Quick take:

- The loan was facilitated by liquidity scaling startup MetaStreet.

- The loan has an APR of 10% and a 30-day duration.

- Co-founder and CEO of MetaStreet, Conor Moore, referred to the borrower as a ‘whale’.

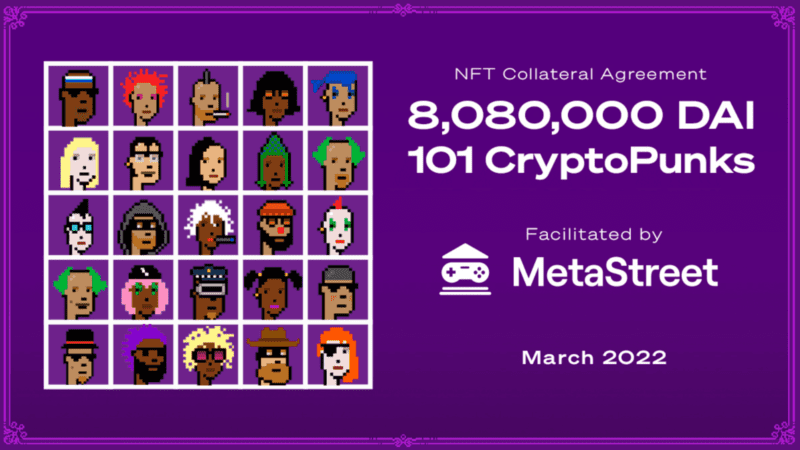

An anonymous borrower has just taken out an $8 million loan using his collection of 101 CryptoPunks as collateral. The loan was facilitated by liquidity scaling startup MetaStreet on peer-to-peer lending platform, NFTfi.

According to a Blockworks exclusive, the loan has an APR of 10% and a 30-day duration. It is regarded by industry participants as an indication of the future of lending collateralised by NFTs. As the NFT space continues to grow, so will institutional interest in the market.

Speaking to Blockworks, Conor Moore, co-founder and chief operating officer of MetaStreet, said that the loan is “orders of magnitude larger” than a previous NFT loan it has helped facilitate.

In November, the platform provided $1.4 million DAI in collateral against a class 10 Autoglyph – the first $1 million loan in NFT debt history.

Moore is keeping the identity of the borrower under wraps and has referred to them as a ‘whale’, a term for someone who holds amounts of cryptocurrency that’s big enough to impact the markets.

In February, MetaStreet announced that it has secured $3 million in seed financing and $11 million in initial protocol liquidity to help scale NFT debt in the quickly developing collateralised NFT lending market.

The platform provides decentralized financial infrastructure to lending protocols such as NFTfi and Arcade.

“It’s sort of like how Fannie Mae works in the US housing market. You’ve got a big aggregation vehicle through which originators can sell loans that then get matched up and split into different tranches,” Moore told Blockworks. “Those different tranches allow for more optimal capital efficiency.”

Co-founder and CEO of MetaStreet David Choi said that NFT collectors want to free up capital more efficiently instead of letting their digital assets collect “virtual dust”.

“I think [NFT] borrowing markets will just grow bigger and bigger, which means its purchasing power will increase,” Choi said to Blockworks. “It’s like instead of putting all of your money into buying a house, you get a mortgage, which means you don’t have to pay that 90% until later. [With MetaStreet], I think we’re extending the purchasing power of the entire industry.”

Stay up to date: