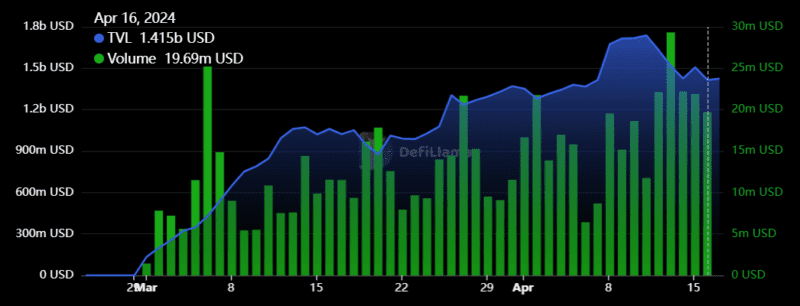

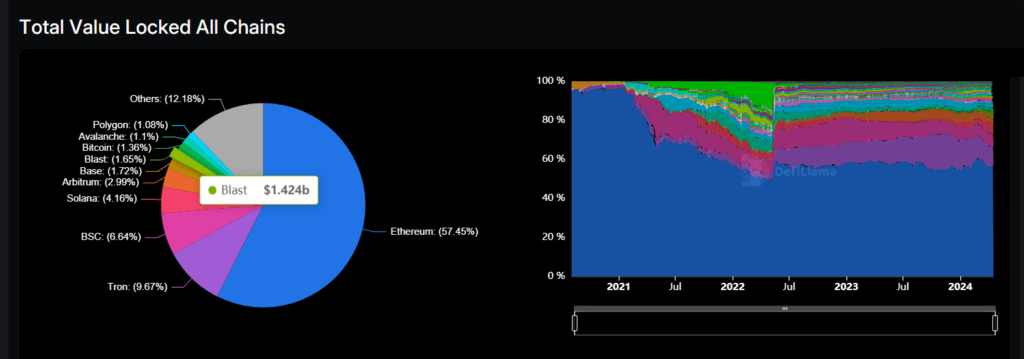

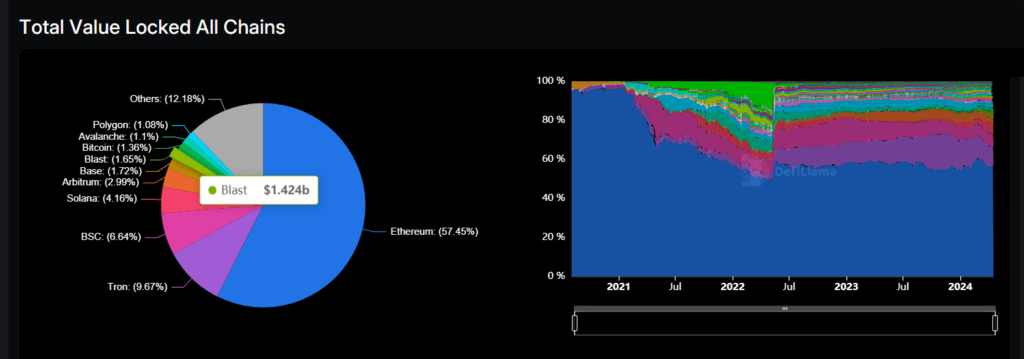

Blast, the Ethereum layer 2 that launched its mainnet on February 29, continues to gain traction despite a more competitive market. Its total value locked (TVL) figure has surged to $1.7 billion on April 11, before correcting to the current level of $1.4 billion. Weekly volumes are at a record high.

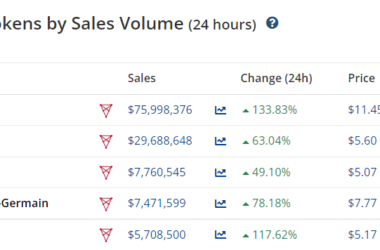

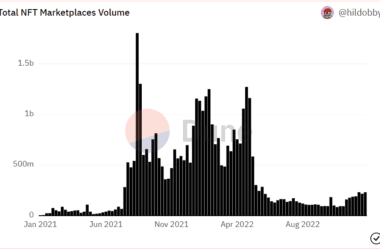

Blast was developed by the same team behind Blur, the NFT marketplace that overcame OpenSea and now accounts for 80% of all NFT trading volume.

The new layer 2 uses optimistic rollups, but it has caught investors’ attention by offering native yield. Users can simply hold certain tokens, such as ETH or USDC, and become eligible for passive income.

Blast is about to launch its own token next month.

Blast Projects Thrive

One month after the launch of its mainnet, Blast has already secured a 1.65% of market share in decentralized finance (DeFi), surpassing established chains like Avalanche or Polygon.

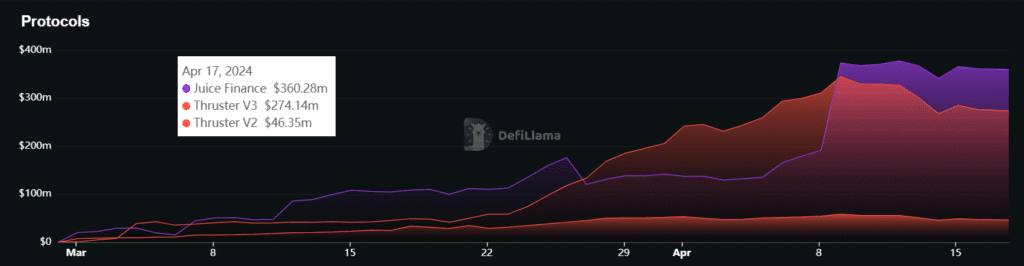

The most popular DeFi apps on Blast are Juice Finance, a yield farming protocol for Ethereum, and Thruster, a decentralized exchange (DEX). The TVL on each of the two projects has surged to over $320 million.

Some smaller DeFi projects have expanded at a fast pace. For example, TVL on yield platform Hyperblock Finance and leverage trading protocol Particle has increased by over 1,600%, and 2,000%, respectively, over the last month.

RiskOnBlast’s Rug Pull Deteriorates Blast Reputation

Blast is starting its journey on the wrong foot. Shortly before the launch of its mainnet, a Blast project, RiskOnBlast, rug pulled by exiting with about 500 ETH and closing its X account.

The crypto community has been disappointed that RiskOnBlast was backed despite its team being completely anonymous.

While many have been questioning Blast’s security measures, the new layer 2 has had a strong start and continues to win market share.

Stay on top of things:

Subscribe to our newsletter using this link – we won’t spam!