Quick take:

- Stoner Cats NFT is the latest project to be probed by the SEC.

- Impact Theory became the first NFT project to face an SEC enforcement action on August 28.

- NFT prices have reacted differently with Stoner Cats floor price rising after the enforcement announcement.

The Securities and Exchange Commission (SEC) has taken its fight against crypto to the world of NFTs. After failing to enforce its rule on Binance and Coinbase amid claims of selling unregistered securities, the US capital markets regulator is looking to enforce the action on the non-fungible tokens (NFTs) market and it seems to be working, at least on some projects.

YouTube and podcast studio Impact Theory became the first company to face enforcement action from the SEC after agreeing to pay a penalty of more than $6 million after being accused of selling unregistered securities. The company also agreed to destroy all the NFTs and compensate buyers of its NFTs.

That move was bound to trigger a ripple effect in the industry and it has done just that. The latest project to fall under the axe of the SEC’s crackdown on unregistered securities that are being offered as NFTs is the Stoner Cats NFT project.

Although NFT transaction volumes increased in the three consecutive days following the Impact Theory announcement on August 28, the picture seems quite different after the latest SEC action.

Volumes remained low on Thursday following Wednesday’s press release. But this may have nothing to do with Stoner Cats at all because its NFTs experienced something perplexing.

As reported by Decrypt, the floor price of Stoner Cats NFTs has more than doubled to 0.049 ETH up from 0.019 ETH following Wednesday’s announcement. The number of transactions also increased significantly compared to the previous day.

According to the SEC, Stoner Cats agreed to a cease-and-desist order and to pay a civil penalty of $1 million.

And just like in the Impact Theory case, the order establishes a Fair Fund to return monies that injured investors paid to purchase the NFTs, with Stoner Cats also agreeing “to destroy all NFTs in its possession or control and publish notice of the order on its website and social media channels.”

The SEC is particularly targeting NFT projects that offer investors an opportunity to earn income from the project by holding NFTs. So, projects that offer NFTs for gaming purposes, or to unlock certain experiences shouldn’t worry about facing a similar action.

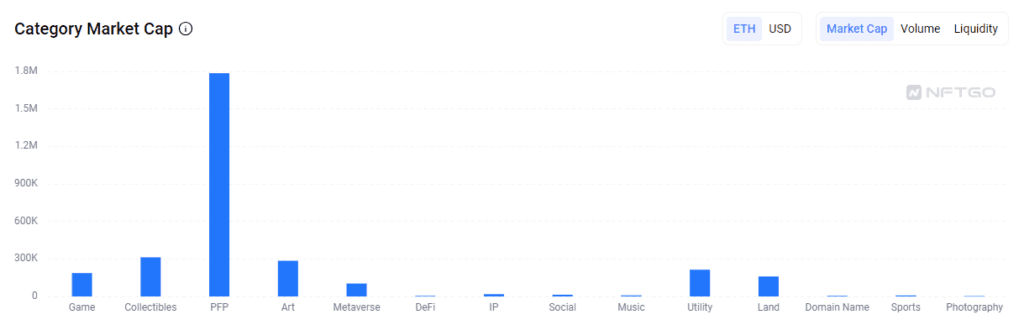

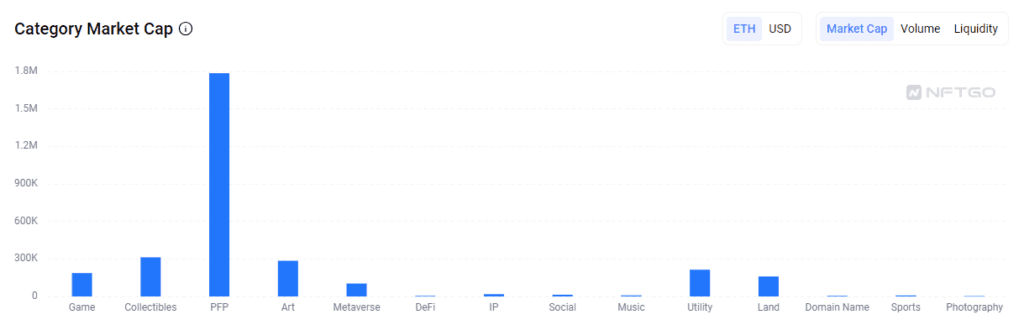

The NFT industry is highly segmented, with different companies offering different types of NFTs. NFT profile pictures (PFPs) account for the biggest segment of the industry with a market cap of about 1.785 million ETH, with digital collectibles and NFT art following at a distance with about 312k ETH and 285k ETH, respectively.

Then we have gaming NFTs with about 186k in market cap and Utility NFTs (those that unlock benefits like merchandise etc.) at 213k ETH. None of the five NFT types mentioned are under threat from the SEC probe, which essentially means the industry may be well-positioned to survive the purge.

****

Stay up to date:

Subscribe to our newsletter using this link – we won’t spam!