Quick take:

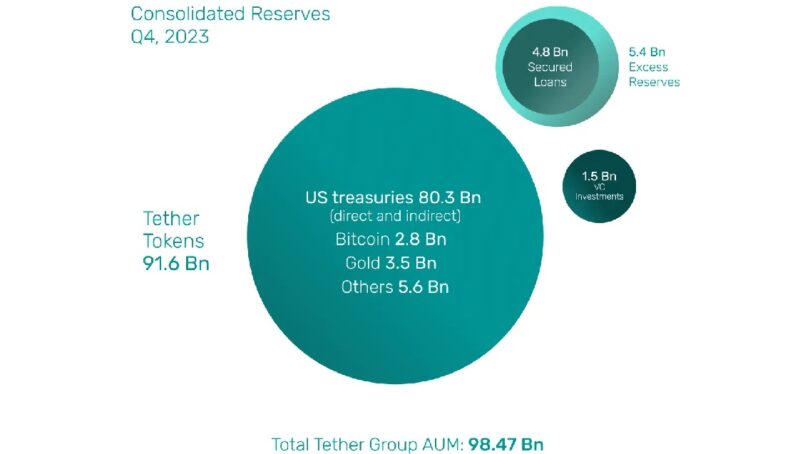

- The USDT stablecoin issuer also revealed $5.4 billion in reserves, exceeding its current loan commitments of $4.8 billion.

- Overall, US treasuries, Reverse Repos and Money Market Funds contributed $4 billion to the Group’s 2023 net profit of $6.2 billion.

- The group’s total exposure to US treasuries was $80.3 billion as of December 31, 2023.

Tether has revealed record-breaking numbers from its Q4 2023 results. The company reported a net profit of $2.85 billion for the quarter, with nearly $1 billion in interest earned from investments in US treasuries.

The results were audited by the globally renowned independent auditing firm BDO. According to the report published on the Tether website, the USDT stablecoin issuer also saw reserves rise by a record $2.2 billion to $5.4 billion, exceeding current loan commitments of $4.8 billion, with the excess reserves of about $640 million invested in mining, AI infrastructure, P2P telecommunications and others.

“This attestation reaffirms the accuracy of Tether’s Consolidated Reserves Report (CRR) and provides a detailed breakdown of the assets held by the Group as of December 31, 2023,” wrote Tether.

Tether holds reserves of fiat currency equivalent to the total amount of Tether tokens in circulation. Interest earned from those reserves is booked as revenue generated by the company.

Tether said in addition to the $1 billion it made from US treasures, the appreciation of Gold and Bitcoin reserves also made a huge contribution to the net profits.

Overall, Tether reported $6.2 billion in net profits in 2023, with $4 billion coming from US Treasuries, Reverse Repos and Money market funds. The group achieved a record high of $80.3 billion in direct and indirect exposure to US treasuries comprising overnight-reverse repos secured by US Treasuries, and money market funds invested in US Treasuries.

The company also said it issued tokens backed by cash and cash equivalents at an impeccable rate of 90%.

The company also said it has addressed one of the community’s main concerns about its portfolio by removing the risk of secured loans from the token reserves. “While such secured loans are widely overcollateralized, Tether accumulated enough excess reserves to cover the entirety of the exposure,” the report reads.

****

Stay up to date:

Subscribe to our newsletter using this link – we won’t spam!