Quick take:

- NFT Aggregators like Genie and Gem are taking the industry by storm amid concerns about centralised marketplaces.

- OpenSea continues to retain leadership despite emerging rivalry from incentivised NFT platforms like LooksRare.

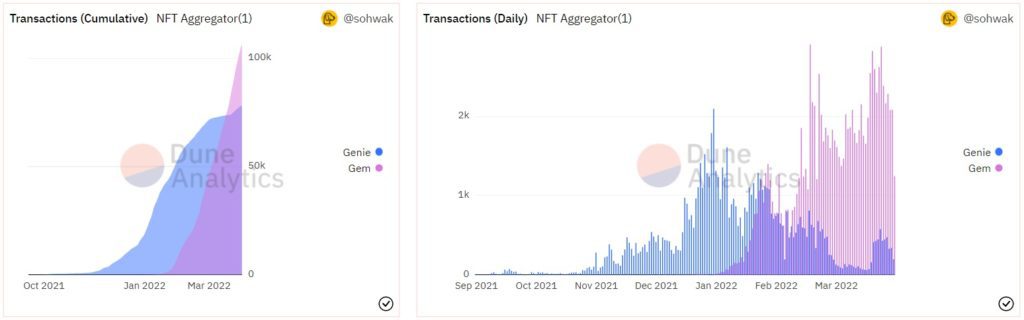

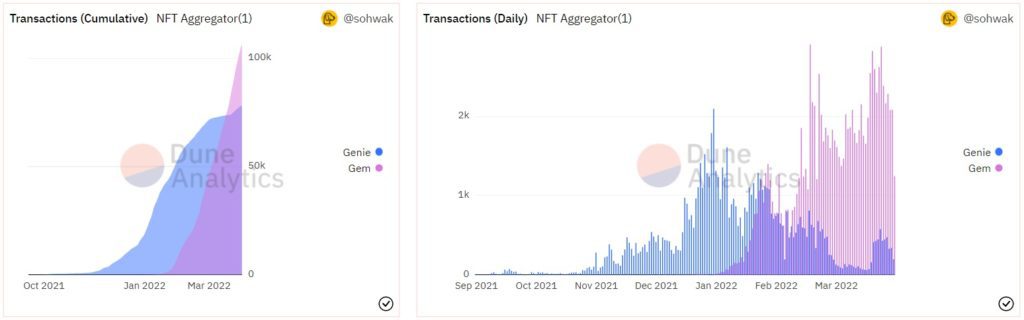

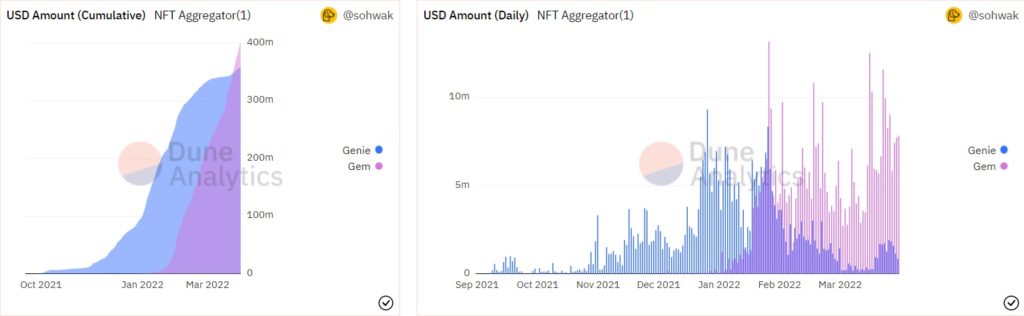

- Data provided by Dune Analytics’ @sohwak indicates that Gem has recently overtaken Genie to become the more popular NFT aggregator

The non-fungible token (NFT) industry become popular last year amid the influx of celebrities and increased funding from blockchain venture capital firms. However, NFTs have been around for longer than that, after emerging back in 2017.

Whilst OpenSea has maintained its market leadership since unseating Rarible, several other platforms have thrown in the challenge. LooksRare launched a high incentivise platform to attract volume traders, whereas the likes of Theta Drop, SuperRare and Autograph have opted for specialisation, focusing on specific segments of the NFT market.

Even giant crypto companies like Binance have jumped in with their own NFT marketplaces.

In 2022, the sentiment seems to be changing and moving towards NFT aggregators.

An NFT aggregator is a platform that allows traders to trade NFT collections from different marketplaces without having to visit those marketplaces. Some of the leading aggregators this year are Gem and Genie, which have seen their transaction numbers skyrocket into hundreds of thousands.

According to data compiled by @sohwak on crypto data and insights platform Dune Analytics, Gem which only started seeing significant volume in January has already surpassed Genie, which was significantly active late last year.

While Genie accounted for a majority of the transactions in December and early January, Gem has since dominated NFT sales on aggregator platforms.

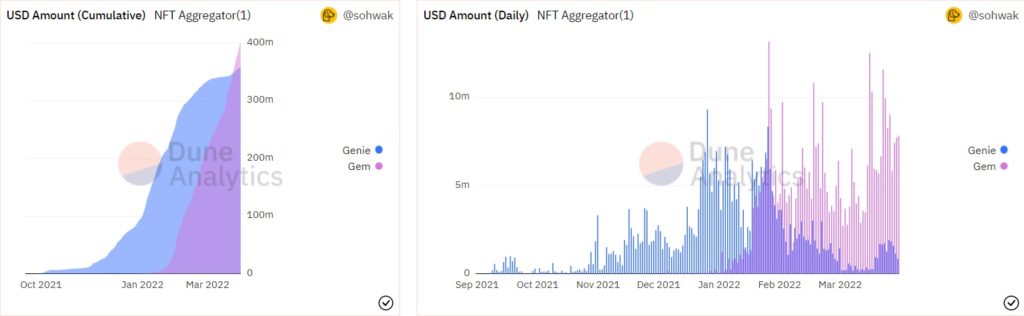

Dune analytics data also shows that Genie and Gem have amassed approximately 111,131 ETH and 139,230 ETH, respectively in transaction volume. The dollar amounts equal to about $275 million and $294 million, demonstrating a shifting trend in the NFT market.

According to experts, one of the reasons behind this paradigm shift is decentralisation. Several NFT marketplaces are highly centralised, which means they list just about any type of collection.

However, NFT aggregators have introduced various tools that can help inexperienced users find legitimate NFTs. For instance, Genie and Gem have leaderboard features that list the top NFTs from all marketplaces in one place. The platforms have also added NFT trading tools allowing users to buy and sell NFTs in batches.

Moreover, these NFT aggregators allow traders to buy and sell NFTs with any token rather than restricting them to using the adopted marketplace token. Traders can also capitalise on comprehensive analysis tools to gain more insights into a wide variety of collections before buying.

By utilising all these tools and features offered by NFT aggregators, traders can limit the adverse effects of using a centralised NFT marketplace.

Stay up to date: