Quick take:

- NFT Worlds bounced back after assuring its community of the way forward following Minecraft’s NFT ban.

- Metaverse tokens rallied to a market cap of $13.5 billion while NFTs and Collectibles topped $24 billion.

- Chiliz, UFO Gaming, Oasis Network and Dego Finance also registered significant gains.

In this edition of the weekly token boom report, the metaverse, NFTs and Collectibles tokens continued to recover for a second successive week. The industry continued to witness a significant inflow in venture funding with Gary Vaynerchuk’s VeeFriends raising $50 million in a round led by a16z. GEM Digital also pumped $50 million in iGaming token Crypto Snack, while Variant closed a whopping $450 million fundraising.

Elsewhere, Web3 data and analytics çompany Step Finance acquired SolanaFloor, expanding its ecosystem into non-fungible tokens (NFTs), while Magic Eden teamed up with Genopets to launch the first semi-fungible token (SFT) marketplace with tradable in-game items.

On the downside, Minecraft banned NFTs and blockchain-related integrations from its game, but the industry breathed a sigh of relief a day later after Epic Games CEO assured developers that the Unreal Engine builder will not be taking similar action.

Metaverse tokens

Last week, metaverse tokens bounced back from two weeks of losses to top $13.5 billion. The segment continued to attract venture capital with Chinese VC BAI Capital launching a $700 million fund to invest in Web3 projects and the metaverse.

Wharton Business School and Tokyo University launched metaverse-based education programs to onboard learners onto web3, while Audacity launched with a $60 million fund to help web2 gaming transition to web3.

Overall, some metaverse tokens benefited from increased market optimism, with NFT Worlds, XYO and UFO gaming topping the charts.

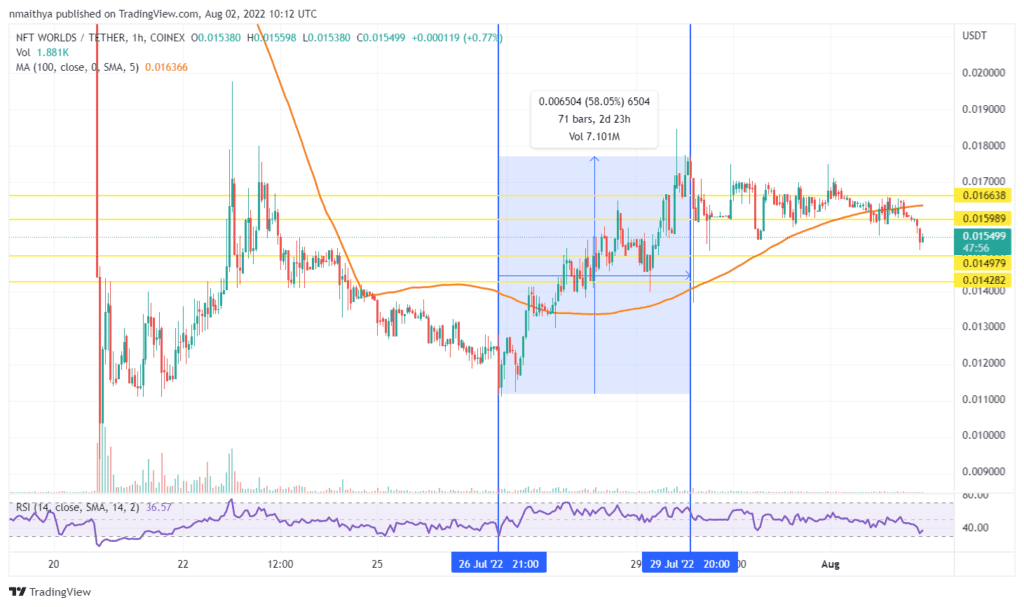

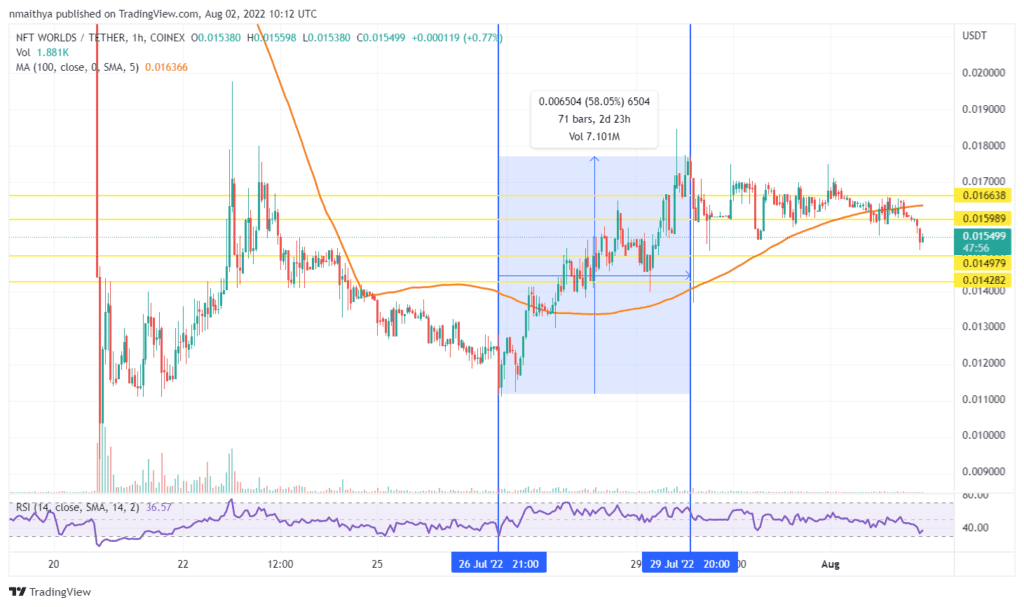

NFT Worlds (WRLD/USDT)

Last week, NFT Worlds suffered a major blow after Microsoft-owned Minecraft decided to ban all NFTs and blockchain-related integrations from its game. The NFT Worlds native token plummeted following the announcement before bouncing back 58%.

The in-game builder has assured its community of the way forward after deciding to develop its own ‘Minecraft’ game. The platform boasts talent from some of the leading gaming companies including Minecraft.

Technically, the $WRLD token seems to have pulled back slightly following the rebound. Therefore could target another round of rebounds at about $0.0159, or higher at $0.0166. On the other hand, $0.0149 and $0.0142 are crucial support zones.

XYO (XYO/USD)

XYO is a project created to improve the validity, certainty, and value of data. The utility token $XYO is used to facilitate transactions for data transfers between blockchains. The protocol is also created to establish secure connections between the physical world and the blockchain, making it a perfect solution for connecting the real world to the metaverse.

Last week, the $XYO token spiked nearly 170%, before pulling back for the rest of the week.

Therefore, traders could target potential rebound profits at about $0.0115, or higher at $0.0154. On the other hand, if the pullback continues, the $XYO token could find support at about $0.0063.

UFO Gaming (UFO/USDT)

UFO Gaming is a web3 gaming platform with play-to-earn (P2E) and non-fungible token (NFT) integration. The gaming ecosystem is governed using the $UFO token, which is used to facilitate transactions inside the game.

Last week, the platform debuted its staking developer app (dApp), sparking a sharp rise in the $UFO token price on Friday. However, the price has since pulled back, creating another opportunity for a rebound.

Therefore, traders could target potential rebound profits at about $0.0000025, or higher at $0.0000026. On the other hand, $0.0000022 and $0.0000020 are crucial support zones.

NFTs and Collectibles tokens

Last week, NFTs and collectibles tokens soared to a market cap of $24.32 billion, bouncing back from two consecutive weeks of declines. The segment registered just under $260 million in total transaction volume.

The segment also benefitted from a significant venture capital activity with Unstoppable Domains raising $65 million at a $1 billion valuation. BITKRAFT Ventures backed Magicave’s $6.4 million fundraising for next-generation digital toys, while Miami teamed up with Time, Salesforce and Mastercard for a collaboration NFT project.

Overall, some of the beneficiaries of the positive vibes emanating from the NFT space include Oasis Network, Chiliz, and Dego Finance.

Oasis Network (ROSE/USD)

Oasis Network is a privacy-enabled Layer 1 blockchain that is pioneering the next generation of decentralised data protocols. The platform provides an ecosystem for developers to build projects for DeFi, GameFi, NFTs, Metaverse, Data tokenization and Data DAOs.

Last week, the platform announced its partnership with Meta to assess the technology giant’s AI models while ensuring privacy protocols are maintained.

The $ROSE token is the utility token used to facilitate transactions on Oasis Network. It rallied more than 100% following the huge announcement.

Technically, traders could target upward profits at about $0.083, or higher at $0.090. On the other hand, $0.073 and $0.067 are crucial support zones.

Chiliz (CHZ/USD)

Chiliz is the parent organisation of the sports tokens platform Socios. The platform provides sports teams around the world with an ecosystem for creating fan engagement tokens.

Last week, the Chiliz ecosystem token $CHZ rallied 37%. On Monday, it spiked sharply after Socios invested $100 million in la Liga club FC Barcelona to accelerate its web3 strategy.

It has since pulled back slightly to create an exciting opportunity for a rebound.

Technically, the $CHZ token seems to have recently pulled back creating profit opportunities at about $0.148, or higher at $0.160. On the other hand, if the pullback continues, $CHZ could find support at about $0.133 or lower at $0.123.

Dego Finance (DEGO/USD)

Dego Finance is a decentralised ecosystem that offers a diverse selection of NFT tools. The platform operates as an independent open NFT ecosystem allowing any user to launch an NFT project.

Last week, the platform teamed up with SecondLive to launch the DEGO Outfit NFT Mystery Giveaway, with fans competing for 600 NFT mystery boxes.

The $DEGO token rallied nearly 75% following the launch of the giveaway, before spiking again on Monday. However, the token price has since pulled back creating an opportunity for another rally.

Technically, traders could target potential rebounds at about $2.86, or higher at $3.01. On the other hand, $2.60 and $2.40 are crucial support levels.

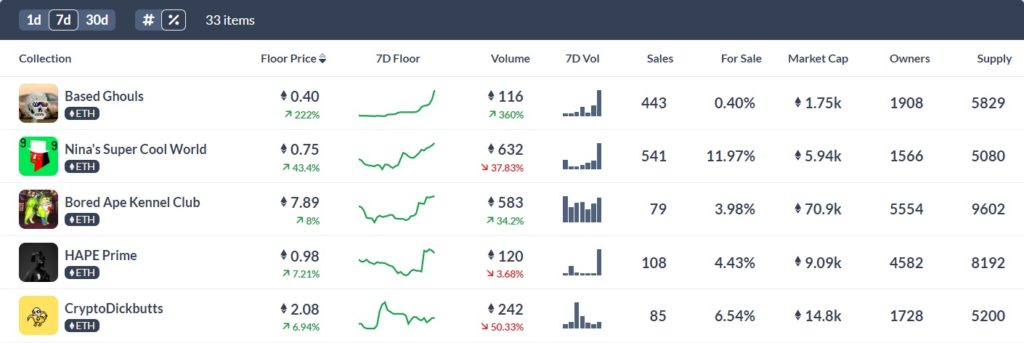

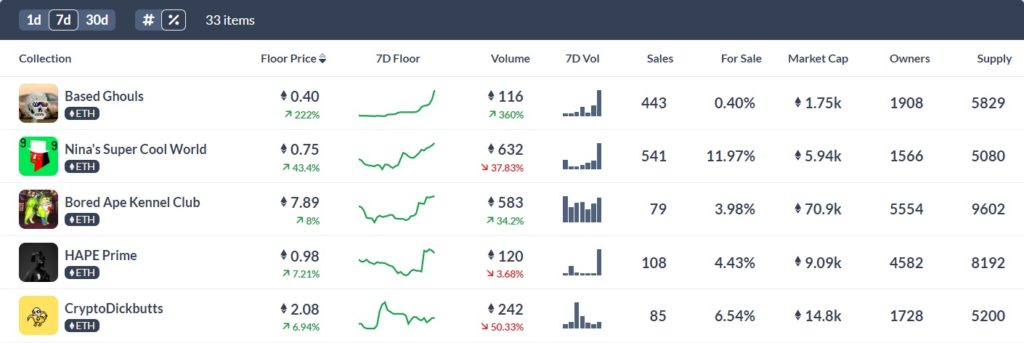

Biggest NFT floor price gainers

The list below has been filtered to include collections with at least 100 ETH in transaction volume for the last seven days.

Yuga Labs’ Bored Ape Kennel Club NFT collection was among the top gainers, with its floor price rising 34% in the past seven days. However, it was the less popular Based Ghouls collection topping the charts with a 360% rise in the floor price.

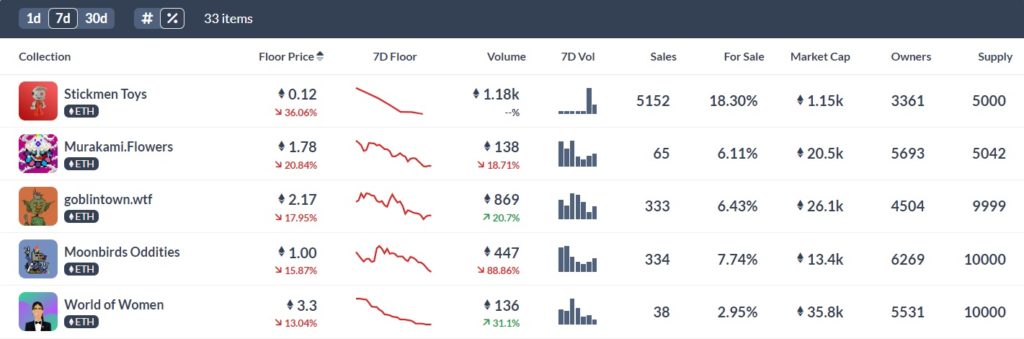

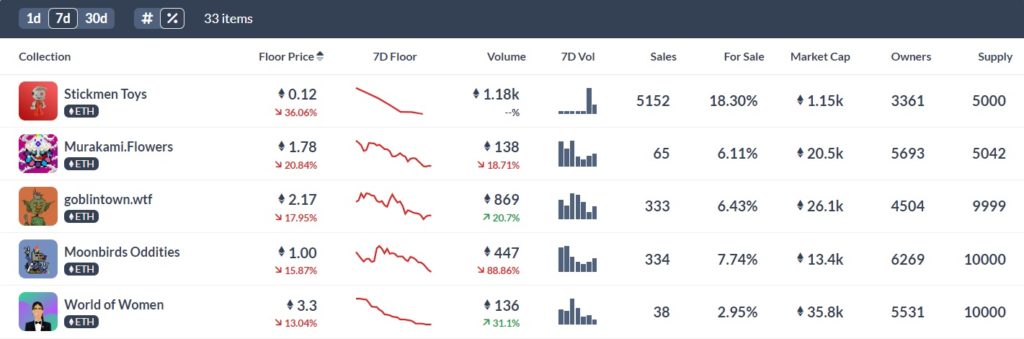

Biggest NFT floor price decliners

World of Women, Murakami Flowers and Moonbirds Oddities featured among the biggest losers for collections with at least 100 ETH in transaction volume.

Topping the list was Stickmen toys with a decline of more than 36%, while WoW capped the top five after the collections floor price fell 13.04%.

Stay up to date: