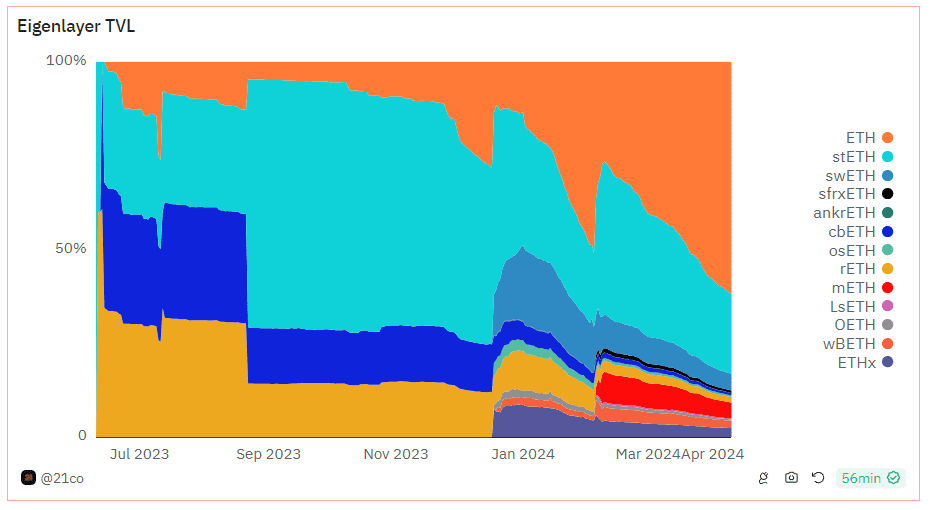

The total value locked (TVL) on EigenLayer has just crossed the $15 billion mark as it launches on the Ethereum mainnet, according to Dune data provided by 21.co.

However, DefiLlama data suggests a TVL figure of $13.5 billion.

Still, EigenLayer continues to update its TVL record and has become the second-largest decentralized finance (DeFi) project after Lido, the most popular liquid staking protocol.

On April 9, EigenLayer announced that its main restaking application and its data availability service, EigenDA, had launched on Ethereum. Up until now, restaking on the protocol implied simply depositing liquid staking tokens (LSTs) or setting validator withdrawal credentials to an EigenPod.

Following the mainnet launch, operators and Actively Validated Services (AVSs) are live, and restaking means to delegate to one of the top 200 operators managing AVSs.

70% of New Validators on Ethereum Use EigenLayer

According to EigenLayer, 70% of all new Ethereum validators use the protocol to restake and maximize rewards.

In less than a year, the protocol’s testnets, Goerli and Holesky (for EigenDA), have attracted over $13 billion worth of ETH for restaking, becoming the second-largest DeFi project and overtaking the likes of Aave, Maker, and Uniswap.

The rapid adoption reflects the success of the restaking concept introduced by EigenLayer, which enables ETH stakers to repurpose the locked coins to secure a range of Ethereum-based applications seeking higher rewards. On the one side, restaking offers higher potential rewards, and on the other, decentralized applications can benefit from Ethereum’s mainnet security.

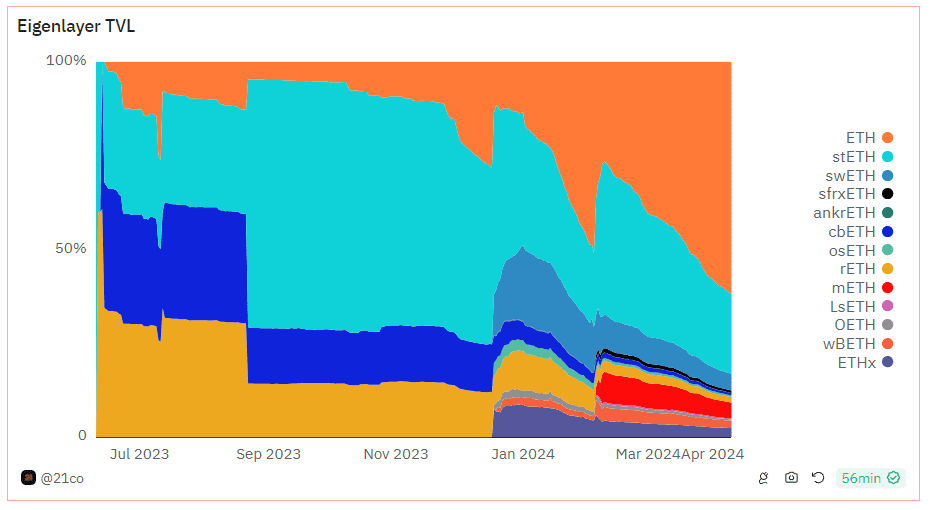

EigenLayer enables users to restake Ethereum and LSTs. The share of ETH deposits has increased over the months, now accounting for over 60%. Lido’s stETH deposits come second with over 20%.

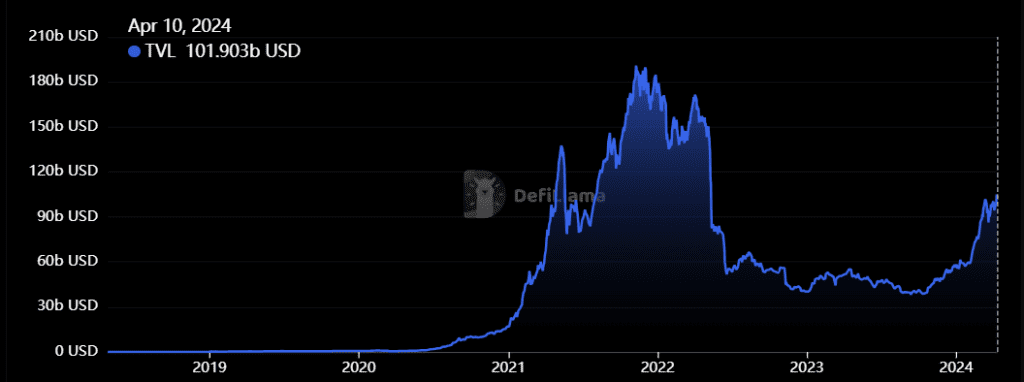

EigenLayer has had a significant contribution to the revival of the DeFi sector, which returned to the $100 billion mark on April 1 for the first time since May 2022.

Stay on top of things:

Subscribe to our newsletter using this link – we won’t spam!