Quick take:

- Government vouchers will be issued using tokenised Singapore dollars.

- The vouchers will facilitate real-world transactions with selected merchants.

- It is an industry effort led by the Monetary Authority of Singapore.

Singapore banking giant DBS today announced that it is launching a live pilot program where government money-based vouchers will be issued using tokenised SGD to facilitate real-world transactions with selected merchants.

This initiative, launched in partnership with Open Government Products (OGP), the Singapore government’s in-house tech team, is part of the nation’s efforts to develop infrastructure that enables the issuance of a digital Singapore dollar.

It also forms part of Project Orchid, an industry effort led by the Monetary Authority of Singapore (MAS), to develop the technology infrastructure and technical competencies as the country explores the use cases of central bank digital currency (CBDC) or digital Singapore Dollar (DSGD).

In an interview with Business Times, MAS managing director Ravi Menon said: “Promoting the growth of digital assets and digital connectivity is part of MAS’ broader strategy to shape the future of financial networks. We see a future, or rather want to create a future, characterised by seamless cross-border digital financial networks and decentralised liquidity pools, that can enable cheaper, faster and more secure financial transactions.”

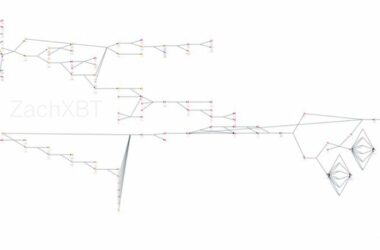

By leveraging blockchain technology, money-based vouchers will be created using DSGD issued by DBS, with smart contract capabilities enabled by OGP. This means small businesses and retail shopfronts can benefit from instant settlement, payments and collections with their banks when customers use the vouchers.

The live pilot program started small with up to 1,000 selected consumers and six merchants in the central business district for a duration of four weeks from Oct 27. DBS says that its program with OGP will be useful in scenarios such as the Community Development Council voucher scheme where Singaporean households receive vouchers to help cope with rising inflation and cost of living.

“We want to test how we can potentially make settlement faster and less costly, and reduce the reconciliation effort of banks, voucher issuers and merchants. If verified to be helpful, perhaps such a model – in which merchants receive DSGD immediately with each voucher redemption instead of a voucher (and needing to be reimbursed separately) – could be a model extensible to future other government programmes,” said Li Hongyi, Director of Open Government Products.

Stay up to date: