Quick take:

- Metaverse and NFT & Collectibles tokens plummeted earlier in the week amid Russia’s invasion of Ukraine.

- The crypto community responded towards the end of the week with some offering support via NFTs.

- Several tokens bounced back with $YGG, $WEMIX, $NIF, and $DFA closing the week higher than they opened.

In this edition of the weekly token boom report, NFTs and metaverse tokens bounced back towards the end of the week to trim losses incurred during the week. The crypto market plummeted earlier in the week amid Russia’s invasion of Ukraine, dragging the metaverse and NFTs & Collectibles segments of the industry.

However, the market responded on Thursday and Friday getting behind Ukraine through NFTs and crypto donations with leading marketplaces also offering their messages of support.

As a result, metaverse and NFTs segments led the industry’s rebound with Yield Guild Games (YGG/USD), Wemix (WEMIX/USDT), Unify (NIF/USDT), and DeFine(DFA/USDT) ending the week higher than they opened.

Metaverse tokens

While most metaverse tokens are based on gaming projects, whenever Meta, formerly Facebook speaks about its plans for the 3D virtual world, everyone takes note. This week, the leading social media conglomerate unveiled its grand plan for AI in the metaverse as it seeks to power conversations in the immersive world.

On the downside, research conducted by the BBC found that metaverse apps are allowing kids into virtual strip clubs, again raising questions about the safety of the metaverse.

Nonetheless, the mixed bag of events did not stop $YGG and $WEMIX from bouncing back from an earlier collapse during the week, to end higher than they opened on Monday.

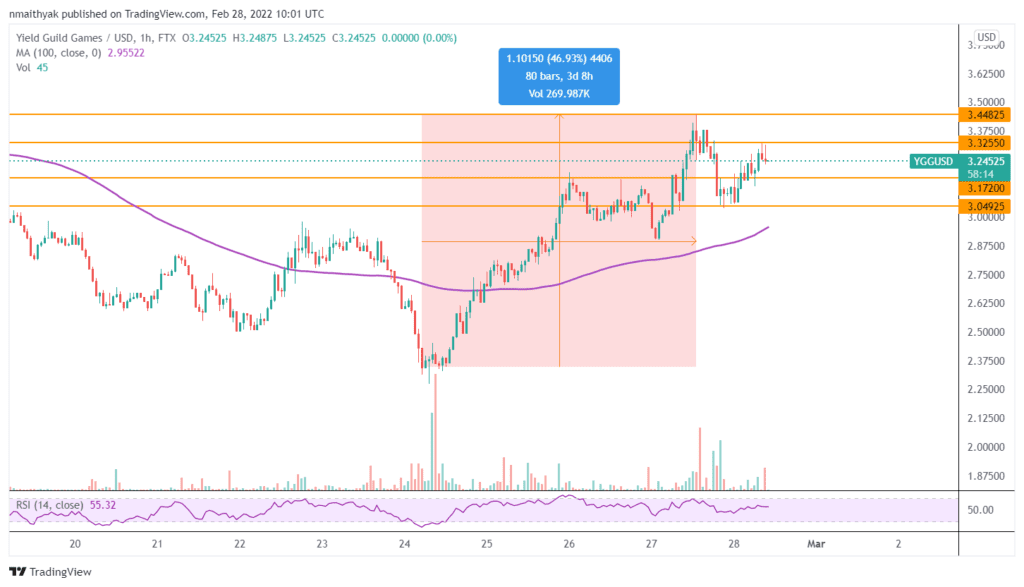

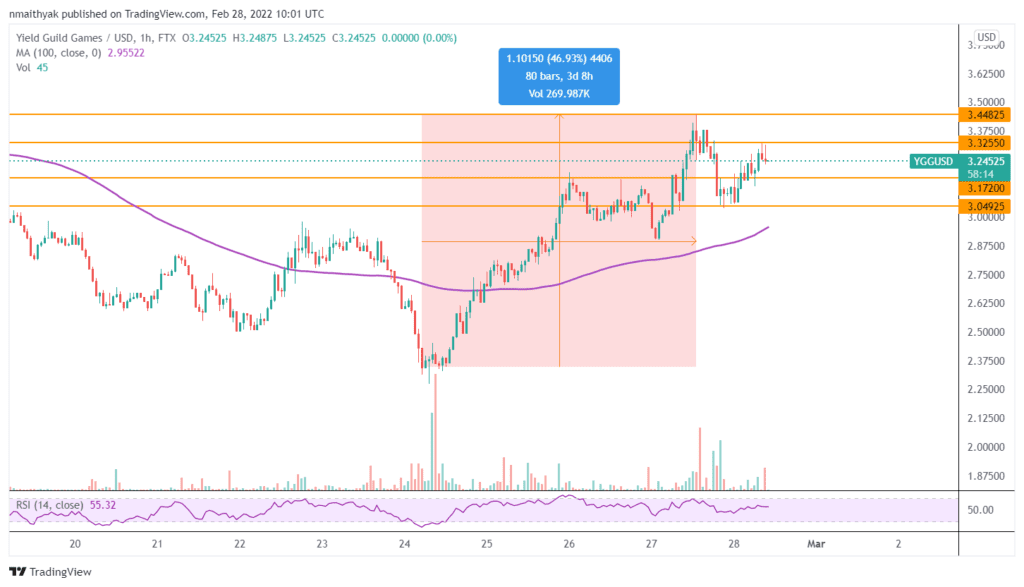

Yield Guild Games (YGG)

Yield Guild Games is one of the leading decentralised autonomous organisations (DAOs) that invests in in-game NFTs in the metaverse. The DAO wants to create one of the biggest virtual economies in the metaverse by wallowing players and investors to invest in NFTs.

Technically, the $YGG token spiked on Thursday through Sunday recouping losses incurred during the week.

Traders can target extended gains at about $3.32 or higher at $3.44, while $3.17 and $3.04 are crucial support zones.

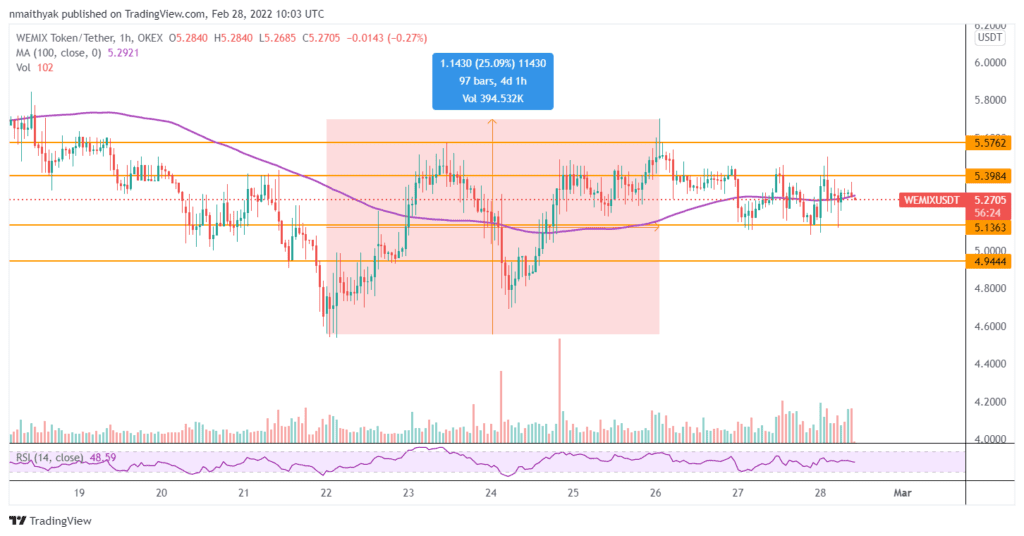

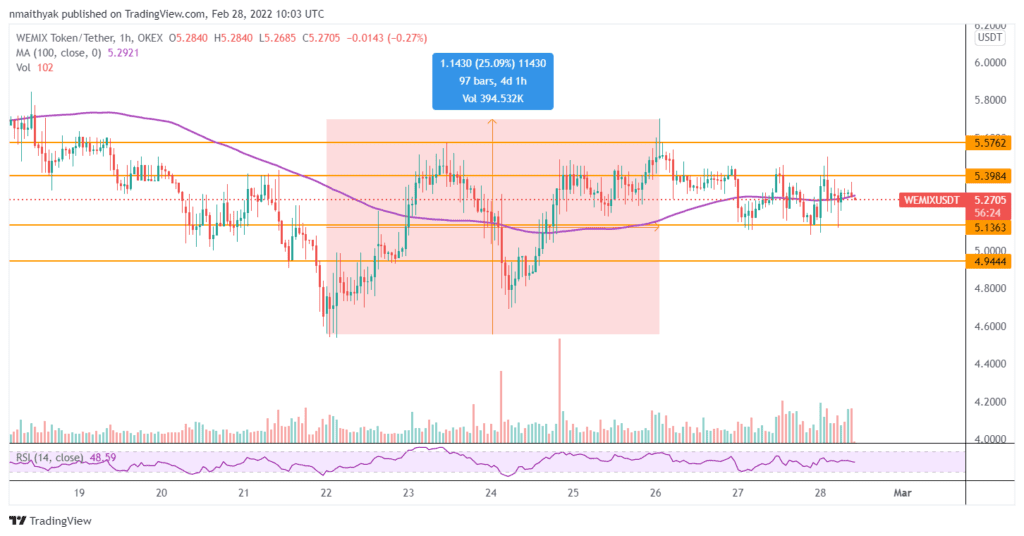

WEMIX (WEMIX)

WEMIX is a hybrid blockchain ecosystem used by play-earn-game developers to create metaverse games that allow players to mint in-game items at fast transaction speeds and without incurring high gas fees.

The platform has combined both public and private blockchains to remove the constraints created by cross-chain transactions. As a result, the platform is able to support the creation of multiple blockchain games.

Technically, the $WEMIX token seems to be trading in a sideways trend after spiking on Thursday and Friday.

Traders can target profits at about $5.39 or higher at $5.57. On the other hand, if the price pulls back, it could find support at $5.23 and $4.94.

Ontology (ONT)

Ontology is a layer-2 scaling blockchain ecosystem that supports cross-chain transactions. The platform was initially launched on the Neo network, before launching its own Mainnet in 2018.

The platform offers several GameFi and identity protection services that will power the Web3 ecosystem. Its scaled blockchain speeds up transactions while lowering gas fees. Binance said on Friday it will support Otology’s upcoming upgrade.

The token spiked 26% between Thursday and Sunday before edging slightly lower on Monday.

Technically, the $ONT token price seems to have created another buying opportunity following Monday’s pullback.

Traders could target a retest of last week’s highs at $0.54 or $0.52, while $0.49 and $0.48 are support levels.

NFTs and Collectibles tokens

The world of NFTs continues to expand with several brands launching limited editions of collectibles for their fans. In this week’s edition of the token boom report, the NFT community became popular for a different reason coming together in support of Ukraine’s defence against the Russian invasion.

Even popular NFT artists like Beeple showed their support while a member of the popular Russian band, Pussy Riot joined up with PleasrDAO and others to launch UkraineDAO, announcing an NFT collection whose proceeds will go to charities supporting the Ukrainian defence.

The general positivity gained towards the end of the week helped boost other NFTs and collectibles tokens led by DeFine, WAXP and Unifty.

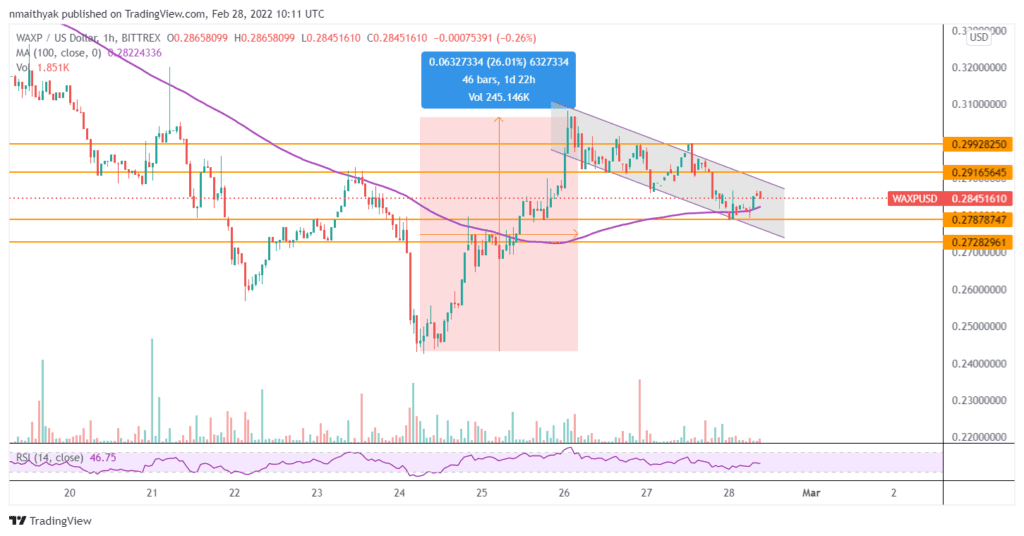

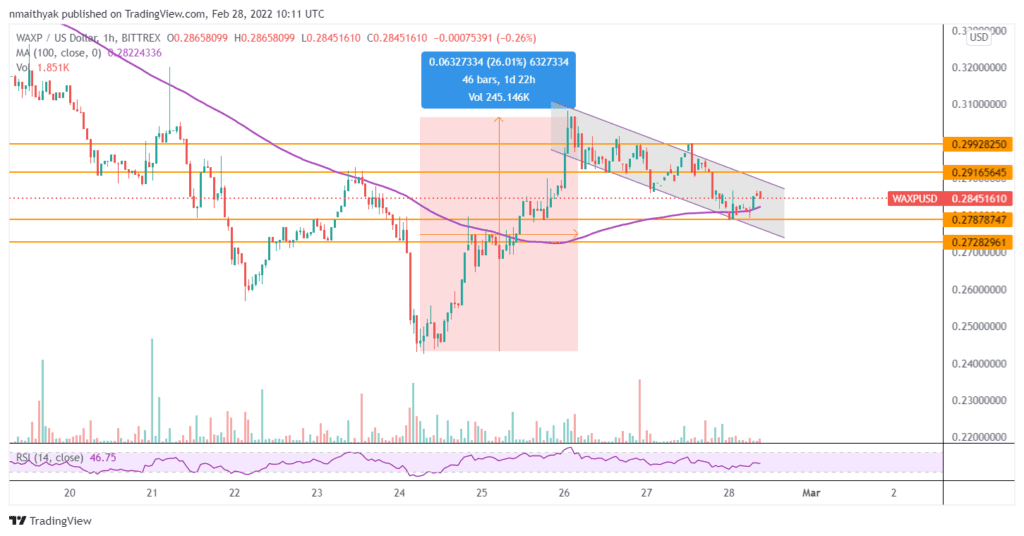

Wax (WAXP)

Wax is a blockchain infrastructure created to support the commerce of developer apps like NFTs.

The platform utilises delegated proof-of-stake (DPoS) as its consensus mechanism enabling fast transactions at low gas fees.

WAXP announced on Friday WWE Hall-of-Famer “The Nature Boy” Ric Flair was joining the network triggering a spike in the price.

However, the $WAXP token has since declined to trim gains before finding support off the 100-hour moving average.

Technically, traders can target potential rebound profits at about $0.29, or higher at $0.30. On the other hand, $0.28 and $0.27 are crucial support zones.

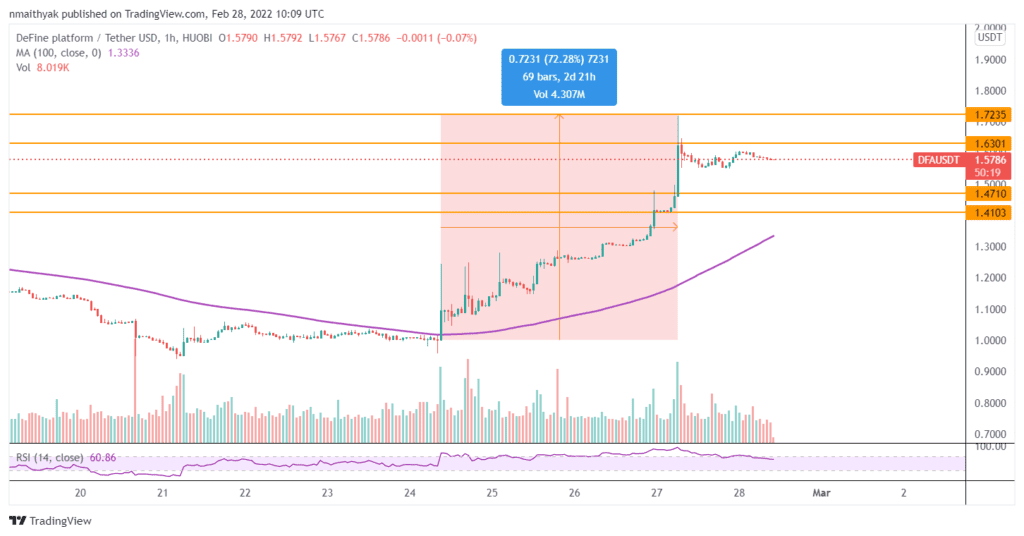

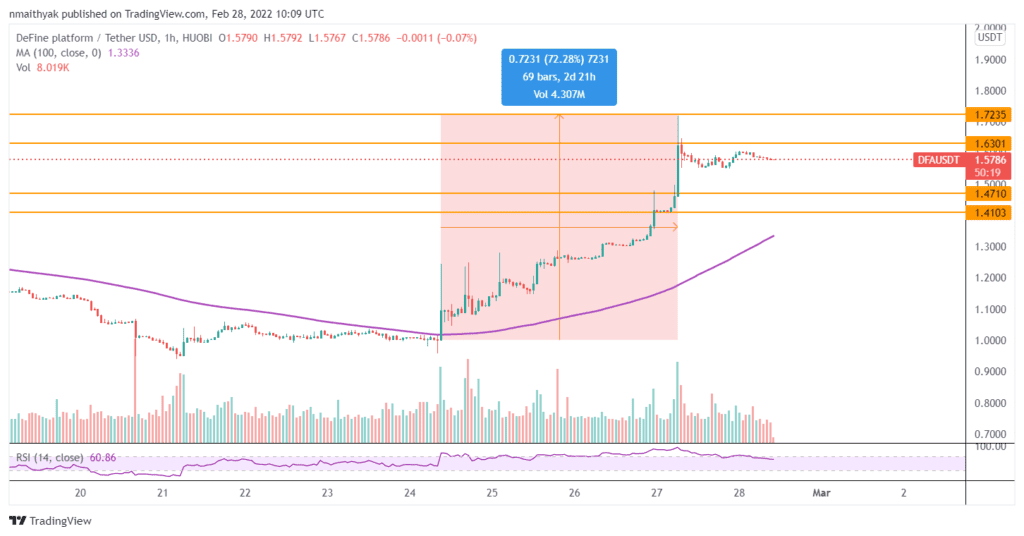

DeFine Platform (DFA)

DeFine is a social NFT marketplace developed to host all types of projects, including works from artists, musicians, influencers, gamers, and athletes. The platform is created with social engagement, interaction and communication in mind.

Creators can launch NFTs and social fan tokens to engage with their fans.

The $DFA token price spiked on Thursday ahead of Banksy’s artwork debut on the platform on Friday.

The price has since extended gains significantly, before pulling back slightly on Monday morning.

The $DFA token rallied between Thursday and Sunday peaking at a high of $1.72 before pulling back on Monday to $1.57.

Traders can target a potential rebound at about $1.63, or higher at $1.72, while $1.47 and $1.41 are crucial support levels.

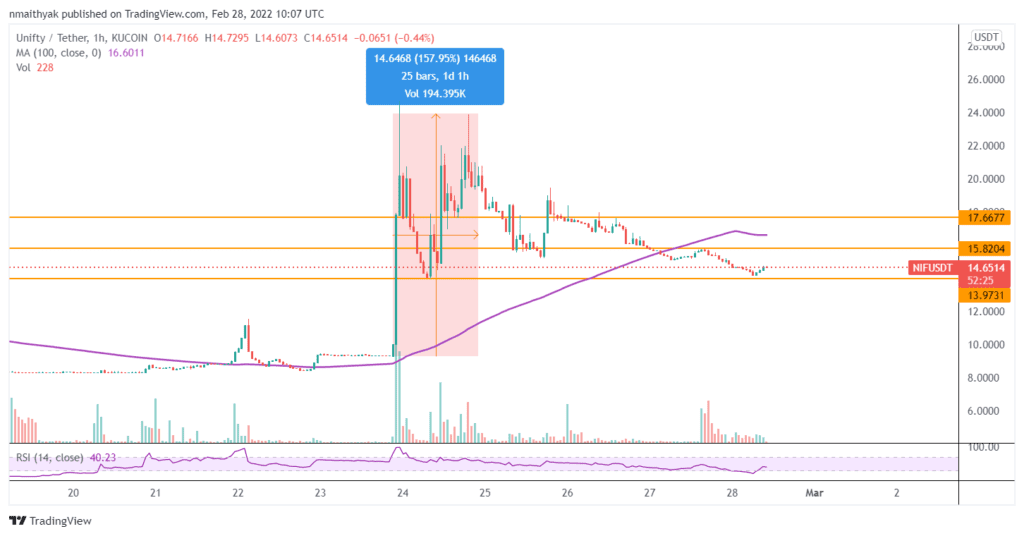

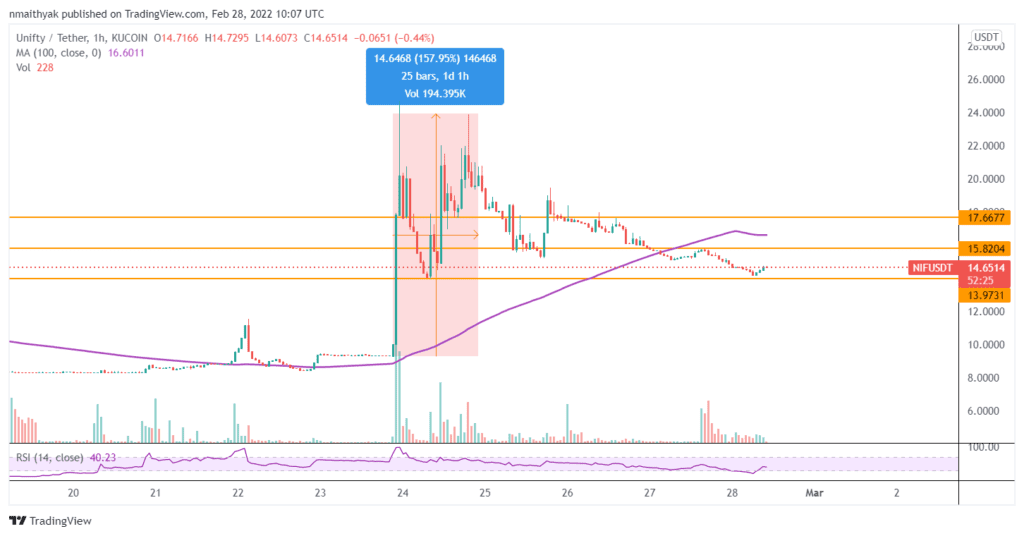

Unifty (NIF)

Unifty is an NFT swapping developer app (dApp) that is currently used for NFT valuation and exchanges. The platform also acts as an NFT (SDK) that allows artists to launch their NFT projects regardless of their coding knowledge.

The Contract-As-A-Service (CaaS) platform has ready-made dApps and a collection of contracts.

Technically, traders can target a potential rebound in the $NIF token price at about $15.82, or higher at $17.66, while $13.97 is a crucial support zone.

Stay up to date: