Quick take:

- Web3 data engine Golden Protocol has raised $40 million in a funding round led by a16z.

- The fundraising also attracted participation from OpenSea ventures and Protocol Labs alongside several angel investors.

- Ali Yahya, General Partner, A16z will join Golden’s board alongside current board member Marc Andreessen.

Web3 data engine Golden has raised $40 million in a funding round led by Andreessen Horowitz (A16z). The Series A round also attracted participation from Protocol Labs, OpenSea Ventures, Harpoon Ventures, Vela Partners and Socii Capital, among other VCs.

Solana founder Raj Gokal and Maryanna Saenko of Future Ventures were also among several angel investors that joined the fundraising.

The company is building a data protocol, which it referred to as being more than just “a Wikipedia for web3”. Essentially, Golden wants to bring order into chaos. According to a blog post published on the company’s website announcing the fundraising, knowledge is highly fragmented, which makes it difficult to find specific information.

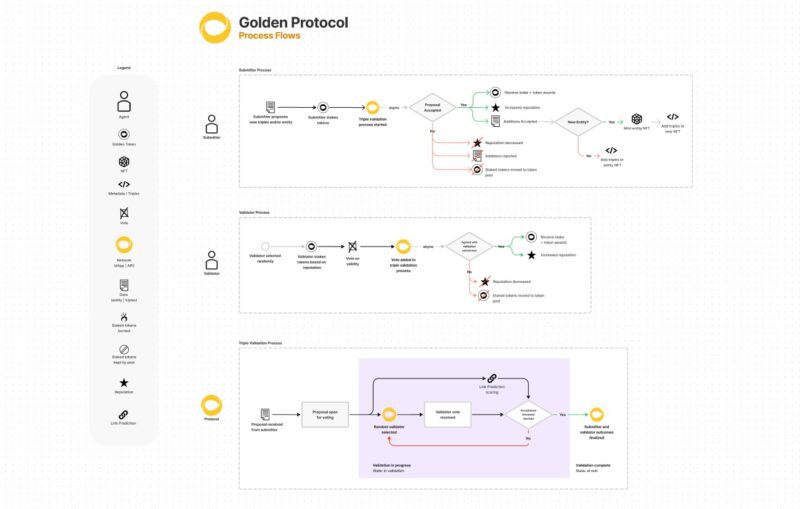

“To find reliable information, one needs to search across centralized repositories, personal webpages, news sites, blogs, and private databases,” the post reads. Thus, Golden wants to streamline the process by providing incentives for data entry, verification, and governance.

The company wants to leverage the disruptive force of web3 technologies to provide a highly incentivised mechanism for efficient task execution.

Golden says it already boasts a discord community of more than 35,000 participants “currently submitting facts, validating information, improving and building the protocol itself.”

The protocol offers participants financial rewards for correct data and disincentives for being wrong.

The company uses the concept of slashing, which is basically removing staked crypto collateral by a participant for every wrong data entered or validated. According to the post, each real-world entity will be represented by a canonical data NFT, upon which all information associated with it will be upended.

“This allows collections of public canonical data to be constructed and also provides a disincentive to producing duplicates (a common problem in knowledge graph construction).”

The canonical NFTs will also have revenue-sharing rights attached to them. This allows data constructs, validators and anyone involved in compiling the data under the canonical NFT to share revenue on a prorated basis every time a paying user uses the data.

The company expects this incentive to motivate data producers to add the most commercially useful data to canonical NFTs.

“To create a stable and growing token economy, companies will be able to rent data from the protocol and pay for usage using a burn-and-mint model. Commercial users will be able to buy protocol tokens then burn them to create stable data credits which are spent to access data,” writes Jude Gomila, CEO and founder of Golden.

Stay up to date: