Last Updated on March 30, 2023

As interest in the NFT space continues to grow, this disruptive new technology has begun to spark debate around the way we define and value art. Due to their intrinsic scarcity and provable ownership, NFTs now provide a unique means for facilitating value across a wide range of digital assets, including music, video, collectibles, video-game items, and digital artwork.

In light of this, NFTs are claiming an increasingly larger share of the global art market with each passing year, which is remarkable considering how novel the technology is.

In fact, some of the most expensive NFT sales, such as collections from Beeple and Pak, are worth considerably more than bonafide masterpieces in the traditional art world. For example, Pak’s “The Merge” sold for $91.8million, which surpasses the inflation-adjusted valuation for “Nymphéas en fleur” by Monet, “Laboureur dans un champ” by Van Gogh, and “Au Lapin Agile” from Pablo Picasso.

With such high stakes, more people than ever are eager to get involved in the NFT space, either by investing in prominent NFT collections or by becoming an NFT artist themselves.

But, before you jump in, you need to make sure you have a true understanding of what NFT collections are, what gives them value, which ones to avoid, and how you can get the low-down on NFT collections before they drop.

Table of Contents

What are NFT collections?

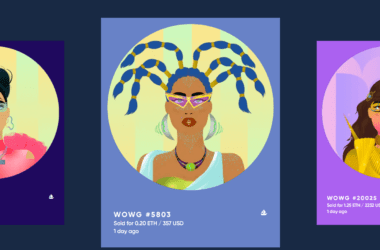

An NFT collection is an assortment of digital assets released by an artist (or group of artists) containing a limited number of individual NFTs. Typically, most NFT collections consist of numerous NFTs that all conform to the same artistic style, with slight variations across each individual token.

A good example of this would be the BoredApeYachtClub, which is one of the most popular and valuable NFT collections in the world. This specific collection is made up of 10,000 unique non-fungible tokens on the Ethereum blockchain depicting simian avatars with various characteristics. For instance, only 5% of Bored Apes have red fur, and 3% sport a biker vest. The more scarce a Bored Ape’s features, the higher price it tends to fetch on the market.

Image Source: Rolling Stone

With that said, NFT collections come in a variety of different forms, such as virtual real estate (Decentraland and The Sandbox), music albums, and even sports trading cards (NBA Top Shot and Sorare).

Who can make an NFT collection?

One of the most attractive aspects of the NFT world is that anybody can become an NFT artist and make their own collection. Unlike the traditional art scene, which generally requires extensive formal training and a significant amount of skill, the barriers to entry are considerably lower when it comes to NFTs.

For starters, since NFTs are created digitally, artists can lean into graphic design and other computer-based skills, which are generally much simpler to master than becoming adept with a paintbrush. Second, many of the most popular NFT collections are rather simplistic in nature, such as the aforementioned Bored Apes Yacht Club, as well as other highly valued collections such as Crypto Punks.

Image Source: Larva Labs

As you can see, Crypto Punks avatars are made up of pixelated characters that would not require a high level of skill to produce or even replicate. However, this illustrates that a large portion of the value in NFT projects is not directly tied to the creative flair of their creators but rather to the artists’ ability to tap into demand, trends, and how they market their collections.

Of course, that is not to say there aren’t any highly skilled artists in the NFT space. Take Beeple, for example, who produces magnificent NFT collections that provide thought-provoking social/political commentary through bizarre abstract images that would certainly not look out of place in a modern art gallery.

How to make an NFT collection

Wondering how NFT collections are made? Well, the good news is that it’s probably much easier than you imagine. With that said, let’s start off with the first and most difficult step – creating the art that will make up your collection.

Creating your art

To begin with, you need to carefully consider the type of content that you want to produce. Whether you are creating music, memes, avatars, video, or digital art, try to find a niche that suits your interests and has some level of market demand. After all, if your goal is to make money with NFTs, you will want to appeal to as wide a demographic as possible.

As for the production itself, it’s up to you what medium you decide is best for your particular type of NFT. If you’re considering going down the digital art route, many artists use software such as Adobe Photoshop and Adobe Illustrator. If you’re new to these programs, there will be a fairly steep learning curve, although there are plenty of free resources out there that will help you develop your skills.

You can even use an NFT maker that will assist you in generating unique digital art within a matter of minutes. In fact, some of these tools require no artistic skill whatsoever. For example, you can use Hotpot.ai to create beautiful digital art by inputting a few keywords into the AI interface. After tweaking a few preference settings, the AI will present you with a piece of digital art that you can mint into an NFT and sell on the marketplace – and the best part is that it’s completely free!

Remember, since you are creating an NFT collection, you will need to produce at least two unique artworks. The number of pieces you include in your collection is entirely up to you. However, try to take a look at similar artists in your field to see what works for them. Both CryptoPunks and the BoredApeYachtClub have 10,000 unique avatars, but that doesn’t mean you need to match that volume.

Set up a crypto wallet

Before you mint your artwork into NFTs, you need a wallet to store them on. There are a few different options you can choose from (most are free), and the one you select should depend on the blockchain you want to use (but more on that later). For now, if you’re looking for simplicity, set up a Metamask wallet and stick with Ethereum.

Mint your artwork on the blockchain

Next up, it’s time to mint your artwork onto the blockchain. This process is what will give your art its value due to the inherent scarcity and uniqueness of NFTs. While it is possible to mint your artwork onto the blockchain manually, it is advised to use one of the NFT marketplaces since you will have the option to sell your collection directly on their website.

On top of this, many of the leading NFT exchanges offer a lazy minting service, which means that you do not need to pay any fees to mint your artwork as an NFT. In this process, the NFT is made available off-chain and only gets minted once it has been sold to a buyer. In some cases, the NFT gas fee is passed on to the buyer too, which means the artist does not foot any of the cost for minting. Some of the most popular websites that offer this functionality include:

- OpenSea

- Mintable

- Rarible

- SupeRare

Set the price of each individual item

Now that you have created your NFT collection, you need to decide on the price you will initially offer them on the market. Generally speaking, the more pieces that you have in your collection, the less valuable each individual item should be. However, that is not always the case. To use the BoredApeYachtClub as an example once again, each Bored Ape was offered for a flat price of $190 during launch in April 2021.

If you are struggling to find a suitable launching price, then carry out some research on similar artists and see what they are charging. That way, you can assess the quality of your work compared to theirs (as well as your audience and the marketability of your brand) before setting a realistic price.

What makes an NFT collection valuable

The very nature of NFT technology is what makes each collection valuable. Because they are non-fungible, each token cannot be replicated, and the blockchain serves as irrefutable evidence of ownership. Thanks to these traits, digital assets have provable scarcity for the first time in history, which is one of the key reasons they have surged onto the art scene in recent years.

With that said, you may be wondering what makes one NFT collection more valuable than another? Let’s take a look at some of the major factors that influence the floor price of individual collections.

Artist reptation

First and foremost, the artist’s reputation will be the most important factor in determining the worth of any given NFT collection. If an unknown artist creates an NFT collection with no audience, social media following, or previous history, it is very unlikely that they will be able to command a high market price for their works. Of course, it’s not impossible, just extremely unlikely.

We see examples of this all the time, with celebrities and well-known artists cashing in on their brand by releasing an NFT collection in their name. Even Sir Tim Berners-Lee got in on the act after he sold an NFT of the original source code to the World Wide Web for $5.4 million in 2021.

Image Source: The Guardian

Ownership history

The success of an NFT collection is heavily influenced by the individuals that purchase items from the collection. If celebrities and notable individuals jump on board and share their purchases with their followers, the value of the collection is likely to rise as awareness of the project grows and more people want to join in. For example, many prominent celebrities have bought Bored Apes, including people like Gwyneth Paltrow, Paris Hilton, Eminem, Shaquille O’Neal, Post Malone, Snoop Dogg, Mark Cuban, and Steph Curry. This is one of the biggest drivers for the collection going viral and exponentially increasing its value.

Utility

Utility is one of the more popular buzzwords in the wider crypto sphere. In general, the term refers to the usefulness of a digital asset (usually a cryptocurrency token) and the value that it brings to its ecosystem. In other words, does the asset do anything, or is its value simply dependent on the speculation of other investors?

As for NFTs, it’s important to note that some tokens have a specific use case on the blockchain. For instance, NFT gaming items and collectibles can be used within a video game, providing some utility to its owners. Gods Unchained, which is one of the most popular competitive trading card games on the blockchain, allows players to compete for weekly rewards based on how well they perform when battling against other players. The more powerful the cards, the more chance a player has at earning higher rewards.

Image Source: Gods Unchained

In addition, there are plenty of other use cases for NFTs, such as yield farming through providing liquidity, staking, renting, and even royalty payments.

Rarity

Similar to the traditional art world, the rarer a collection is, the more valuable it becomes. Although, rarity can be viewed from two separate angles. First of all, artists can create one-off bespoke artworks for each of the items in their collection. This would be similar to how Beeple created his “The First 5000 Days” collection, where he made a unique picture every single day from May 1st, 2007 – January 7th, 2021.

The other way to create rarity would be to follow a similar method to that of popular collections like CryptoPunks, Bored Apes, Doodles, and Moonbords. Rather than come up with a completely novel idea for each token, the creators of these projects simply introduce slight variations (or traits) to each avatar. Since none of them are identical, each one has its own distinct value that attracts investors.

Where do NFT collections sell?

While some of the most expensive collections in the world are sold at traditional auction houses, such as Christie’s, the vast majority of NFT collections are bought and sold across NFT exchanges. Not only do these websites offer a great platform to market and display NFTs, but they provide increased security and liquidity, benefiting both the buyer and the seller. Some of the best NFT marketplaces include:

- OpenSea – The world’s largest NFT marketplace, with a diverse selection of non-fungible tokens such as art, virtual worlds, trading cards, sports items, and collectibles.

- Rarible – A large NFT marketplace that has a focus on art collections, including books, music albums, digital art, and movies.

- Nifty Gateway – An exchange that is designed for art enthusiasts. While there are high fees at 15% per transaction, Nifty Gateway is one of the industry-leading marketplaces where buyers and sellers of digital art can connect.

- SuperRare – A marketplace that offers NFT collections from some of the world’s top artists. The platform is very selective on whom they work with and is known for showcasing high-quality, exclusive art.

How to find NFT collections that are minting soon

If you are planning to invest in NFT collections and want the best bang for your buck, your best bet would be to find exclusive NFT drops so you can jump on projects early before their prices increase. Back in June 2017, the CryptoPunks collections were offered for free on a first-come-first-served basis. Over the subsequent few years, the CryptoPunks collection became one of the most sought-after projects in the entire NFT space, making those who participated in the drop very wealthy without having to invest a single cent.

While it is going to be next to impossible to replicate that feat, there are still plenty of tactics you can use to keep your ear to the ground and find out about hot NFT drops before the general public catches wind.

- Social media – Love it or hate it, monitoring social media is one of the best ways to find out about exclusive NFT projects before they hit the mainstream. Twitter, in particular, is often the first place that creators advertise their upcoming NFT projects before they go to market. However, the main challenge with using this method is finding a way to cut through all of the noise generated by speculators and shillers. Fortunately, you can use tools such as Whotwi to help identify up-and-coming creators without subscribing to thousands of random accounts.

- NFT aggregators – Before a project launches, artists typically reach out to aggregation sites such as Rarity Tools to provide information about their collection and where people can invest. It’s worth checking in on these websites every now and then to look for new collections.

- Minting monitors – Online tools like icy.tools monitor mining activity on the Ethereum blockchain within the NFT space. Using these platforms, you can monitor your favorite artists and find out when they mint new projects. This will ensure you are one of the first informed about new projects so you can jump on them before they blow up.

Understanding the different NFT blockchains

As we touched upon earlier, NFT collections can be deployed on a variety of different blockchains. The blockchain of choice is entirely up to the discretion of the artists since each network offers its own set of advantages and disadvantages. On that note, here is a quick rundown of the most popular NFT blockchains and their unique characteristics:

- Ethereum – The most popular NFT blockchain for NFTs through its ERC-721 token standard. Ethereum is by far the most liquid and ubiquitous chain. However, it comes with high minting and transfer fees.

- Polygon – Polygon, formerly known as Matic Network, functions as a secondary layer on top of Ethereum’s core blockchain network. In short, Polygon is a scaling solution focused on the use case of lowering transaction costs and increasing performance. In fact, Polygon has no gas fees, but the tradeoff is that it is less secure and has a substantially smaller user base than Ethereum.

- Solana – One of the fastest programmable blockchains. It has substantially reduced transfer times and fees than Ethereum, although it has far fewer marketplaces and less liquidity.

- Binance Smart Chain – BSC is another great alternative to Ethereum as it offers high-speed, low-fee transactions. However, the cost of these benefits is that BSC is centralized, which is a turn-off for many investors.

Beware of scams when investing

With more than $17 billion traded on NFTs in 2021, it’s no surprise that the industry has become a breeding ground for scammers and opportunists looking to take advantage of unsuspecting victims. Unfortunately, many of these scammers are finding success, especially since a substantial percentage of newbies entering the space are unfamiliar with the unforgiving nature of blockchain technology. Moreover, it’s important to note that the cryptocurrency space is mostly unregulated, which means that investors are subject to high levels of risk. As always, education is the best protection when it comes to scams, which is why we have provided a list of some of the most common that you need to be aware of below:

- Rug pulls – A rug pull occurs when an artist hypes up a project so that investors jump on board, only so they can sell out of their positions and cash in. When the original creator bails from the project, the value of the NFTs typically plummets, leaving your investment in tatters.

- Phishing – Phishing scams are designed to trick you into willingly handing over sensitive information, such as your usernames, passwords, or seed phrases that provide access to your NFT wallets. These scams usually involve phony advertisements through fake websites and pop-ups.

- Counterfeit NFTs – These scams occur when someone steals an artist’s work by impersonating them and offering it in the marketplace. As a result, scammers sell counterfeit NFTs that have no value to unsuspecting victims that do not take the time to verify the identity of the seller.

- Bidding scams – These rather unsophisticated scams involve fraudulent buyers switching out the currency used for bidding without your knowledge. In most cases, a buyer would bid for your NFT collection for, let’s say, 10 ETH, but when the time comes to transfer, they send over 10 DOGE, which is significantly less. Fortunately, most NFT exchanges have preventive measures in place to make this scam less effective.

Final Word

Whether you are an investor or artist, the NFT industry provides a wealth of opportunities to connect, engage, and trade digital art with people from all over the world. While the technology is undoubtedly in its infancy, its rapid rise to the mainstream signifies a drastic (and arguably) much-needed shake-up of the art world as people finally have an authentic means to monetize digital art.

Hopefully, after reading this article, you now have all of the tools and knowledge you need to capitalize on this exciting market. That said, if you’re new to the space, remember to keep your wits about you and watch out for some of the scams mentioned above. Other than that, there’s not much more to say other than good luck and happy hunting!