Quick take:

- Binance experienced a whopping $700 million in withdrawals on Monday after the SEC sued citing customer fund mishandlings.

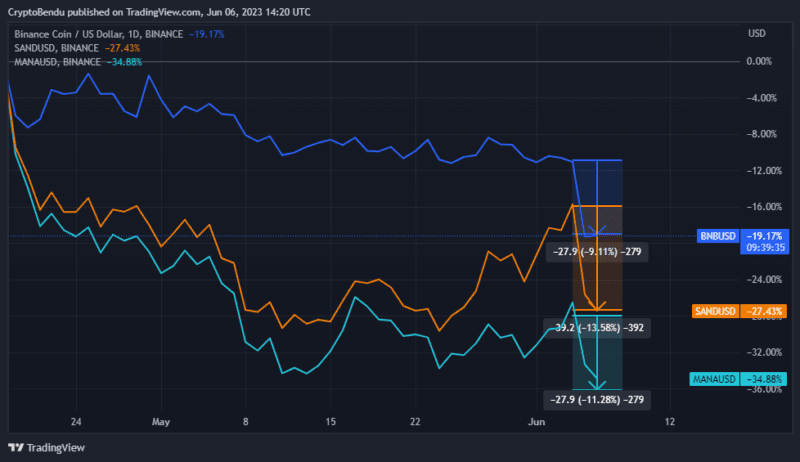

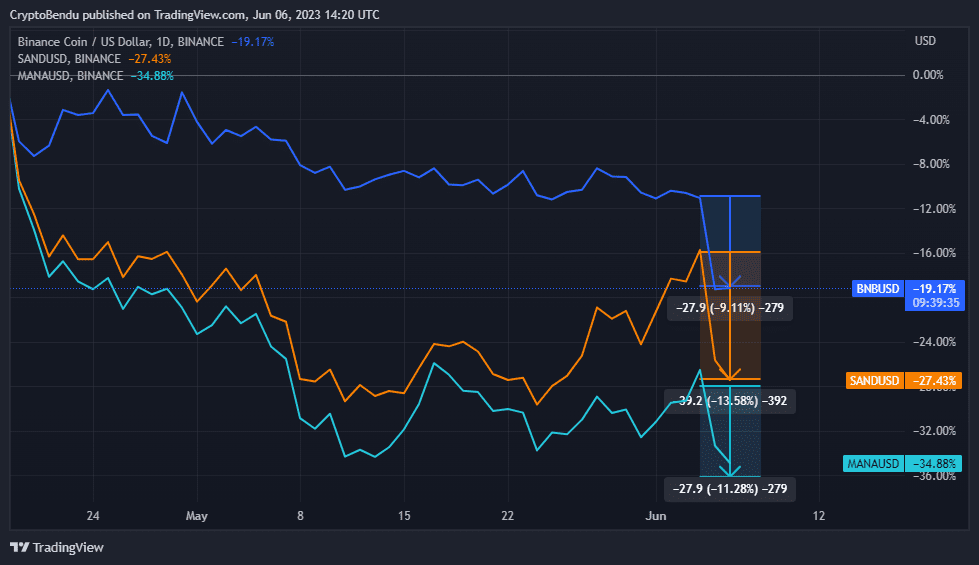

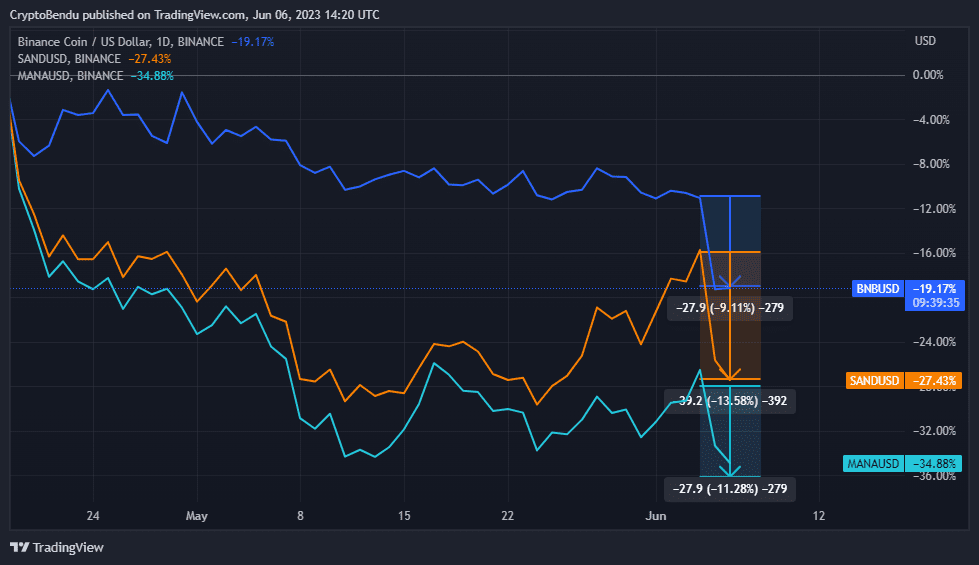

- Major metaverse tokens named in the lawsuit including Decentraland’s MANA and The Sandbox’s SAND also saw declines.

- SOL, DADA, MATIC, ATOM, FIL, AXS and ALGO were also among the security assets mentioned in the lawsuit.

Binance has experienced more than $700 million in withdrawals over the past 24 hours according to data by Nansen.ai. The world’s largest crypto exchange company was on Monday sued by the Securities and Exchange Commission (SEC), which cited mishandling of customer funds and operating an illegal crypto exchange platform in the US.

Crypto markets fell significantly on Tuesday following the SEC’s lawsuit against Binance on Monday, with bitcoin easing towards $25,000 off Monday’s highs of about $27,300.

The panic created by the accusations saw more than $230 million in withdrawals on Binance in the few hours that followed, with the outflows increasing to $719 million on Tuesday.

Binance’s native token $BNB lost more than 9% in value, falling to $276 but it was not the only one affected with multiple tokens also named in the lawsuit. Leading metaverse tokens Decentraland’s $MANA and The Sandbox’s $SAND experienced significant declines with MANA down by 11.3%, while SAND fell 13.6%.

Other tokens listed in the lawsuit include Binance stablecoin $BUSD, Solana’s $SOL, Cardano ecosystem token $ADA, Polygon $MATIC, Filecoin $FIL, Cosmos blockchain’s $ATOM, Algorand’s $ALGO, and NFT game Axie Infinity’s $AXS, among others.

SEC claims all the tokens listed in its lawsuit fall under the category of unregistered securities, and therefore, Binance broke securities laws by offering them for trading on its platform.

Despite Monday’s events and the subsequent declines in the prices of multiple tokens, the CoinDesk Market Index fell slightly by 3.5% on Tuesday.

But by mid-day, the market was already on a recovery trajectory with Bitcoin up to $26,000, while Ethereum (ETH) recovered from a session low of about $1,800 to trade at about $1,840.

****

Stay up to date:

Subscribe to our newsletter using this link – we won’t spam!