Quick take:

- Sudoswap is dropping SUDO, its native governance token.

- The Ethereum-based tokens will be airdropped to members of the marketplace.

- Holders of XMON will receive the lion’s share of the airdrop.

NFT marketplace, Sudoswap, has announced its Ethereum-based native governance token, SUDO. The initial supply of 60 million tokens will be retroactively airdropped to members of the platform.

Holders of XMON, the utility token of NFT project 0xmons, will receive 25.12 million or 41.9% of the SUDO token via a lockdrop, meaning that XMON holders who lock their XMON to indicate their commitment to participate in the governance of the sudoAMM protocol can receive SUDO. 0xmons NFT holders will get 1.5% of the 60 million supply.

XMON holders are receiving the lion’s share of the tokens as the team behind 0xmons are helping to build Sudoswap. The announcement also detailed that 1.5% of the initial supply will be retroactively distributed to liquidity providers, while 21.5% goes to the treasury. Governance will be able to mint more SUDO to the treasury, if needed, up to a max inflation cap of 10% a year.

Sudoswap’s initial team members as well as SudoRandom Labs will get 15% each, vested over three years with a one-year cliff.

SUDO will initially be non-transferable. A governance proposal to initiate transferability may be put forward at a later time to ensure that SUDO does not go into circulation until there is sufficient participation from SUDO holders in governance.

For the uninitiated, Sudoswap is an NFT platform that allows users to buy and sell NFTs via liquidity pools. The platform allows users to swap NFTs using an automated market maker (AMM). Similar to an AMM decentralised exchange like Uniswap, liquidity providers have to enter the NFT-crypto liquidity pool for the pair to be tradeable.

As explained by “@corleonescrypto” on Twitter, the AMM model enables users to “provide liquidity to investment pools that buy and sell NFTs to earn revenue; list NFTs on the Marketplace at set prices; and create pools that gradually buy or sell NFT collections along price curves, allowing users to buy and sell NFTs in a cost-efficient way.

For instance, users who create pools that sell along price curves can gradually increase the selling price while those who buy along price curves can make collection offers with the price decreasing after each purchase, allowing them to dollar cost average (DCA) for their purchase.

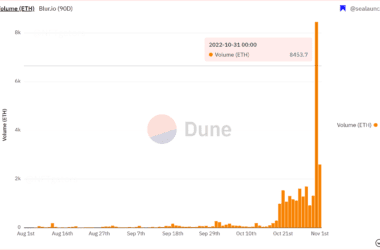

Since launching in July, Sudoswap has seen over $34 million in volume with more than 135,000 NFTs traded, according to data by 0xRob on Dune Analytics.

Stay up to date: