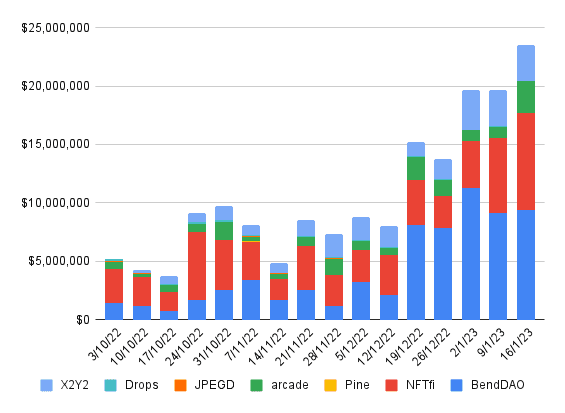

The NFT lending ecosystem has experienced significant growth in recent months, with weekly borrow volume rising from $5.2 million to $23.4 million since October 2022. This trend is driven by a number of platforms that are now offering lending services for NFTs, the most notable of which include BendDAO, NFTfi, X2Y2, and Arcade.

BendDAO has been particularly successful in this area, with the platform accounting for 40% of the total volume in the NFT lending ecosystem over the past week. This is thanks in large part to its large holdings of NFTs, including over 423 MAYC and 94 Doodles NFTs.

NFTfi, another major player in the NFT lending ecosystem, has also seen significant growth in recent weeks, accounting for 35% of the total volume. X2Y2 and Arcade also saw notable growth, with 12.9% and 11.5% of the total volume respectively.

Recently, 154 Bored Ape Yacht Club NFTs were deposited to BendDAO as collateral, further strengthening the platform’s NFT holdings.

These trends are a clear indication of the growing importance of NFTs in the lending market, and the increasing demand for ways to borrow and lend these unique digital assets. As the ecosystem continues to evolve, it is likely that we will see even more platforms and services emerge to meet this growing demand.

Follow our On-Chain NFTs section to get daily NFT insights you won’t get anywhere else.