Weekly NFT Loan Volume Surges to 6-Month High, Led by Blur’s Blend Protocol.

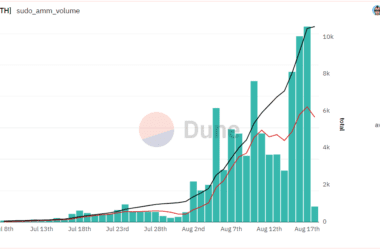

In a remarkable surge, the weekly volume of NFT loans has reached a six-month high, totaling an impressive $67 million. Dominating this surge is Blur’s recently launched lending protocol, Blend, which accounted for a staggering 74% of the week’s volume, with over $50 million in loan volume alone.

Blend, a collaborative effort between Blur and Paradigm, officially unveiled its innovative lending protocol on May 1st, aiming to provide users with increased flexibility and liquidity in the NFT space.

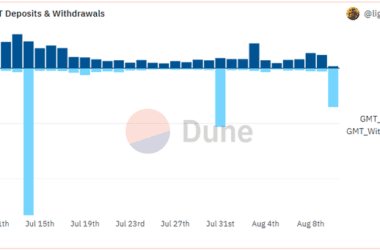

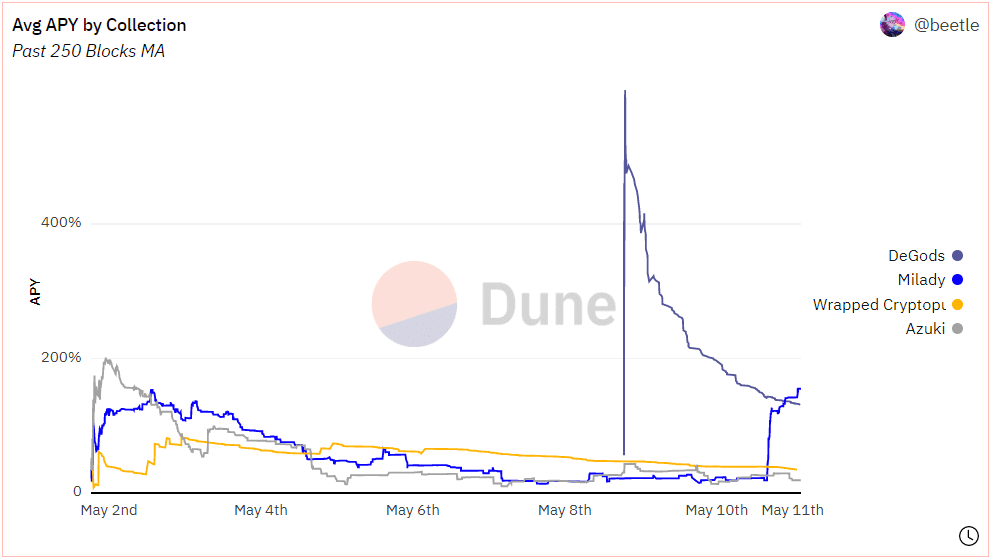

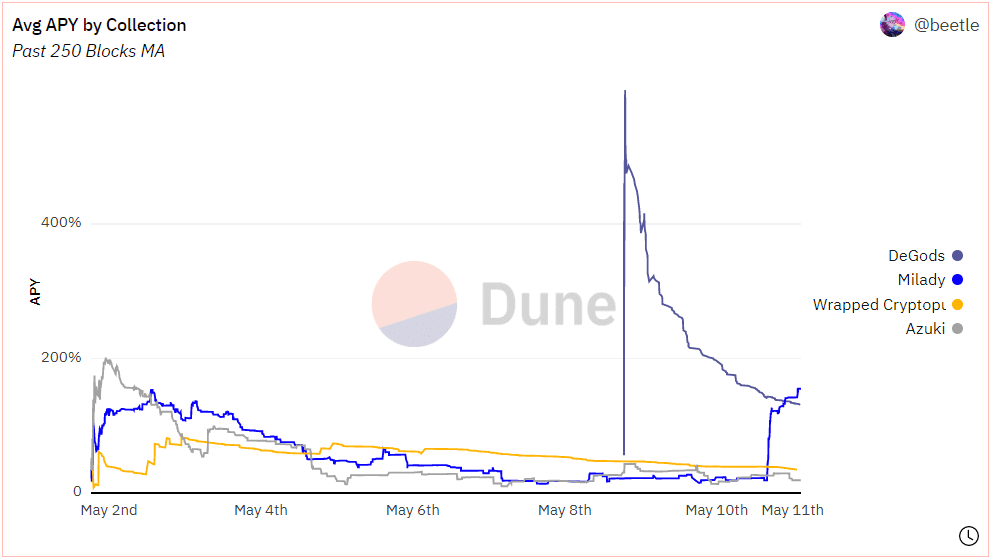

At its peak, Blend enticed users with an eye-catching offering of over 500% APY (Annual Percentage Yield) on loans backed by the captivating DeGods NFT collection. While that APY has since been adjusted, Blend continues to offer an impressive 150% APY on loans secured by the enchanting Milady NFT collection.

Since its inception, Blend has facilitated a staggering 55,700 ETH (equivalent to $101 million) in total ETH loans, spanning across an impressive 3,426 unique loans. On average, each loan accounted for 16.3 ETH, demonstrating the significant interest and appetite for NFT-backed lending. Moreover, an astounding 960 lenders participated in the platform, with an average of 3.6 loans per lender.

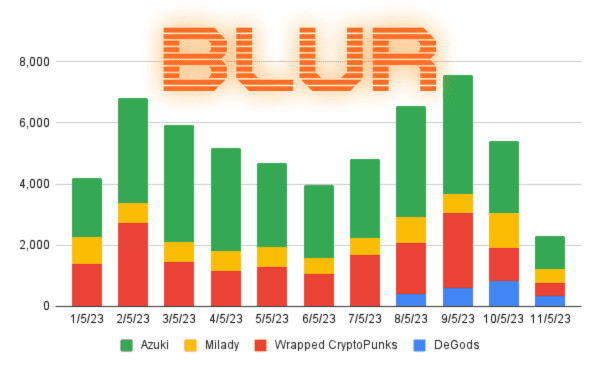

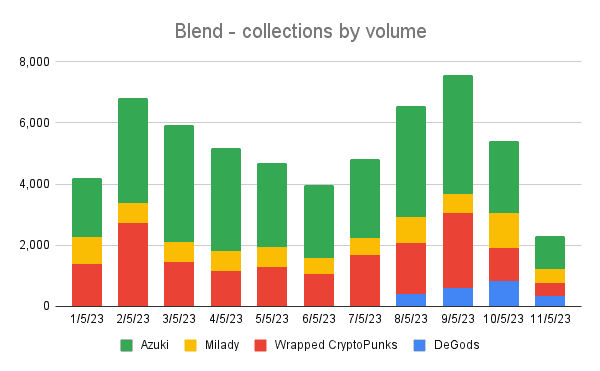

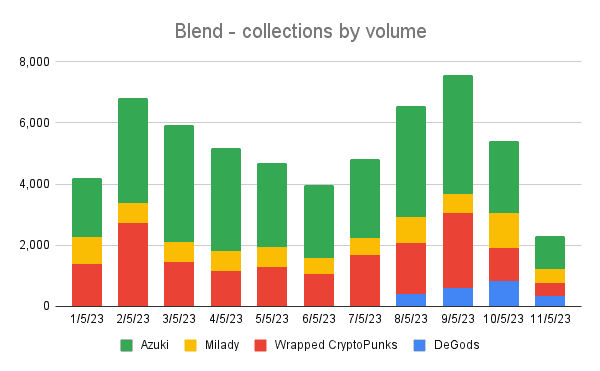

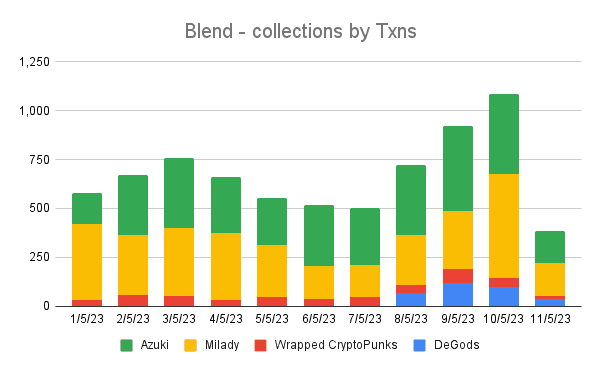

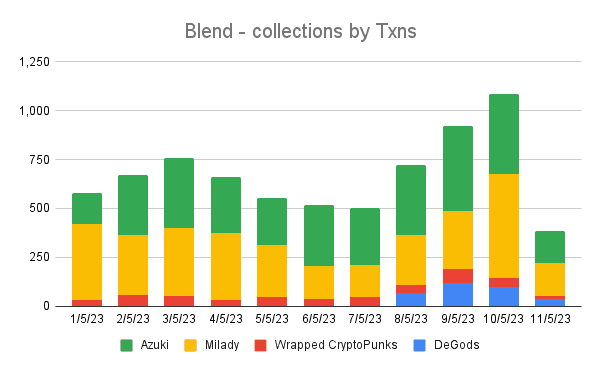

Leading the way on Blend is the renowned Azuki collection, which boasts a substantial 54% share of the protocol’s volume and an impressive 45% share of its total transactions. With over 31,200 ETH generated from 3,300 transactions, Azuki continues to dominate the NFT lending space on Blend.

Following Azuki, the Wrapped CryptoPunks collection takes second place, with a notable volume of 16,300 ETH. The Milady NFT collection secured the third position with 7,700 ETH, while the DeGods collection rounded out the top four with a respectable 2,100 ETH.

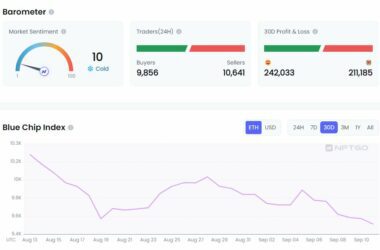

The surge in NFT loan volume, particularly on Blur’s Blend protocol, highlights the growing demand for NFT-backed lending solutions. As the NFT ecosystem continues to evolve, platforms like Blend are playing a pivotal role in providing liquidity and unlocking the true potential of these unique digital assets. Investors and enthusiasts alike will be closely monitoring the next steps and developments in the vibrant world of NFT lending.

****

Stay up to date:

Subscribe to our newsletter using this link – we won’t spam!