Quick take:

- NFTs are here to stay according to a panel of experts at this year’s Asian Finance Forum.

- Warren Cheng, director of Fine Art Asia said NFTs represent a new form of art consumption.

- Wave Financial’s Les Borsai said NFTs could be the solution for artwork trading in the secondary market.

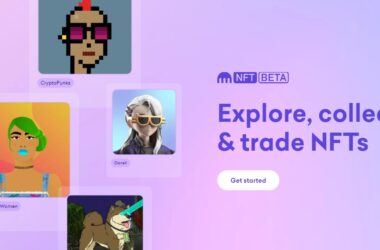

If you are calling the NFT trend a fad, then you could be up for a surprise. At this year’s Asian Finance Forum, panellists agreed that non-fungible tokens (NFTs) are here to stay. The industry whizzed to $25 billion last year, substantially outperforming forecast.

And despite the overall crypto market retreating in recent months, NFTs have continued to soar, with collectibles transaction volume at the world’s largest NFT marketplace OpenSea on course for a record month.

One of the panellists was Warren Cheng, director of Fine Art Asia, who is also a staunch supporter of NFTs and cryptocurrencies overall. Speaking at the forum, Cheng related NFT trading volume with Ether (ETH), which is used in about 90% of all NFT transactions.

Cheng points to the fact that six-nine months ago, NFT trading volume had a near-perfect positive correlation to the price of Ethereum, implying that an increase in NFT sales resulted in a positive movement for the ETH price.

However, the price of Ethereum has recently declined, whereas NFT trading volume continues to rise.

“I’ve asked a lot of people around me how they see it. They said, “Yes, Ethereum has dropped, but if I find an interesting project that can go four or five times higher, why should I care about the 20 percent slump?” Cheng said.

Cheng, who also owns Wui Po Kok gallery in Hong Kong, believes that rather than being a short-term craze, NFTs are creating a new form of art consumption by attracting a younger generation to the industry, adding that they also create a realm where creators can engage with collectors.

However, he pointed to the slow acceptance and resistance by traditional art dealers that don’t know how to use cryptocurrencies. “The NFT craze has created a new community of native NFT buyers who are used to paying loyalty and guest fees,” he said.

At his Wui Po Kok gallery, he designed NFTs based on a collection of antique weapons. in one example, collectors were required to have at least one of the 30 minted NFTs to bid for a 2,000-year-old dagger on display.

“For players in the art market, they’ve never thought that antiques could be packaged like this, and for those who are into NFTs and cryptos, they are surprised and curious to learn more about antiques and history,” Cheng said.

Les Borsai, chief strategy officer at Wave Financial chimed in highlighting the eagerness of art galleries to offer their collections in secondary markets as a clear example of why NFTs could be a game-changer for the industry.

“When galleries are trying to figure out how to be part of a secondary sale, that’s what all this technology allows for,” Borsai said, adding that it is encouraging “to see that a lot of traditional galleries and art museums are striving to investigate how NFTs might fit into their agenda.”

Stay up to date: