Quick take:

- A research paper published by Arnav Kapoor, Mehul Mathur, Manish Gupta and others tries to come up with a realistic way of valuing NFTs.

- The writers agree that due to the volatility of NFTs, using the average price to determine value may be the best option.

- The paper also draws a correlation between social media activity about NFTs on Twitter and NFT sales on OpenSea.

Social media platforms like Twitter have been the driving force behind the explosive adoption of NFTs according to a new research paper published by Arnav Kapoor, Mehul Mathur, Manish Gupta and others.

The report tries to come up with the best possible way to value an NFT, as well as, the vital role that Twitter plays in pricing.

The value of a non-fungible token (NFT)

According to the authors, digital collectibles provide proof of ownership and not of copyright. This argument is based on the fact, that once downloaded, some NFTs can easily be shared online for free without consequence.

On the other hand, if a person gains access to an NFT belonging to someone else on social media and decides to sell it, chances are it won’t gain as much traction compared to the NFT sold by the authentic owner.

The authors used the example of one of the most popular memes NFTs ever sold, ‘disaster girl’, which went for $495,000. The exact image of the NFT is still freely available and distributed on the internet. “The same meme sold as an NFT by other people on the marketplace did not receive any traction.”

Therefore, the authors have established that “the value of an NFT is derived from the recognition of the creator and the overall marketing around the NFT itself.”

In other words, social media traction plays a role in determining the price of an NFT. As such popularity of the collection and its creators are vital cogs in the value chain.

NFT price volatility

While the social media traction and the popularity of an NFT project and its creators are vital to the valuation matrix, nearly all NFTs exhibit high volatile price movements periodically.

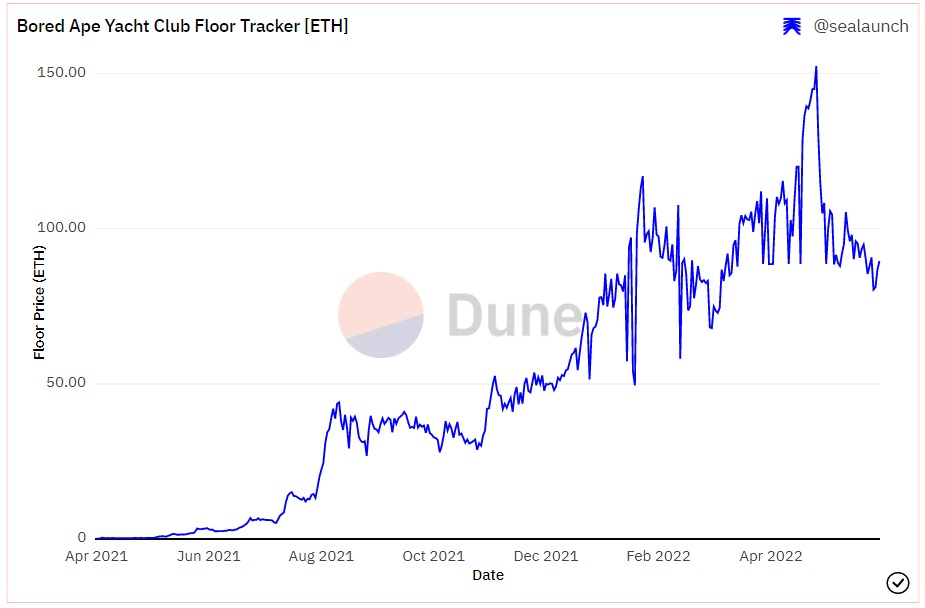

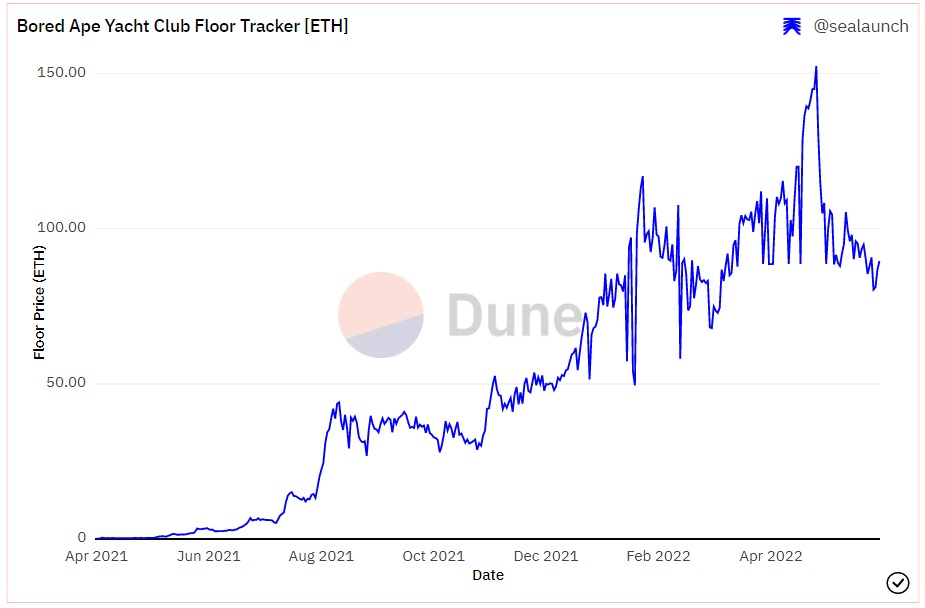

Just to point a reference, the Bored Ape Yacht Club NFT collection, one of the most popular collections in the market, recently saw its floor price rise to about 152.47 ETH. Yet as of this writing, it had dropped to, as low as, 89.6 ETH according to a dashboard prepared by @sealaunch on Dune Analytics.

The Floor price is the lowest amount of money a person can spend to become a member of a given project. In this case, it would take you 89.6 ETH, or roughly $162,576 to join the BAYC community by purchasing a Bored Ape.

Explaining the reason behind the unpredictable movement in NFT prices, the authors argue that “unlike company stocks or cryptocurrency exchanges, which are traded at regular intervals, NFTs have sporadic sales.”

Being non-fungible means NFTs are not mutually interchangeable. Therefore, with owners changing with each sale, transactions relating to a particular NFT can be isolated and far between.

As a result, Kapoor and others argue that “a single sale cannot account for the overall value of an NFT as the next buyer may be willing to pay much more or less than the previous sale amount depending on their current perception of the NFT.”

Thus, they have opted to use the average of all sales to assign a value to the NFT. Nonetheless, this method also has its own flaws because of the lack of a tangible asset for most NFTs. That is why it is almost impossible to assign a mathematical model that can be applied to all NFTs to determine their value.

The authors argue that the process is more of “a social phenomenon involving marketing schemes and the recognition and popularity of the NFT.”

Social media and NFTs

The authors have used the largest NFT marketplace and the most popular social media platform for non-fungible token promotion and community building Twitter to illustrate the relationship between NFT sales and social media traction.

Twitter is used by NFT project marketing campaign managers to build the public perception and attract buyers.

The paper also points to the influx of celebrities in the NFT space, which seems like a deliberate plot by project creators to tap into their massive followers to create public awareness of their NFTs.

For instance, Paris Hilton, Logan Paul, Snoop Dogg, and Steve Aoki are some of the most popular A-list celebrities on Twitter. They all have launched various NFT and metaverse projects that quickly sold out due to their influence.

Citing their own example, the authors pointed to the “several instances of well-known personalities like Mark Cuban, Jack Dorsey, etc. on Twitter selling high-priced NFTs, [which] indicate that social media reach can play a role in influencing asset value.”

From Twitter to OpenSea

The authors created datasets from both OpenSea and Twitter, as well as, the NFT image itself to establish the relationship between user activity on Twitter and the price of the NFT on OpenSea.

They also tried to determine whether it is possible to use the signals derived from the dataset to predict the NFT value, whilst highlighting the features with the highest impact on the price.

The results showed that the data from both platforms influenced the model output with the “best model comprising of an ensemble of Twitter and OpenSea features achieving an accuracy of 69.5%.”

The authors curated 245,159 tweets from Jan 1, 2021, to Mar 30, 2021containing an opensea.io NFT asset link. Those tweets were posted by a total of 17,155 unique users. They also used 62,997 unique OpenSea assets belonging to 16,001 unique collections. The model also factored in Twitter engagement and popularity features such as (likes, retweets and followers) among other metadata.

They measured the NFT popularity on Twitter by aggregating features of all tweets that mentioned the asset. According to their findings, more than half (54.6%) of the tweets are posted less than a day after the NFT creation.

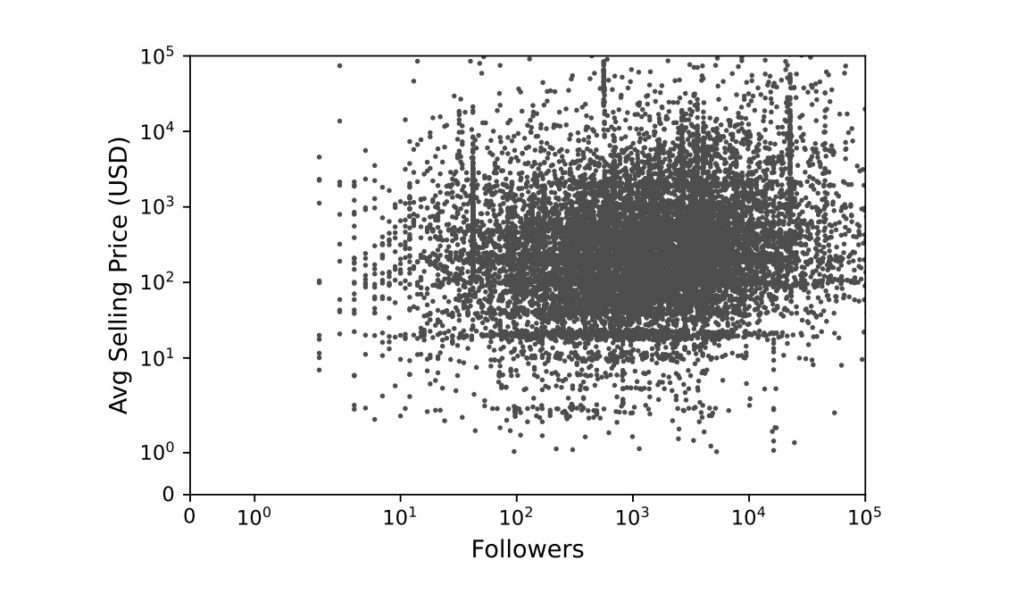

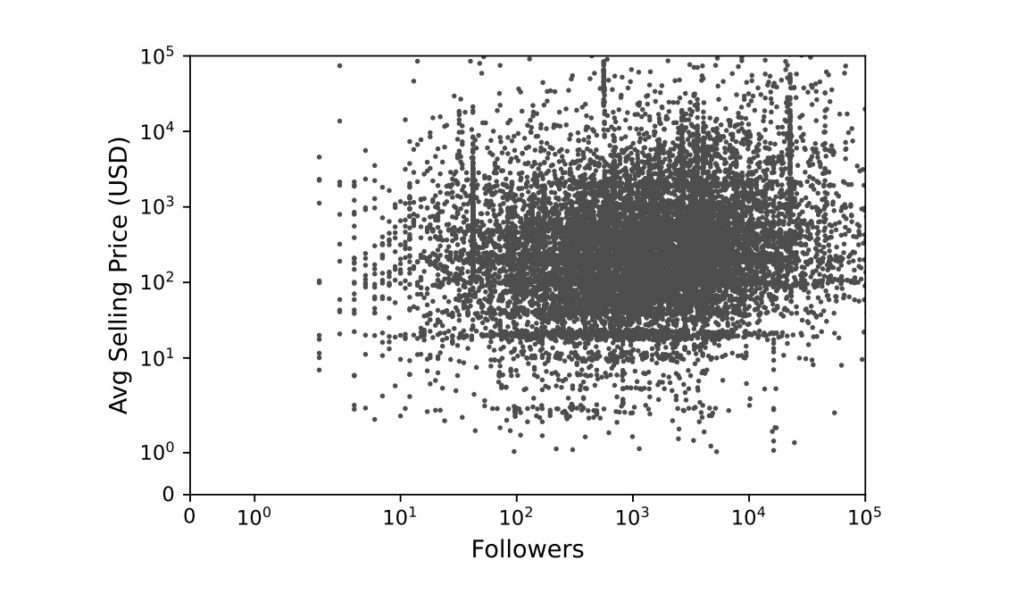

The model also analysed the usernames of those who post the NFT related tweets, finding that most of them had n-grams with affinity to the word NFT. This implies that these are accounts with strong links to the NFT space. They were also able to draw a positive correlation between the number of followers of an NFT project on Twitter and the asset value of the NFT.

According to the outcome, the authors found that though with a low Spearman’s correlation coefficient of 0.20, social media does have a positive impact on the average price of an NFT.

Combining both OpenSea and tweet features, the authors were able to obtain an accuracy of 69.33%. They also established that the number of likes and the number of retweets were among the most important tweet features, while the number of offers and bid withdrawals were top OpenSea features that helped determine the price of the NFT.

Stay up to date: