Quick take:

- SIR MIX-A-LOT’s trademark application hints at plans to release NFTs.

- Lionsgate has plans for NFTs, metaverse avatars and digital tokens.

- Mastercard has filed another Web3 trademark for crypto security.

Rapper and music producer SIR MIX-A-LOT has filed a new Web3 trademark application indicating plans for multimedia files authenticated by NFTs. The trademark was filed on Nov 22 with the United States Patent & Trademark Office (USPTO) and the media files refer to artwork, music, text, video recordings relating to the field of entertainment.

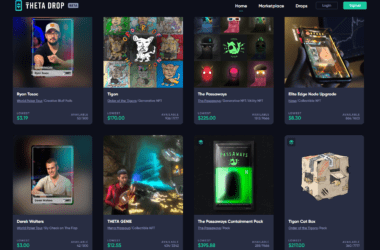

Following its partnership The Sandbox in June to create a film-themed entertainment destination in the metaverse, Lionsgate, has also filed a Web3 trademark application. It covers non-fungible tokens (NFTs) and other application tokens; digital tokens used with blockchain technology; downloadable digital characters, avatars and skins; and downloadable virtual goods.

Lionsgate’s trademark application also covers software for trading in cryptocurrency markets and for facilitating transactions using digital collectibles, digital tokens, NFTs, digital art and other application tokens and software for creating, storing, processing, securing, tracking, transacting and portfolio management of digital collectibles, digital tokens, NFTs, digital art and other application tokens.

Mastercard has filed another Web3 trademark, this time for Mastercard Crypto Secure. The new trademark application indicates plans for the company to provide financial risk assessment services in the field of cryptocurrency; business training regarding risk monitoring in the field of crypto transactions; providing software as a service for continuous crypto transaction monitoring and analysis; and providing software as a service for assessing exposure to fraud, compliance, regulatory and reputational risk related to crypto transactions.

In October, Mastercard’s chief digital officer Jorn Lambert told CNBC that “crypto is on the cusp of going mainstream” as the company launched Crypto Source, a new program that enables financial institutions to offer crypto trading abilities and services.

Crypto Source offering is complemented by Mastercard Crypto Secure to bring additional security to the crypto ecosystem and support card issuers in their compliance with complex regulations.

Mastercard’s suite of crypto-related offerings for banks and fintechs includes technology that supports crypto trading, security management, crypto spend and cash-out capabilities, and crypto program management.

****

Sign up to the world’s biggest crypto exchange Binance to buy and sell cryptocurrencies.

Stay up to date: