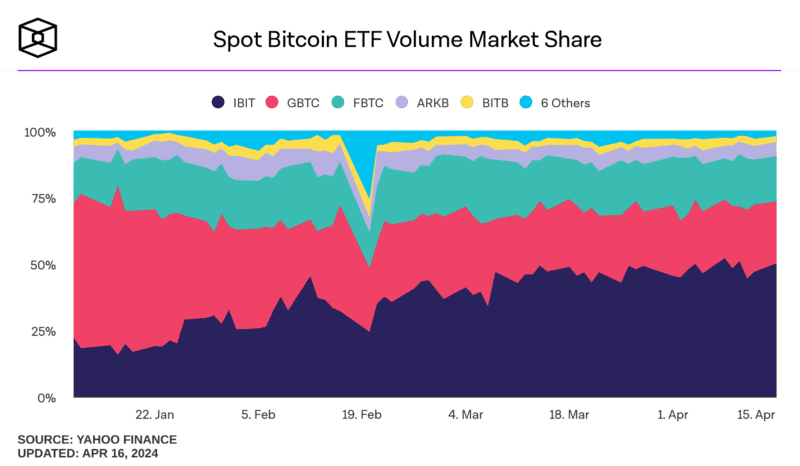

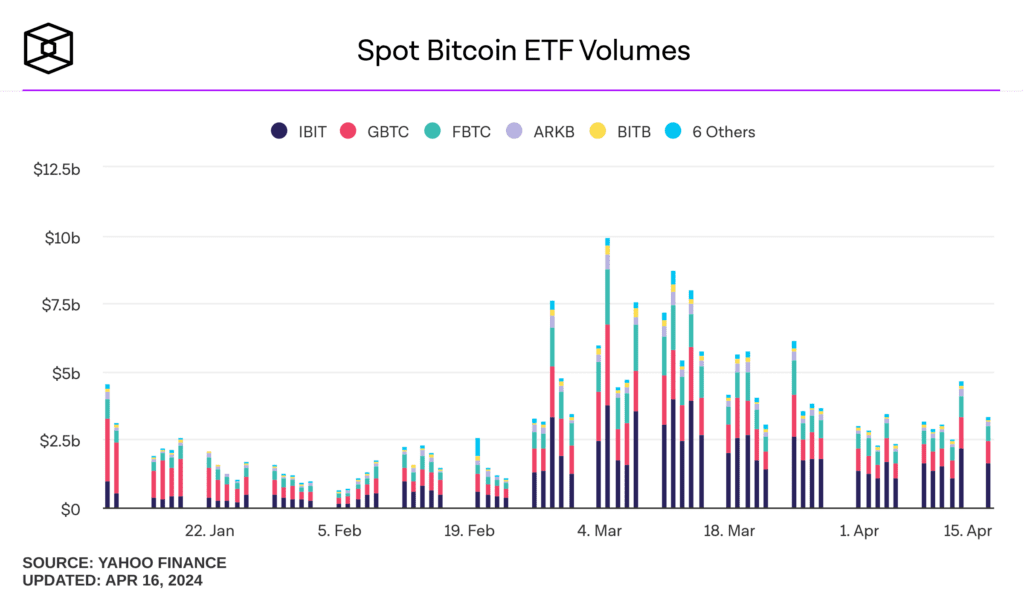

BlackRock’s Bitcoin exchange-traded fund (ETF), traded on Nasdaq with the ticker IBIT, continues to win market share. Earlier this month, IBIT’s share of Bitcoin ETF volume crossed 50% for the first time since the 11 spot Bitcoin ETFs were launched in mid-January.

Meanwhile, the Grayscale Bitcoin Trust ETF (GBTC), which accounted for almost 60% of all ETF trading volume in early days following the launch, is currently left with less than 24%.

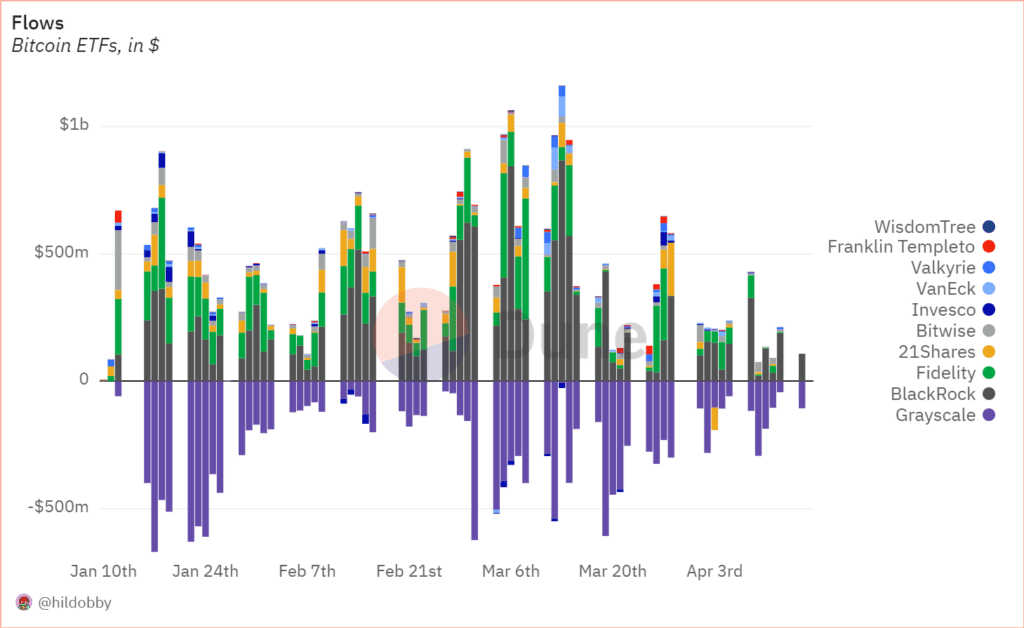

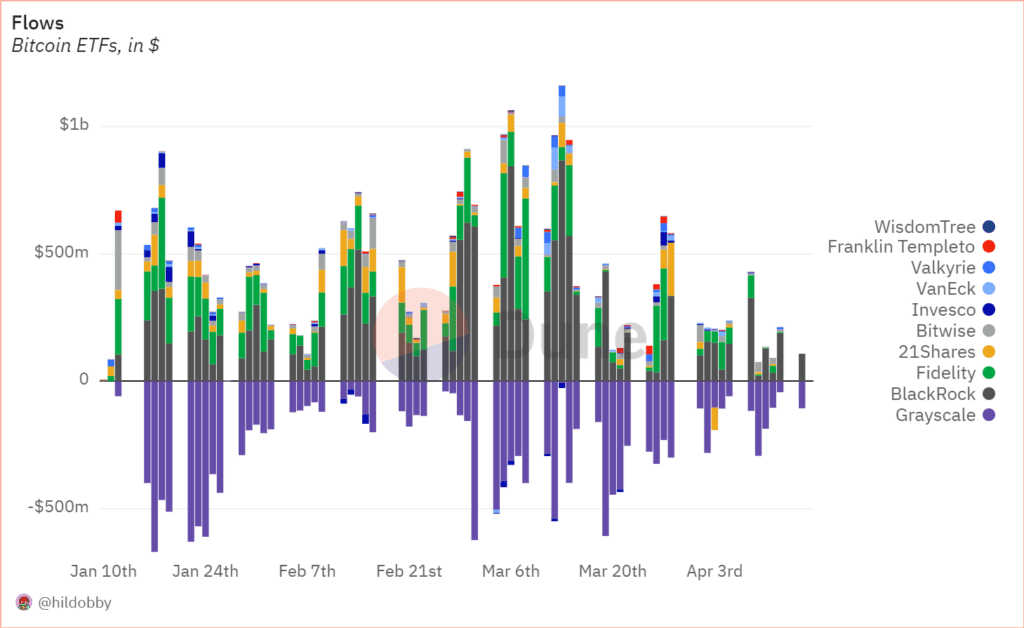

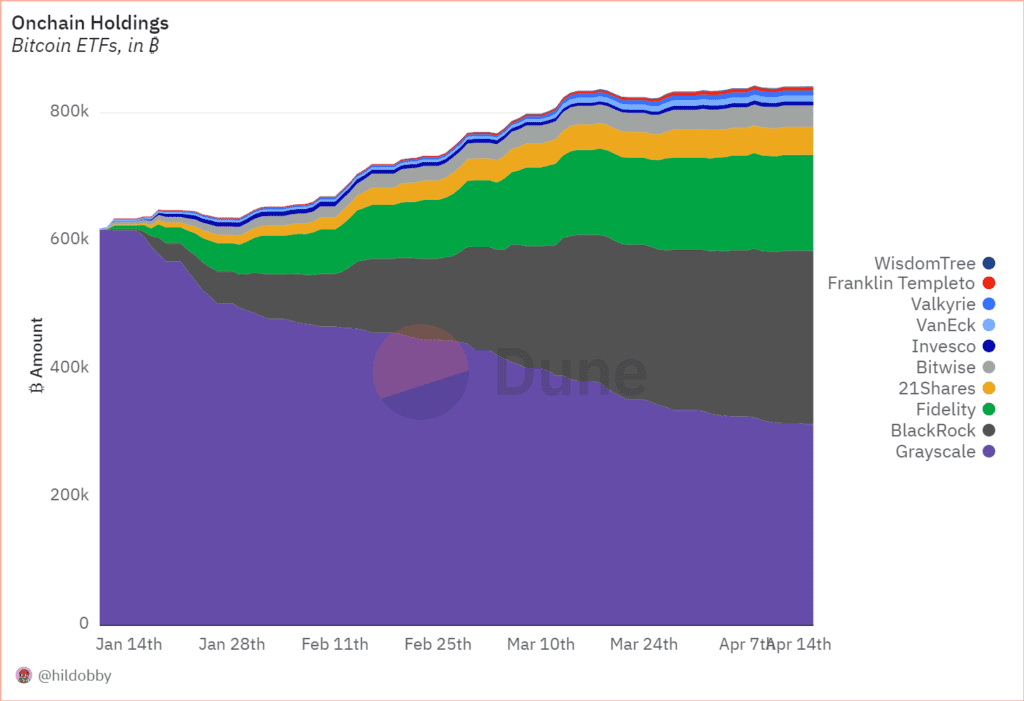

The Bitcoin ETF flow chart shows systematic outflow of funds from GBTC and systematic inflows to IBIT and Fidelity’s FBTC in recent months.

One of the reasons why many investors prefer IBIT over GBTC is because the latter charges a 1.5% annual management fee. In contrast, IBIT and FBTC charge only 0.25%.

On top of that, BlackRock has a greater reputation due to its status of the world’s largest investor with $9 trillion in assets under management. Also, IBIT is one of the few Bitcoin ETFs listed on Nasdaq, which is associated with tech companies and innovation.

Meanwhile, total Bitcoin ETF volume has been correcting in April compared to record figures in March.

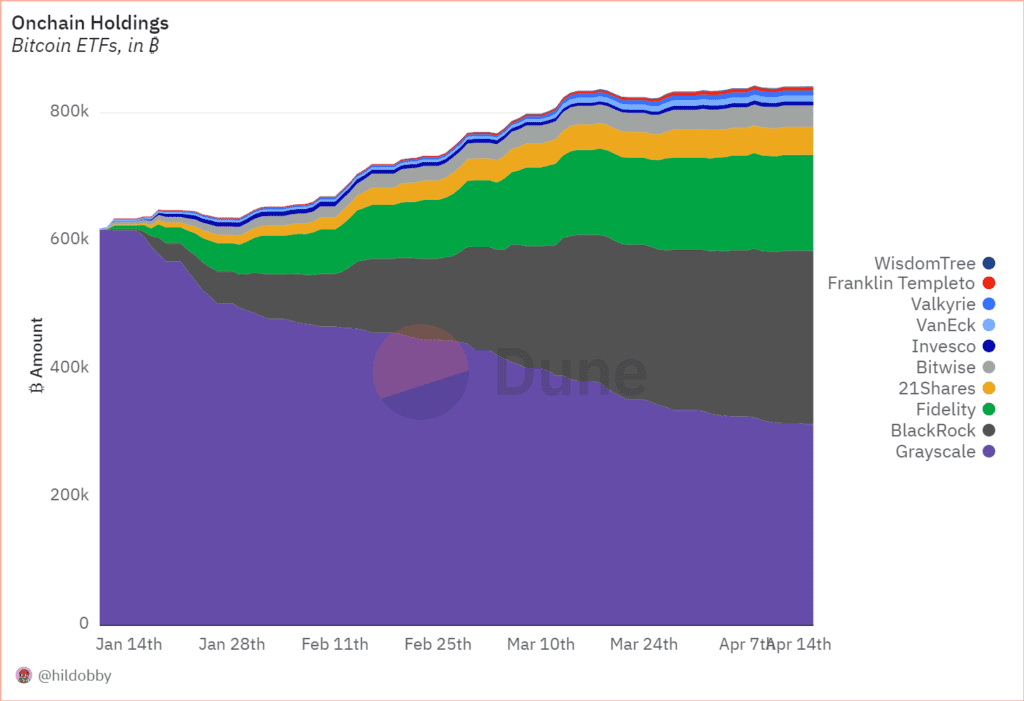

Grayscale Still Has Largest Chunk of ETF Funds

Despite IBIT’s dominance in Bitcoin ETF activity, Grayscale remains with the largest shares of Bitcoin ETF AUM, but not for long.

Currently GBTC’s market share is 37% versus IBIT’s 32%, but things are evolving rapidly.

IBIT may continue to win market share, as BlackRock recently added major US banks as participants in its Bitcoin ETF product, including Goldman Sachs, Citigroup, and UBS.

Eric Balchunas of Bloomberg took to X to say:

“BlackRock updated its bitcoin ETF prospectus w/ many new Authorized Participants incl first-timers Citadel, Goldman Sachs, UBS, Citigroup. Takeaway: big time firms now want piece of action and/or are now OK being publicly associated w this.”

Bitcoin ETFs are already playing a major role in the crypto industry, as they hold over 4% of Bitcoin’s supply.

Stay on top of things:

Subscribe to our newsletter using this link – we won’t spam!