Quick take:

- The funds will be used to accelerate the development of the essential infrastructure of the platform.

- Infrared Finance is an incubation project of the Berachain Foundation, which raised $42 million last year.

- Some of the infrastructure projects in progress include creating a network of validators and proof-of-liquidity (PoL) vaults, among others.

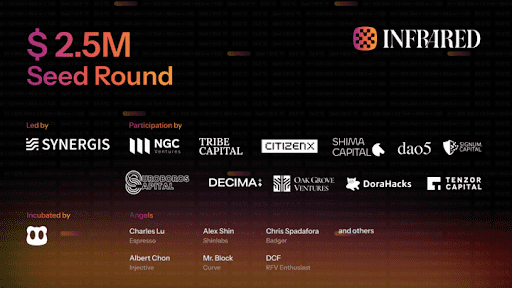

Infrared Finance a liquidi staking protocol based on the Berachain ecosystem has completed a $2.5 million seed round led by Synergis.

The fundraising also attracted participation from NGC Ventures, Tribe Capital, CitizenX, Shima Capital, Dao5, Signum Capital Ouroboros Capital, Decima, Oak Grove Ventures, DoraHacks, Tenzor Capital, Alex Shin, Albert Chon, Charles Lu, Mr. Block, Chris Spadafora, DCFGod, and others.

According to Infrared, the company plans to use the fresh capital to accelerate the development of the infrastructure required to run the protocol. Some of the key segments the company is building include a network of validators, proof-of-liquidity (PoL) vaults, and the inaugural native Liquid Staking Token (LST) launch, iBGT.

Commenting on the announcement, Raito, the CEO of Infrared Finance said: “Infrared is specifically built with the Berachain architecture in mind. We recognise the unique characteristics of PoL and more specifically the soulbound elements of BGT. By reimagining liquid staking through iBGT we abstract away the complexities of navigating POL and enable users to unlock the maximum value of BGT while maintaining exposure to staking rewards.”

According to Raito, iBGT creates a composible source of yield-bearing collateral that can be utilized by any application on Berachain. “This not only incentivizes the development of new protocols and applications but also fosters the growth of the overall Berachain ecosystem,” said Raito.

Matthew Kosiewska, partner at Synergis commented: “Infrared will be at the heart of Berachain’s new Proof of Liquidity consensus. By supporting a liquid BGT market for stakers as well as an incentive layer for liquidity flows, Infrared will streamline the process of navigating Berachain and its novel staking system for all users.”

Infrared Finance is one of the five pioneering projects in Berachain Foundation’s first cohort of the Build-A-Bera incubator program. The company believes the support it is getting from Berachain, investors, advisors and others positions it well to serve as a core infrastructure solution.

“Leveraging our support, extensive development efforts, and the advantages of early entry into the ecosystem, Infrared aspires to establish itself as the preeminent network of validators within Proof-of-Liquidity,” Infrared wrote in a blog post earlier this month.

According to the Medium blog post, Liquidity providers engaged across the Berachain native DApps and other BGT-eligible liquidity venues stand to earn trading fees, and native emissions, and claim liquid BGT via iBGT, our native LSD.

****

Stay up to date:

Subscribe to our newsletter using this link – we won’t spam!