Quick take:

- In this edition of the token boom report, some metaverse and NFTs & collectibles tokens experienced short-term spikes.

- $EFI, $FET and $RNDR spiked earlier in the week before trimming gains for the rest of the week.

- $DEP and $CHZ fell during the weekend to trim weekly gains while $HIGH spiked sharply on Saturday and Sunday.

With the Russian invasion of Ukraine continuing to disrupt the markets. Cryptocurrency prices this week experienced limited rallies with most of them ending the week lower. As a result, the NFTs and metaverse tokens also edged slightly lower trimming their overall market capitalizations.

From an industry perspective, the US Securities and Exchange Commission was reported to be investigating NFTs to establish grounds for regulation. Specifically, the report by Bloomberg indicated that the SEC is interested in fractionalized NFTs, as it considers treating them as securities.

The capita markets watchdog is also looking into NFTs that allow creators to earn income from royalties.

Elsewhere, the metaverse continued to attract more trademark applications from companies including Tencent, Wingstop, and CVS Health, among others.

Metaverse tokens

The metaverse attracted a flurry of trademark applications with Wingstop offering to bring hot wings to the virtual universe.

Elsewhere, Tencent followed up on the success of its New Year’s eve metaverse concert with a trademark for similar events, while CVS Health is betting on a virtual pharmacy.

Nonetheless, none of these developments could prevent the metaverse tokens segment from falling to a market cap of about $22.7 billion, down from about $25 billion in the previous week.

The few that ended the week with gains experienced significant spikes during the week, before trimming gains towards the end of the week.

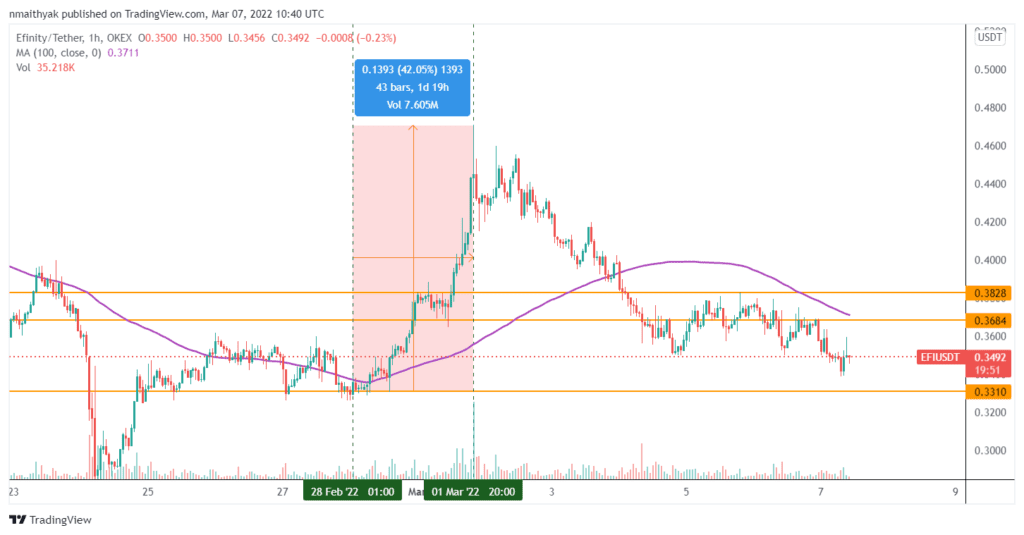

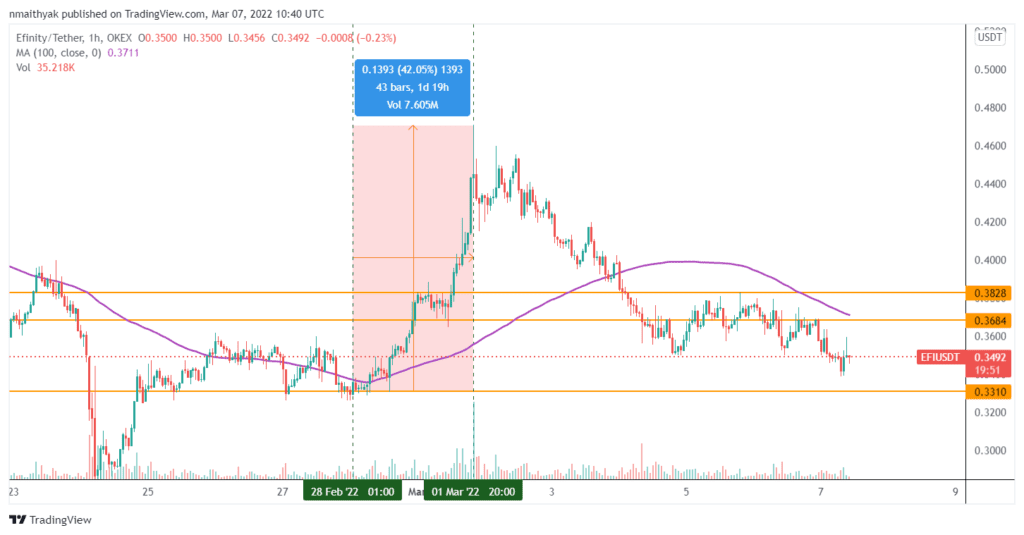

Efinity (EFI/USDT)

Efinity is a cross-chain blockchain platform developed by Enjin, the ecosystem that pioneered non-fungible tokens.

The platform is environmentally friendly and is built to accommodate various dApps especially, blockchain games.

Last week, the $EFI token launched on the Polkadot network, with onboarding scheduled this week.

The $EFI token spiked 42% on Monday and Tuesday before trimming the gains. However, it still ended the week slightly higher than it opened on Monday.

Technically, traders could target another rebound at about $0.368, or higher at $0.382, while $0.331 provides a crucial support zone.

Highstreet (HIGH/USD)

The $HIGH token is the native cryptocurrency of the play-to-earn metaverse gaming ecosystem Highstreet. The game is built with virtual reality support, allowing players to immerse themselves into the 3D virtual world.

The token is used primarily as a governance token and for staking, while the platform utilizes another token $STEET is used when buying in-game items like armour, weapons and skins.

Technically, the $HIGH token spiked late in the week to end higher than it opened. However, on Monday it pulled back shapely to trim the gains.

Traders could target a rebound at about $4.15, or higher at $4.38, while $3.74 and $3.50 are support levels.

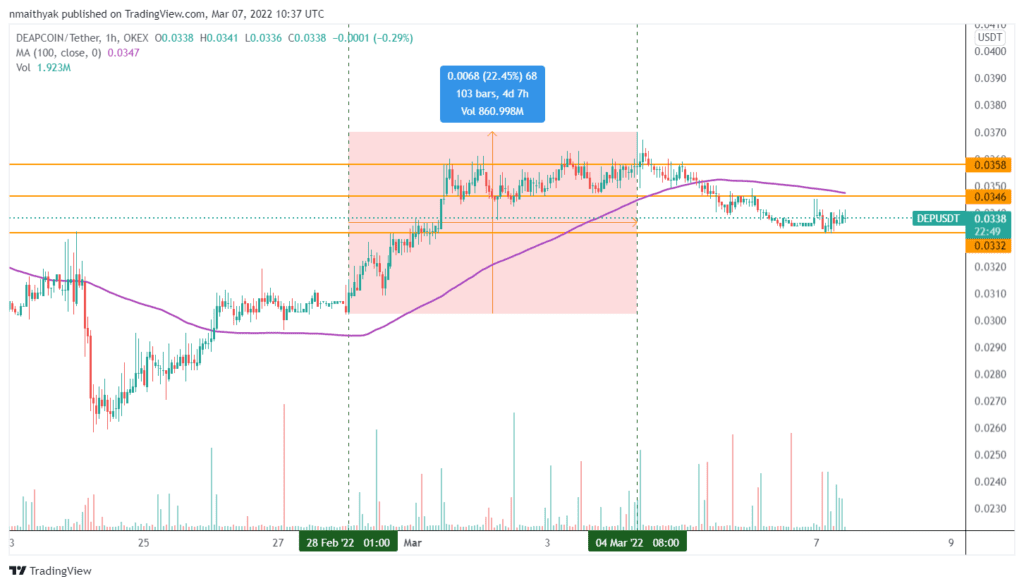

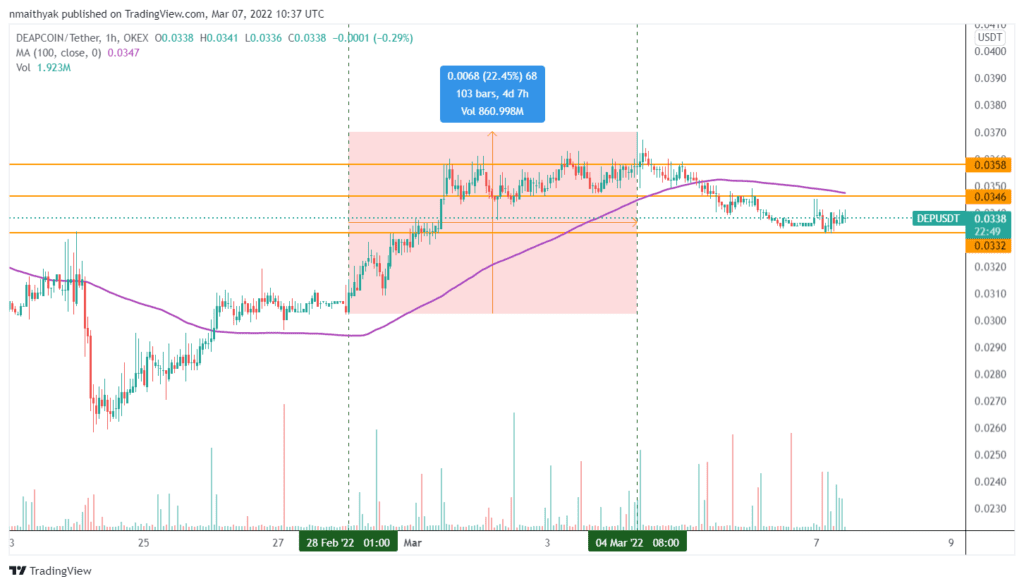

DEAPcoin (DEP/USDT)

DEAPcoin is the native token of the DEA project, a blockchain ecosystem initiated by a Singaporean company Digital Entertainment Asset. The ecosystem facilitates the development of blockchain games, NFT projects and decentralised finance.

Unlike several metaverse tokens, DEAPcoin rallied 22% from Monday through Friday, before trimming gains during the weekend.

However, it still ended the week higher than it opened.

Technically, the $DEP token price seems to have pulled back creating another opportunity for a rebound.

Therefore, traders could target profits at about $0.0346, or higher at $0.0358, while $0.0332 is a crucial support zone.

NFTs and Collectibles tokens

The NFTs and Collectibles tokens also experienced a significant pullback, with the segment falling to a market capitalisation of about $34.2 billion, down from about $37.3 billion in the previous week.

Although the impact of news about new NFT collections barely shakes the market, a report indicating that the SEC s probing NFTs to establish a basis for regulation didn’t go unnoticed.

Ágain, the tokens featured in this segment spiked momentarily earlier in the week before declining for the rest of the 7-day period, apart from Chiliz, which gave up a significant chunk of its weekly gains on Sunday.

Chiliz (CHZ/USD)

Chiliz is a cryptocurrency by Malta-based sports and entertainment, which acts as the native token for its sports-focused NFT platform Socios. The token is used by fans to govern the key decision-making process of their favourite brands.

It recently launched a campaign to find the perfect name for its sports and entertainment brand.

Socios features some of the leading sports brands, including Juventus, Manchester City and Barcelona. Brands are using the platform to bridge the gap between passive and active fans.

Technically, the $CHZ token seems to have pulled back significantly since Sunday, creating an opportunity for a rebound.

And with the Azzuri token launching all 3 phases this week, starting Monday, traders could target gains at about $.2099, or higher at $0.2194, while $0.1899 is a support level.

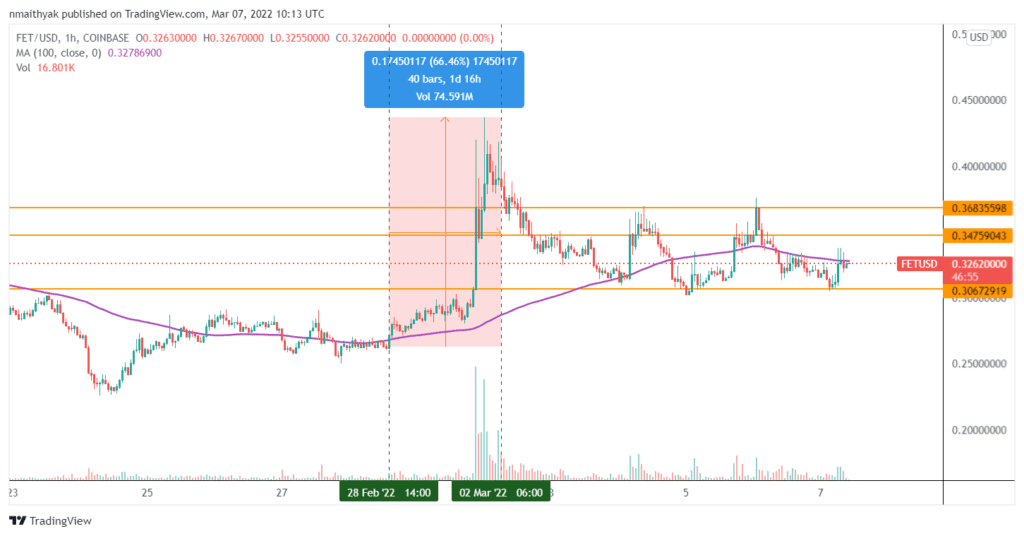

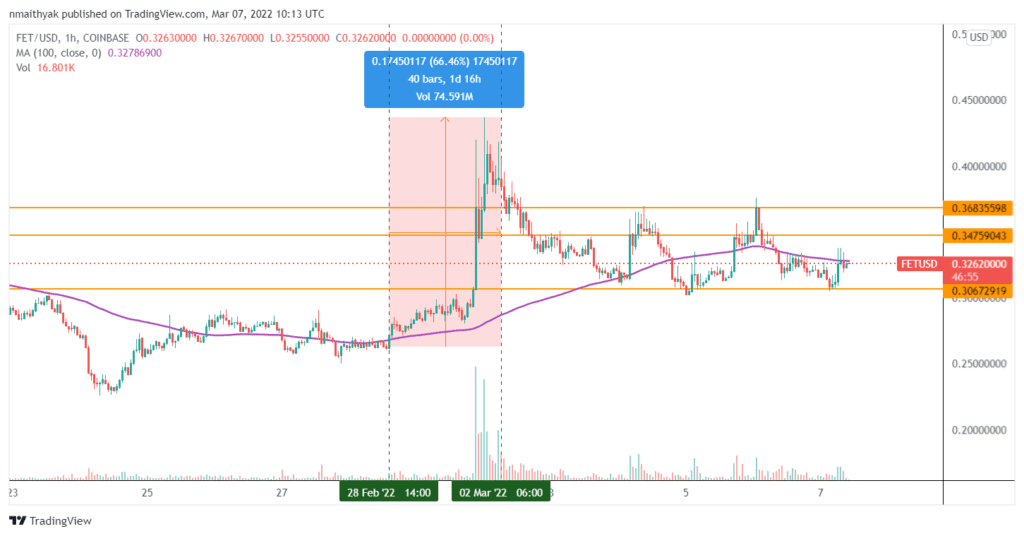

Fetch.ai (FET/USD)

Fetch.ai is an AI-based decentralised NFT platform that targets social interactions. Fetch.ai’s blockchain ecosystem is launching digital twin apps that will allow businesses to automate various operations, thereby eliminating unnecessary middlemen in workflow management.

The AI platform learns from activities involving the business, its customers and suppliers with time helping it to run operations smoothly.

The smart AI platform is now being adopted to launch NFT projects, one of the trendiest buzzwords in the crypto world right now.

Technically, the $FET token spiked nearly 67% earlier in the week before trimming gains throughout the week. However, it still ended the week more than 25% higher compared to the opening price on Monday.

Traders could target profits at about $0.3475, or higher at $0.3683, while $0.3067 is a crucial support zone.

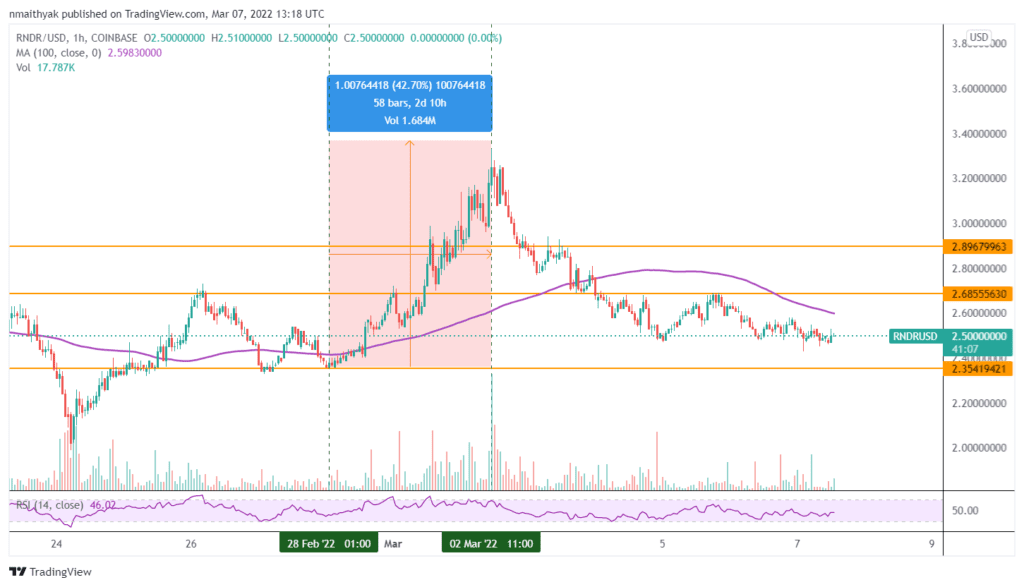

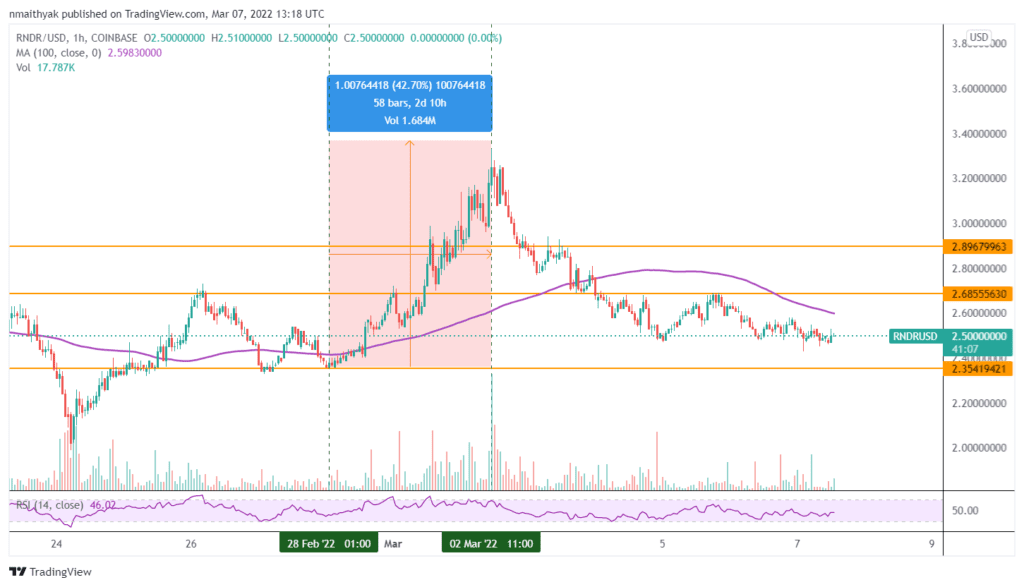

Render token (RNDR/USD)

The Render token is a rendering protocol built on the Ethereum network to allow artists to exchange tokens for GPU power. One of the drawbacks of using Ethereum is the massing energy consumption in minting tokens.

Artists can buy rent GPU compute partners from GPU providers (node operators) willing to share their mining capabilities.

The platform utilized a proof-of-render mechanism, to prove that all art has been rendered before the payment is transferred.

Technically, the $RNDR token seems to have spiked sharply on Monday and Tuesday before easing the gains throughout the rest of the week. The taken gained more than 42% between Feb 28 and Mar. 1.

Therefore, traders could target potential rebounds at about $2.68, or higher at $2.89, while $2.35 is a crucial support level.

Stay up to date: