Quick take:

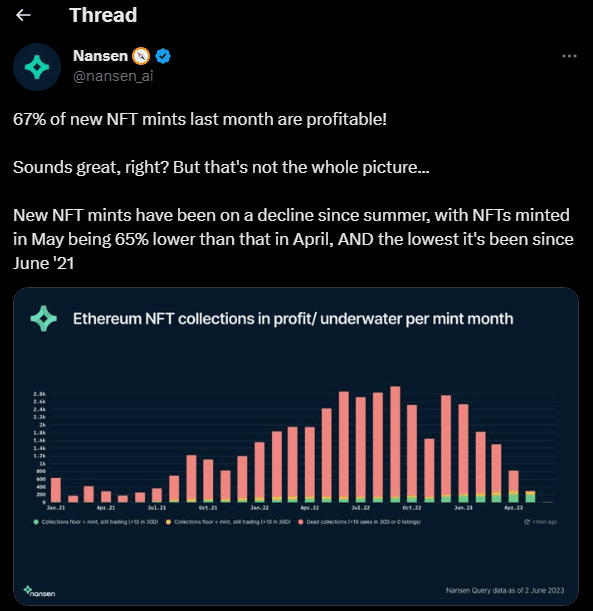

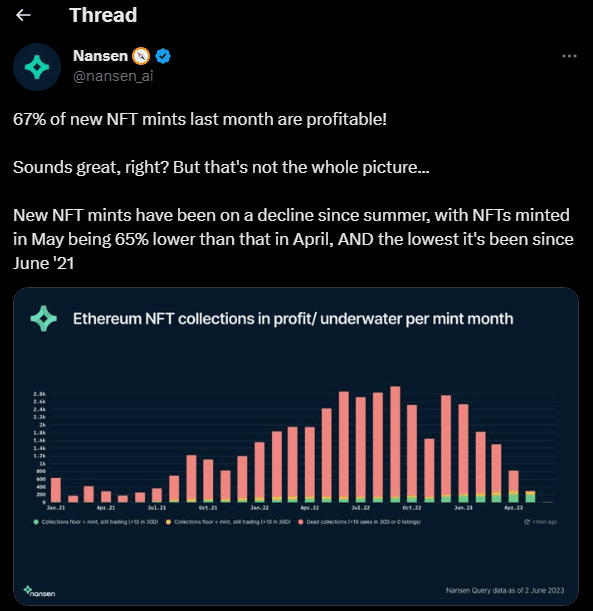

- A report by Nansen indicates that 67% of newly minted Ethereum NFTs are profitable.

- The report also points out the declining number of new NFTs mints since the summer.

- The current number of mints is the lowest since June 2021.

The NFT market has plummeted since June last year. Some say NFTs are dead, while others try to avoid being associated with the term completely. Yet despite the slump, Nansen Research has come up with some interesting statistics.

According to a report published Monday, 67% of freshly minted Ethereum NFTs are profitable, which means their floor prices remain above the auction price.

However, according to Nansen Research, new NFT mints have been on a decline since the summer, which could explain why the profitability rate remains high.

“New NFT mints have been on a decline since summer, with NFTs minted in May being 65% lower than that in April, AND the lowest it’s been since June ’21,” the company wrote in a tweet.

As demonstrated in the graph above, NFT profits tend to be higher in the first few days after the mint before declining in the days after.

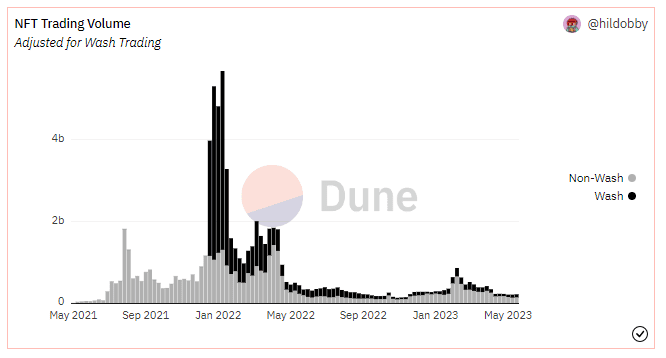

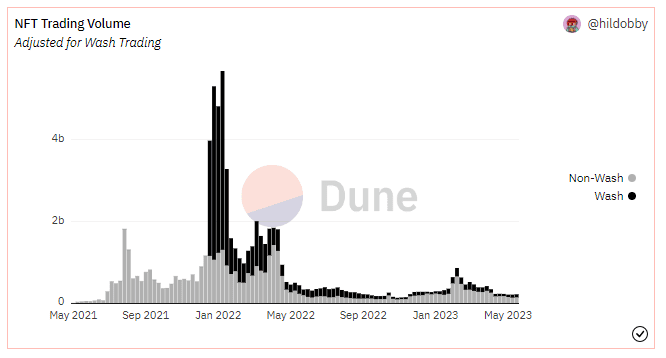

Ethereum NFTs still dominate the industry in terms of volume traded. According to a Dune Analytics board prepared by Hildobby, Ethereum NFTs generated nearly $139 million in transaction volume in May 2023, excluding wash trading. That is a significant decline from this year’s best month of more than $650 million reported in February.

Nonetheless, the data shows that the NFT market has rebounded significantly since the start of the year compared to the decline experienced in the second half of 2022.

The NFT market registered the best period during the first quarter of 2022, largely driven by the launch of the LooksRare NFT marketplace and X2Y2, albeit with significant volume driven by wash trading activity.

A significant bump witnessed in February this year was a result of a ripple effect created by the emergence of Ordinals NFTs, which seemed to reignite the market.

****

Stay up to date:

Subscribe to our newsletter using this link – we won’t spam!