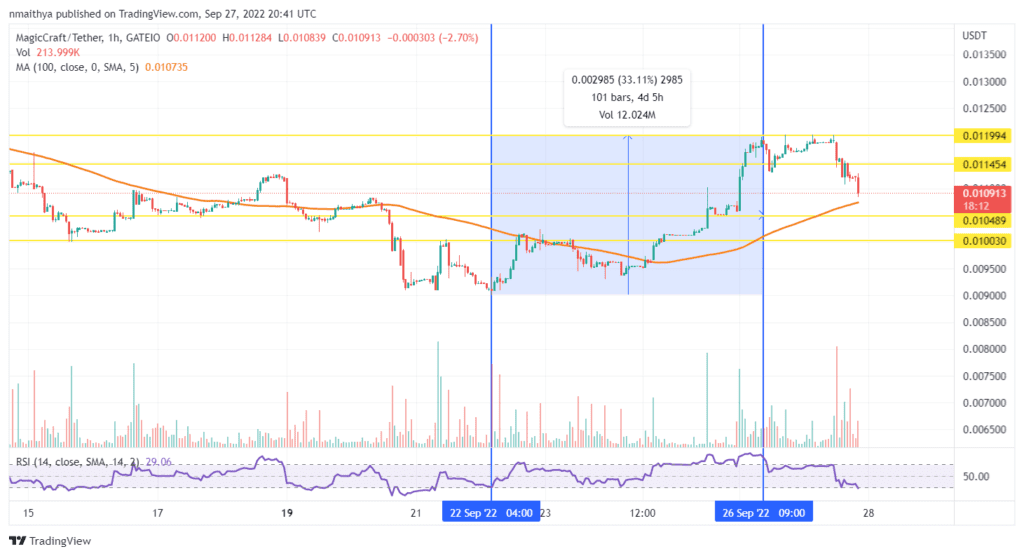

MagicCraft token (MCRT/USDT)

The $MCRT token is the ecosystem token of the MagicCraft game. This battle league and Castle Siege game allow multiple players to battle against each other at the same time. MagicCraft is part of the BNB Chain gaming ecosystem.

Players use the NFT characters to participate in battles, form teams with other players and earn rewards from their playing activity.

On Sunday, the company revealed that it was launching its NFT marketplace on Monday, sparking a late rally in the $MCRT token.

However, the token price has since pulled back slightly creating an opportunity for investors looking to buy.

Technically, traders could target potential rebound profits at about $0.11145 or higher at $0.1199. On the other hand, if the decline continues, the $MCRT token could find support at about $0.01048 or lower at $0.01003.

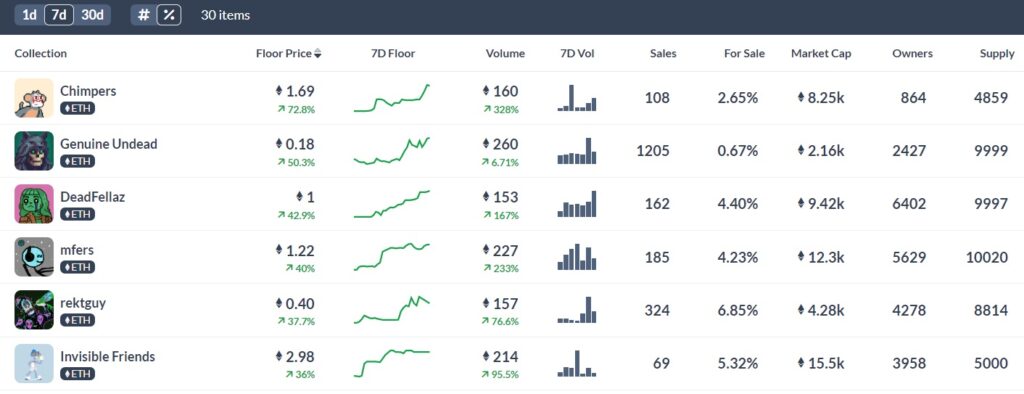

On-Chain NFT Floor Price Gainers

Over the last seven days, NFT collections continued to experience a rise in floor prices, with Chimpers leading gains with a 72.8% rise for collections with at least 100 ETH in transaction volume.

Genuine Undead and DeadFellaz followed a distant second and third, respectively with 50.3$ and 42.9% gains.

Elsewhere, Mfers’NFT floor price gained 40% with a transaction volume of 227 ETH, while Rektguy registered a 37.7% rise in the price. Invisible Friends, with the highest market cap of 15.5k ETH in this week’s list, posted a gain of 36%.

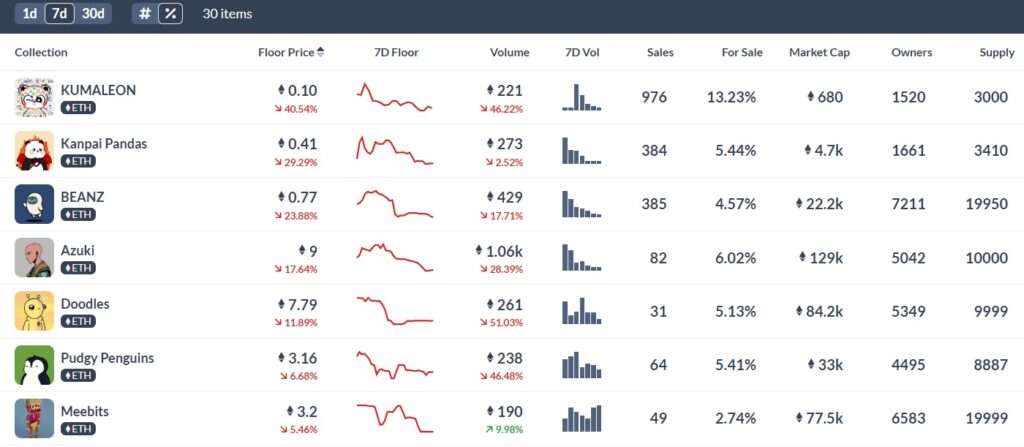

On-Chain NFT Floor Price Decliners

Digital artist Okazz’s KUMALEON NFT collection led the declines among NFTs with a 7-day transaction volume of at least 100 ETH, the NFT floor price fell by 40.5%. Kanpai Pandas followed with its price lower by 29.29%, while BEAZ registered a 23.88% decline.

Azuki was the biggest collection to feature in the list of decliners after its floor price decreased by 17.64%. It was joined by other leading Blue-Chip NFT projects including Doodles, which fell by 11.89% and Meebits, down 5.46%. Pudgy Penguins fell 6.68%.

Stay up to date: