Quick take:

- The United States Office of Government Ethics has issued guidance on real estate NFTs.

- The Federal Agency wants officials to periodically report all NFT investments worth $1000 or more.

- The officials are also required to report any NFT profits worth $200 or more.

The United States Office of Government Ethics (OGE) has issued its officials guidelines for non-fungible tokens (NFT) investments. The Federal Agency wants its officials to report real estate NFT investments (including fractionalised NFTs) worth $1000 or more at the end of the reporting period.

The agency also requires the officials to declare any NFT profits of $200 or more made during a reporting period.

“Public financial disclosure filers must also disclose purchases, sales, and exchanges of collectible NFTs and F-NFTs that qualify as securities,” the new guidelines state.

The agency has decided to clarify its position on NFTs after previously ruling that personal assets, including clothing, electronics or family photos, and any NFTs linked to them “are not reportable.”

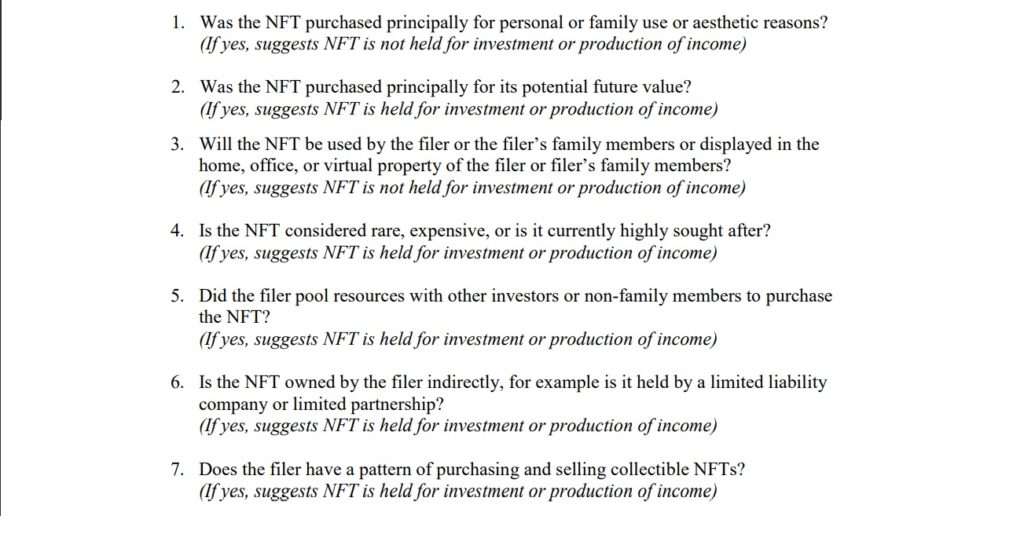

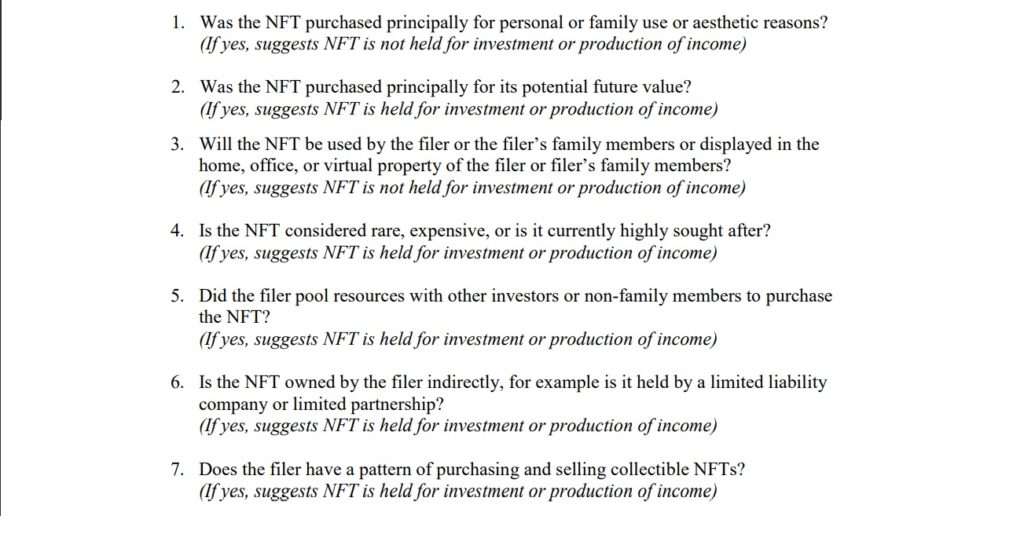

OGE has provided a seven-question-answer checklist to help officials determine which investments should be reported as income.

Those filing disclosures for NFT investments have been asked to use Form 278e and must include information about the income type and amount of all qualifying NFTs.

This is not the only government office to recognise NFTs as income assets.

Earlier this year, India announced plans to introduce a 30% tax on non-fungible tokens, calling them virtual assets.

In February, the Israeli Security Authority introduced new guidelines under which digital assets may be classified as securities. Although the regulatory body did not explicitly mention NFTs as a candidate under the new rules, there was consensus that they may be deemed as such, especially where real estate assets are involved.

Hong Kong Securities and Futures Commission last month also issued guidelines requiring licensing of fractionalised NFTs while Singapore joined Israel and India in introducing taxes on profits from NFTs.

While the NFT industry is still in its nascent state, government agencies are increasingly zooming in on the investments in the space, bringing it closer to the mainstream.

The industry is particularly drawing attention because of utility NFTs, which have become a target of leading retail brands.

Stay up to date: