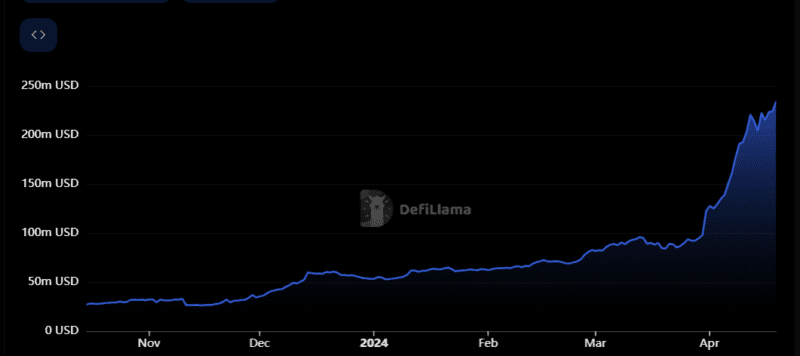

Linea, an Ethereum layer 2 by Consensys that uses zero knowledge (zk) technology, has pushed the gas pedal down to the bottom. The total value locked (TVL) on Linea apps has almost doubled in April to $234 million as of this writing, according to DefiLlama.

The TVL figure has surged by over 400% since the beginning of the year, initially breaking above $50 million in December 2023.

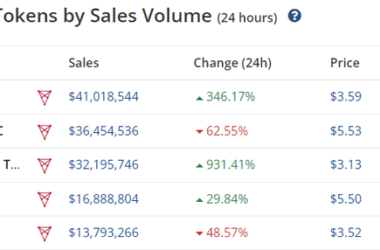

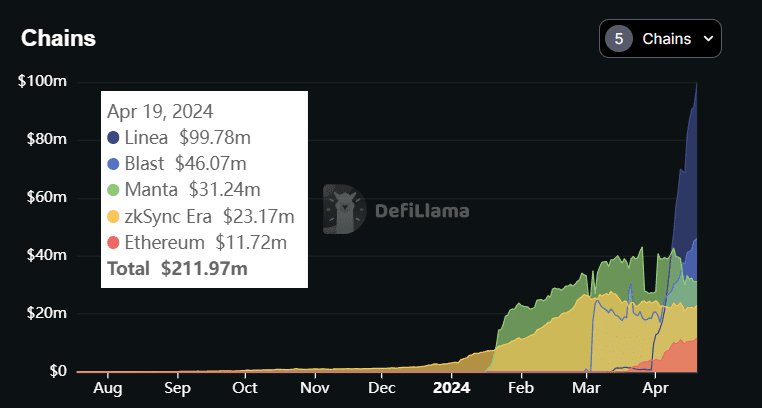

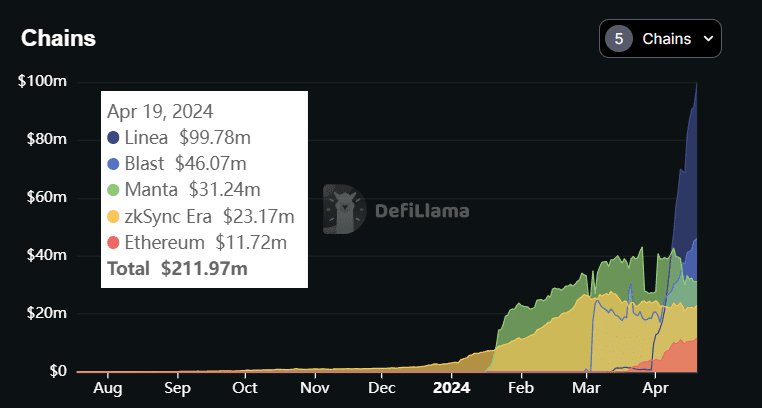

ZeroLend has the lion’s share of Linea assets locked in decentralized finance (DeFi). The lending protocol has a TVL of $100 million on Linea and an additional $100+ million on four other chains, including Blast, Manta, zkSync Era, and Ethereum. ZeroLend’s TVL on Linea has surged over 8,000% over the last month alone, contributing to the layer 2’s rapid growth in April.

Activity on Linea is also driven by the support of Renzo, the second-largest liquid restaking protocol after Ether.fi. Renzo has a TVL of over $3 billion across seven chains, including $150 million on Linea.

Renzo’s ezETH token accounts for over 53% of all assets on ZeroLend. Investors can deposit ezETH through ZeroLend to aim for an APY of 0.3% and earn Renzo and EigenLayer points.

Other popular DeFi apps on Linea are Mendi Finance, a lending protocol, and Lynex, Linea’s native DEX.

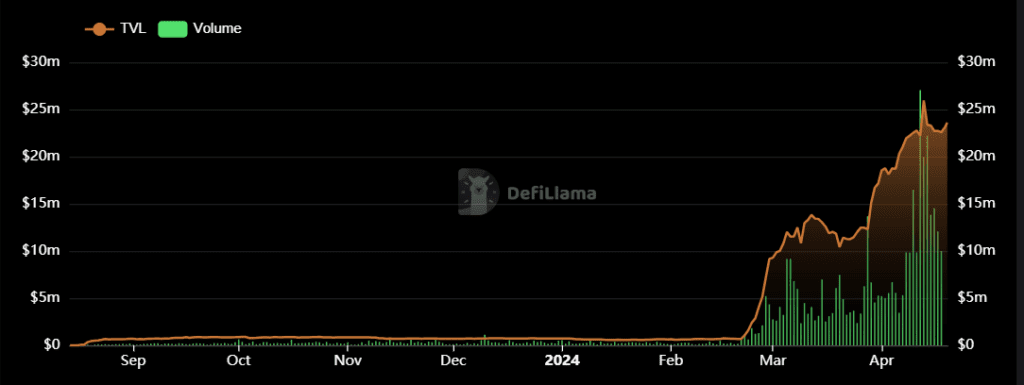

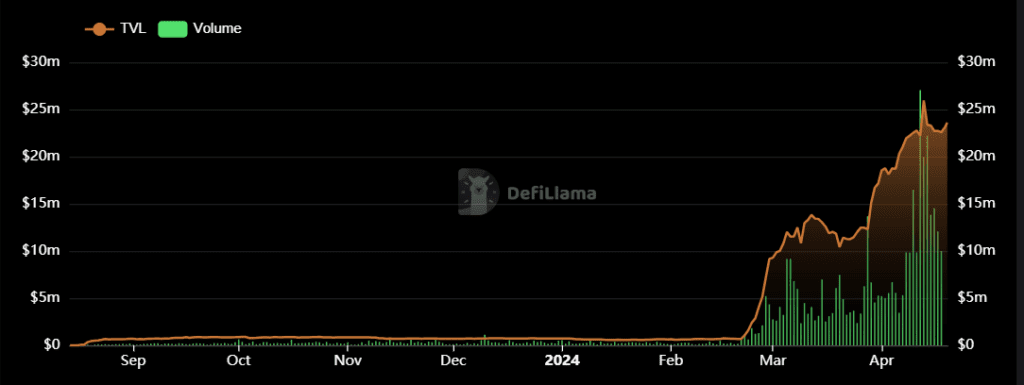

Lynex’s TVL and trading volumes have surged to record levels in mid-April, driven by demand for USDC, USDT, and ezETH.

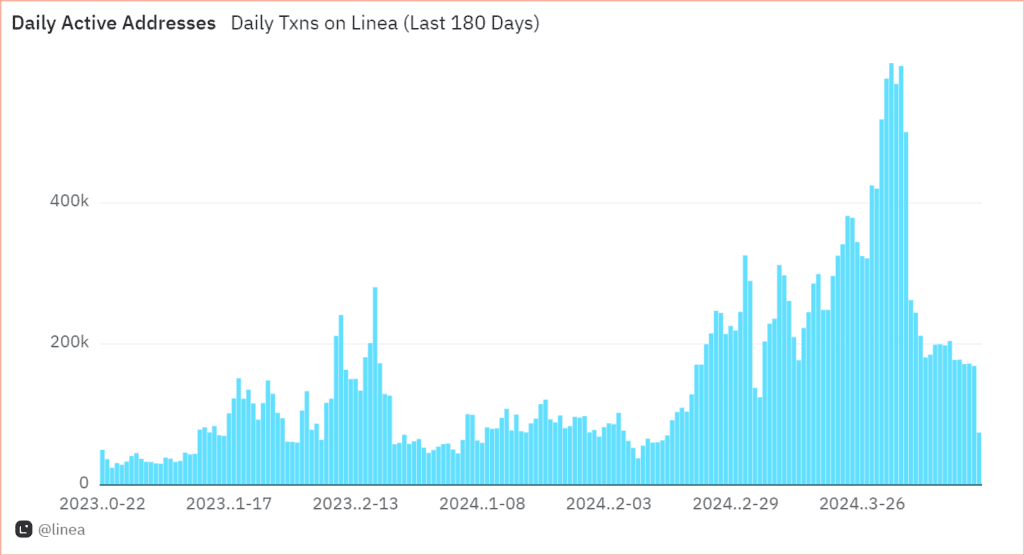

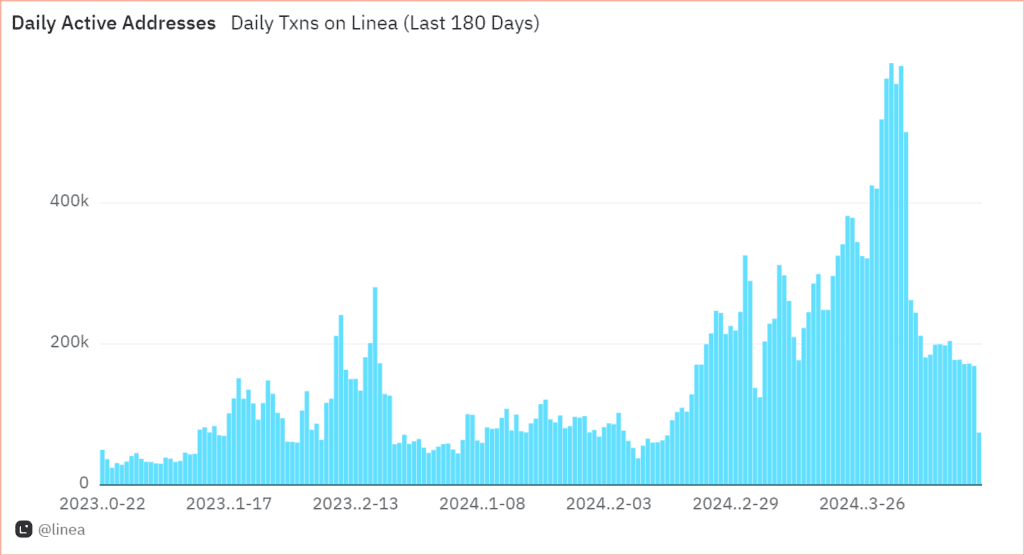

Linea’s daily active addresses and daily transaction figures have surged to record levels at the beginning of April.

On April 1, the layer 2 chain saw over 600,000 active addresses conducting over 4.6 million transactions.

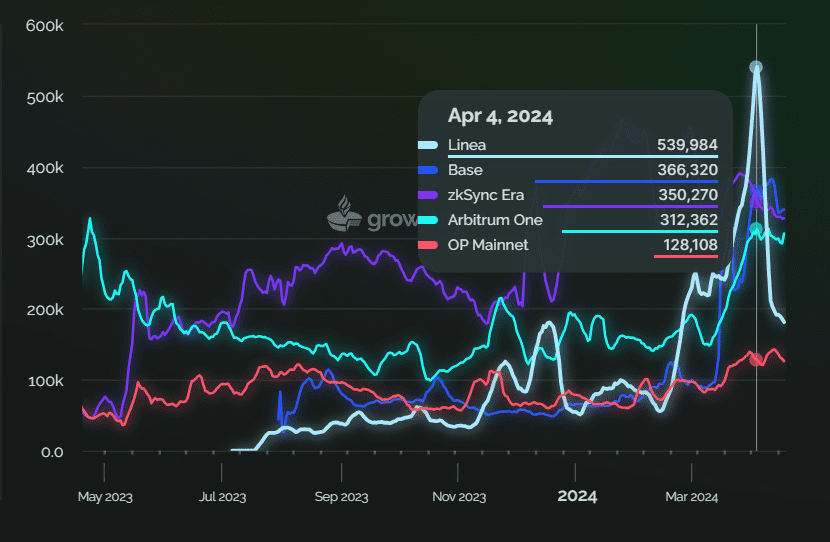

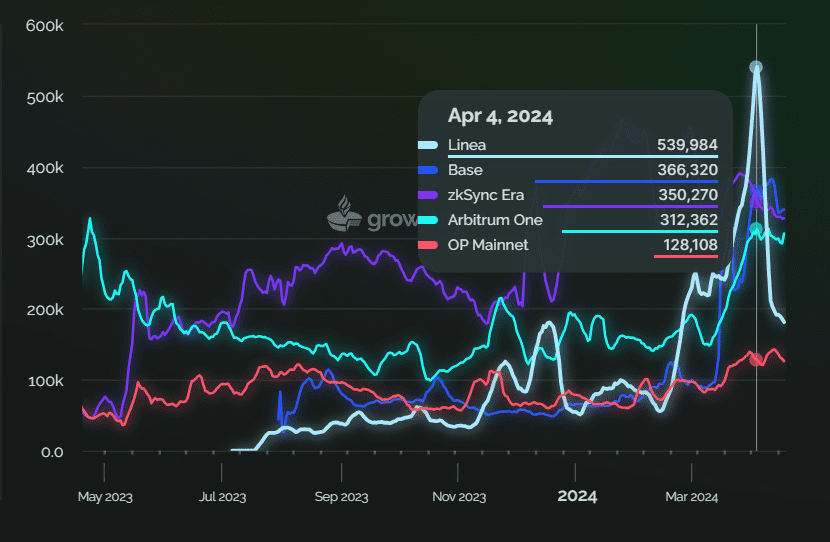

At the time, Linea had more active users than Base, zkSync Era, Arbitrum, and OP.

Earlier this month, we reported that active users on Arbitrum, OP, and Base had increased to record high levels, suggesting a rapid growth of layer 2s.

Stay on top of things:

Subscribe to our newsletter using this link – we won’t spam!