Quick take:

- Gamers who rent NFTs are from low-income countries.

- NFT rental services and scholarship providers are profit makers not just for blockchain gaming startups, but also for independent landlords.

- Critics have discussed whether play-to-earn games and scholarship programmes are a ponzi scheme.

Play-to-earn games are giving NFT lenders opportunities to turn a bigger profit from renting out their NFTs to gamers than actually playing games themselves.

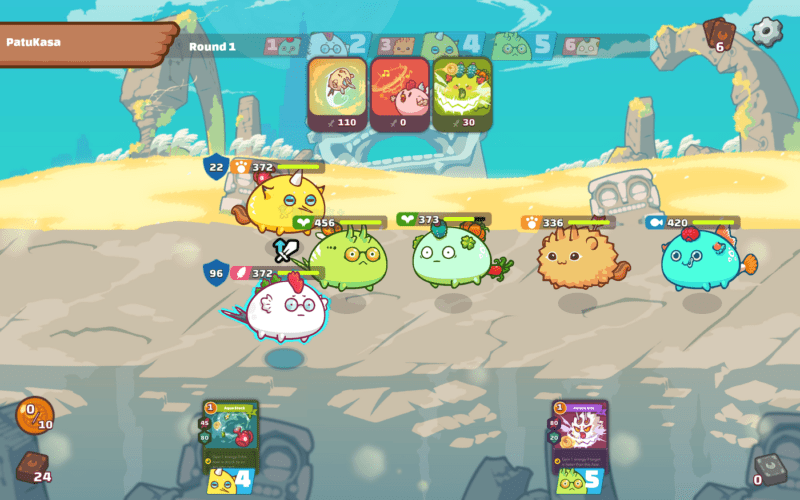

NFT lending is done through a game scholarship programme, originally introduced by the Axie Infinity player community. The scholarships allow players to rent NFTs of in-game tools, skins or creatures, giving gamers the chance to participate in play-to-earn games without having to cough up capital upfront. Lenders then take a cut of the crypto profit from gamers.

Play-to-earn games are popular in low-income countries, especially the Philippines, where Axie Infinity has become a national sensation. Currently, 40% of Axie players are from the Philippines.

According to a documentary titled Play-to-Earn: NFT Gaming in the Philippines, players in a rural community were able to cash out $300-$400 in the first few weeks of playing, which is more than many in the country would expect to earn in a month.

Gaming startups that provide scholarship programmes have raised millions in funding last year. Yield Guild Games, which is based in the Philippines, raised $4.6 million in its latest funding round in August, led by VC firm Andreesen Horowitz. In November, GuildFi completed a $6 million seed round, co-led by DeFiance Capital and Hashed.

The popularity of play-to-earn games has also given rise independent scholarship providers who are profiting from placing scholarships. Maxim de Clippelaar and Mick de Bock from the Netherlands told Fortune that they bootstrapped their rental service, Axie University, with $12,000 in August. All 50 scholars in their programme are from the Philippines.

Compared to Yield Guild, which gives gamers 70% of the profit, Axie University takes a 60% cut while gamers keep the remaining 40%. Axie University’s gamers are required to play every day and must meet a rising minimum threshold of earnings.

Axie University grosses just $5000 a month before paying scholars and investors with the rest of the revenue invested into breeding more Axies to rent out. However, a Redditor claimed that his brother was making $19,000 a month with his scholars on Axie Infinity.

In scholarship programmes offered by Yield Game Guild and Axie University, scholars can also increase their earnings by recruiting, managing and training new scholars, prompting several discussions on the Internet about whether the games and scholarship programmes are a pyramid scheme.

Axie University says that scholars can buy their own team and “graduate” once they’ve made enough money or stay on as a manager and earn a 50/50 or higher cut by renting out their own teams of gamers in addition to getting the 60/40 split as a scholar.

Being a scholarship provider also comes with risks as scholars who play using multiple accounts will get banned from the games, losing the provider the NFTs that have been rented out.

Stay up to date: