Ondo Finance, a decentralized finance (DeFi) protocol that offers exposure to short-term US Treasury securities, continues to gain traction in the Real-World Asset (RWA) subsector.

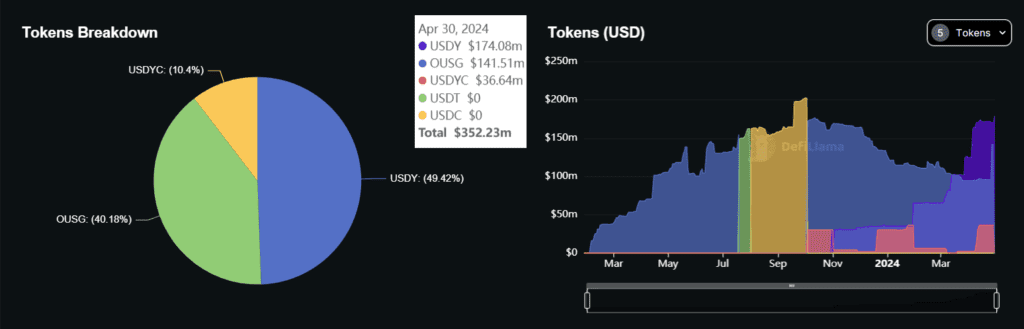

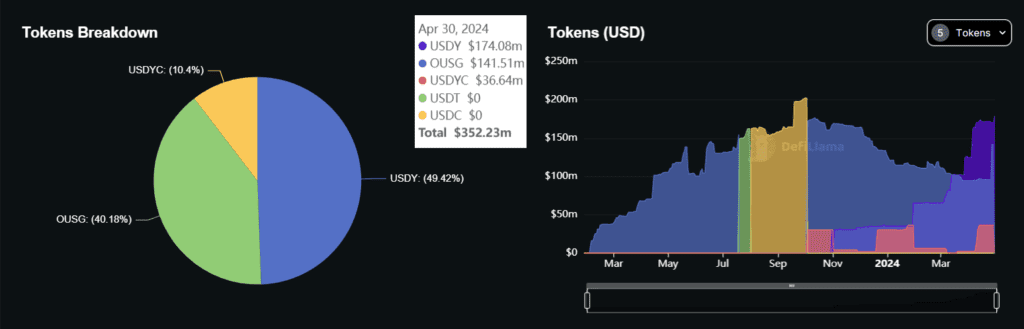

On April 30, the total value locked (TVL) on the platform crossed the $350 million mark to set a new record and consolidate its position as the fourth-largest RWA protocol, according to data from DefiLlama.

Unlike the top three RWA projects, all of which focus on USD stablecoin minting, Ondo is tokenizing traditional fixed-income products, predominantly short-term US Treasuries. This enables it to offer generous on-chain yield while benefiting from the stability of traditional bonds.

Ondo’s two most popular products are USDY and OUSG. The former represents a tokenized note backed by short-term US Treasuries and bank demand deposits. It offers an annual percentage yield (APY) of 5.20%.

The other tokenized investment product, OUSG, is mostly focused on short-term US Treasuries held in the BlackRock USD Institutional Digital Liquidity Fund (BUILD). Up until the end of March, OUSG was exposed to BlackRock’s iShares Short Treasury Bond ETF, but it moved to BUILD for better flexibility. OUSG offers an APY of 4.96%.

OUSG dominated the Ondo market until mid-March. Since then, USDY has the largest share, accounting for almost 50%.

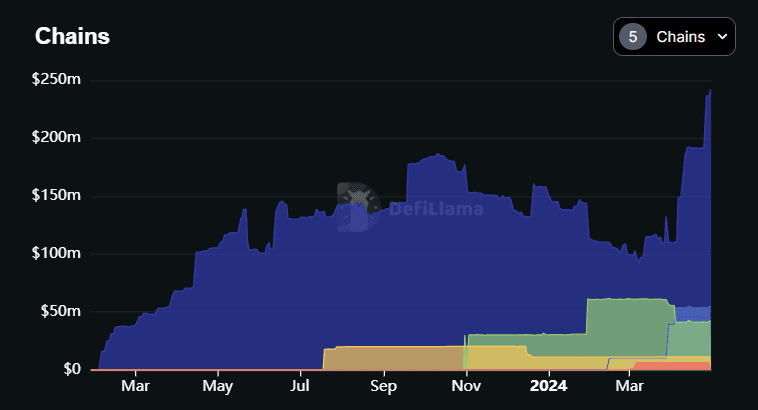

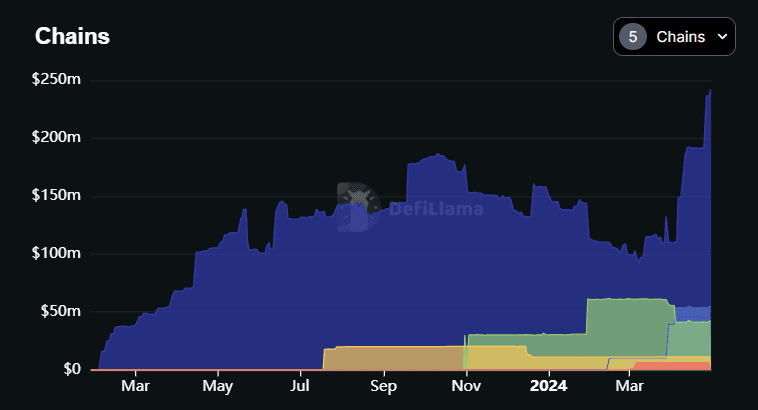

USDY and OUSG reside on multiple chains. The most popular chain for Ondo’s tokenized assets is Ethereum, with almost $240 million in TVL, followed by Solana and Mantle, with $54 million and $41 million, respectively.

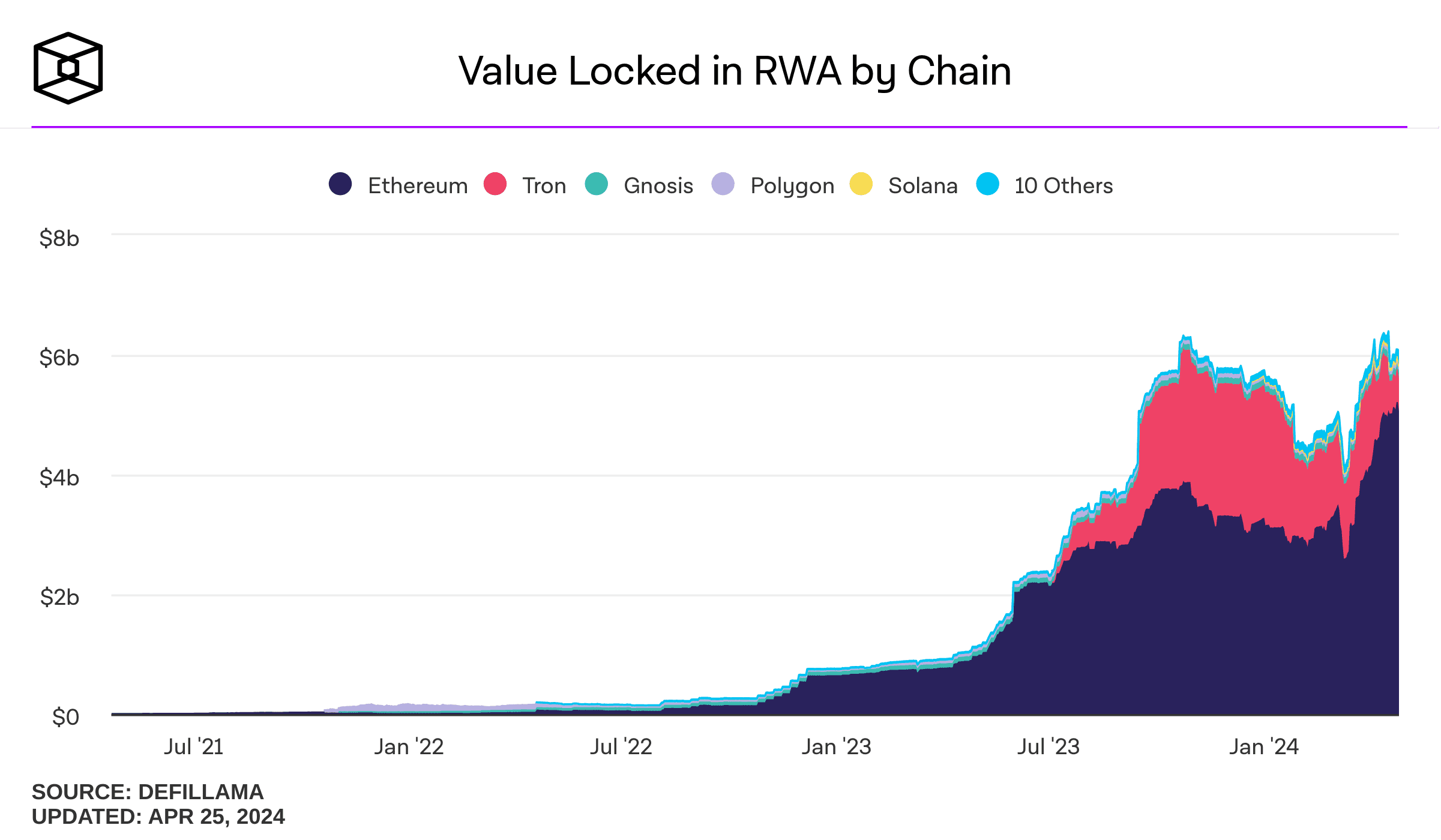

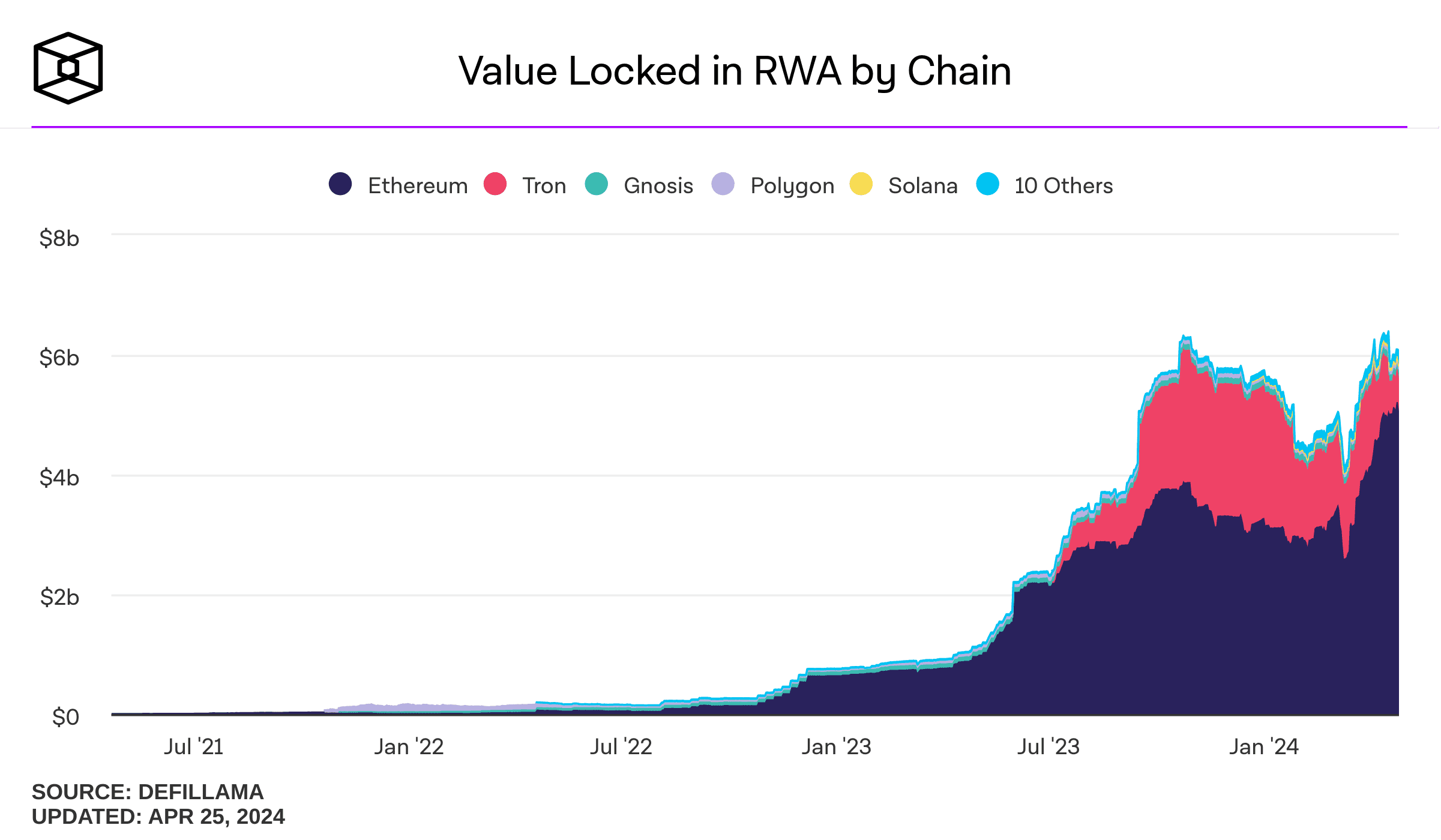

Last week, the TVL of RWA assets on Ethereum reached a new record at $6.09 billion, with Ethena and Maker being the main drivers.

On April 18, Ondo reportedly partnered with asset issuance chain Noble to offer its tokenized bonds to the Cosmos ecosystem. The first asset to reach on Cosmos will be USDY. Cosmos will become Ondo’s sixth blockchain network.

Stay on top of things:

Subscribe to our newsletter using this link – we won’t spam!