The pioneering cryptocurrency known as Bitcoin has been on an intriguing journey in 2023 as it strives to reclaim the remarkable highs of its past. After the volatility and uncertainty of previous years, Bitcoin’s performance in 2023 has been closely monitored by both seasoned investors and newcomers. In this article, we will provide an in-depth analysis of the factors contributing to Bitcoin’s price rally so far in 2023 and examine the challenges and opportunities it faces.

Recap of Bitcoin’s Recent History

Many people now say the glory days of cryptocurrencies are fading away due to analysis of some of the best crypto tools. Some who have invested in the past have stopped investing, while new investors are skeptical of joining the bandwagon of crypto traders. Before we discuss Bitcoin’s performance and acceptance in 2023, let’s closely examine significant news about the coin in recent years.

2011 – Market Recognition

Bitcoin gained more attention in 2011 when it reached parity with the US dollar, briefly trading at $1 per BTC. As interest grew, crypto exchanges and marketplaces emerged, providing platforms for buying and selling digital currency. Moreover, it was noticed by many financial organizations and was considered a threat.

2013 – Price Surge and Silk Road Shutdown

In 2013, crypto experienced a significant price surge, reaching over $200 per BTC. However, the year also experienced the closure of the infamous Silk Road, an online marketplace that used Bitcoin for transactions related to illegal goods and services.

2017 – All-Time Highs and Mainstream Recognition

Bitcoin’s price skyrocketed in 2017, reaching an all-time high of nearly $20,000 in December. This surge resulted from increased institutional interest, growing awareness, and the launch of Bitcoin futures on major exchanges. Mainstream media began covering crypto extensively, bringing it into the public consciousness.

2018 – Market Correction and Regulatory Scrutiny

The euphoria of 2017 followed a market correction in 2018, with Bitcoin’s price dropping significantly. Regulatory scrutiny also increased globally, with governments exploring ways to regulate and tax cryptocurrency transactions.

2020 – The Halving and Institutional Adoption

Bitcoin’s third halving event took place in May 2020, reducing the reward for miners and decreasing the rate at which new cryptos are created. This event and growing institutional interest contributed to a renewed bullish trend. Companies like MicroStrategy and Square publicly announced substantial crypto investments.

2021 – Institutional Validation and All-Time High Redux

Institutional adoption of crypto continued to gain momentum in 2021. Tesla, led by Elon Musk, announced a significant investment in crypto and started accepting it as vehicle payment. Bitcoin reached a new all-time high, surpassing $60,000 in April.

The latter half of 2021 experienced increased volatility and regulatory developments. China intensified its crackdown on crypto mining, causing a significant hash rate drop. Regulatory concerns became more prominent, particularly regarding environmental impact and consumer protection.

2022 – Bearish Period and Market Resilience:

Much of 2022 saw a bearish market sentiment, with BTC and other cryptocurrencies experiencing significant declines. Despite this, the market demonstrated resilience, and infrastructure development continued, focusing on scalability and sustainability. That year, Bitcoin dropped to $40,000, hovering around that price for months until the great dip to $15,000 in December 2022.

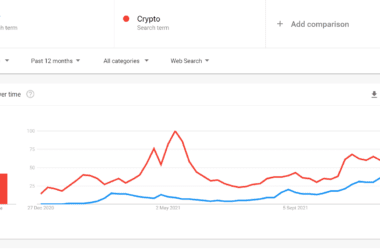

Price Performance in 2023 and What You Should Know about the Rally

The price performance of Bitcoin in 2023 has been nothing short of impressive. Recovering from the dip of 2022, Bitcoin has consistently gained value. Currently, Bitcoin is trading at approximately $36,760, reflecting a substantial increase compared to last December. However, this means that the coin gained over 80% and is staging an incredible turnaround.

While the price rally has been promising, it’s essential to acknowledge that Bitcoin’s journey is marked by volatility. This volatility can lead to sudden price corrections, as observed in previous bull markets. Investors should approach the market cautiously and prepare for upside potential and downside risks.

Factors Fueling the Rally

There are many reasons why the price of Bitcoin is increasing rapidly with positive sentiments. Let’s explore the factors that are driving Bitcoin’s 2023 rally:

Institutional Investment: Large institutions, including banks, investment funds, and corporations, have continued to allocate significant resources to Bitcoin. Their participation is a strong indicator of confidence in the long-term potential of cryptocurrency.

Wider Adoption: Bitcoin’s utility and use cases have expanded beyond simple digital currency to more complex financial instruments, including decentralized finance (DeFi) and non-fungible tokens (NFTs). These innovations have attracted a broader audience.

Market Sentiment: Positive market sentiment has been a vital rally driver. As Bitcoin reached new highs, it triggered a “Fear of Missing Out” (FOMO) effect, increasing buying pressure.

Geopolitical Events: Geopolitical tensions and economic crises have heightened interest in non-traditional assets like Bitcoin. In some regions, people are turning to cryptocurrency to preserve their wealth in times of uncertainty.

Infrastructure Development: The development of Bitcoin-related infrastructure, including wallets, exchanges, and custody services, has made it easier for investors to enter the market. Improved accessibility has played a pivotal role in the rally.

Regulatory Clarity: Regulatory guidance, while varied by region, has provided a degree of certainty for market participants. Investors are more comfortable knowing that they are operating within legal boundaries.

Challenges on the Horizon

As Bitcoin continues its rally in 2023, several challenges loom on the horizon that could impact its performance. Before investing in Bitcoin, these challenges are worth considering as they help you plan for unexpected conditions. Below are some of the significant challenges that may cause Bitcoin to fall like it did last year.

Regulatory Changes: The regulatory environment remains uncertain, and regulation changes can impact the cryptocurrency market. Investors must stay informed about evolving rules and requirements.

Market Corrections and Economic Factors: Cryptocurrency markets are volatile, and corrections can be steep. You need to be prepared for market pullbacks and not overextend themselves. Moreover, Economic shifts, inflation, and global events can influence market sentiment and impact the value of Bitcoin.

Technological Risks: Despite its robust security, Bitcoin is not entirely immune to technological risks. While rare, network disruptions and vulnerabilities can pose temporary challenges. Hackers and scammers are now utilizing Bitcoin opportunities for their several atrocities.

****

Stay up to date:

Subscribe to our newsletter using this link – we won’t spam!