Quick take:

- GameCredits $GAME rocketed more than 160% earlier in the week before trimming gains towards the end.

- LooksRare $LOOKS rallied nearly 130% and shows no signs of slowing down.

- SwiftCoin also saw huge gains after advancing 135% while Origin Protocol, LUKSO and Altura also gained significantly.

In this edition of the weekly token boom report, the metaverse NFTs and collectibles tokens spiked significantly earlier in the week before pulling back towards the end. Only a few maintained an upward movement right to the end ahead of the NFT NYC event.

The Web3 tokens also benefitted from a significant capital injection from venture capital firms, with Immutable launching a $500 million fund to follow in the footsteps of the likes of Binance and Solana.

Elsewhere, renowned Web3 entrepreneurs and developers BMAN Lee and Huobi Global co-founder Jun Du teamed up to launch a $400 million fund to invest in Web3 builders.

Therefore, while the metaverse and NFTs and collectibles tokens may continue to experience market pressure, for the time being, it seems like the general outlook remains positive as venture capitalists continue to bet big on Web3.

Metaverse tokens

Over the last seven days, metaverse tokens spiked, then pulled back to end the week slightly higher than the previous week’s market cap of $9.9 billion with $10.1 billion.

The industry received another positive outlook report after McKinsey & Co followed in the footsteps of Morgan Stanley, Goldman Sachs, and Citigroup with a bold prediction that the metaverse could reach a market value of $5 trillion by 2030.

Venture capital continued to pour in with Revoland raising $10.6 million to build its battling arena game, while game development studio WildCard Alliance raised $46 million for its new blockchain gaming franchise.

GameCredits, LUKSO and Altura led gains in the metaverse tokens segment.

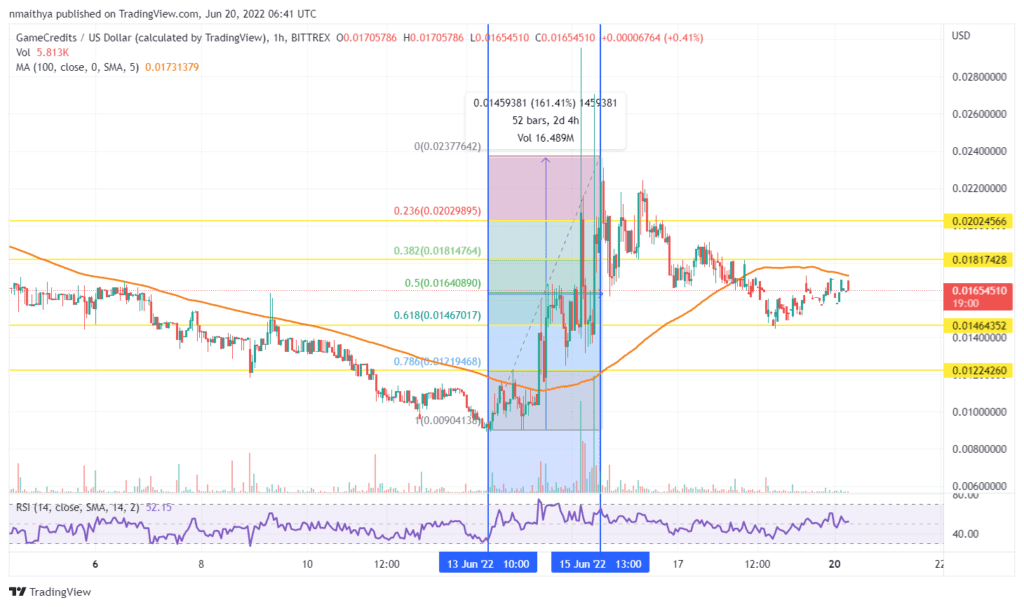

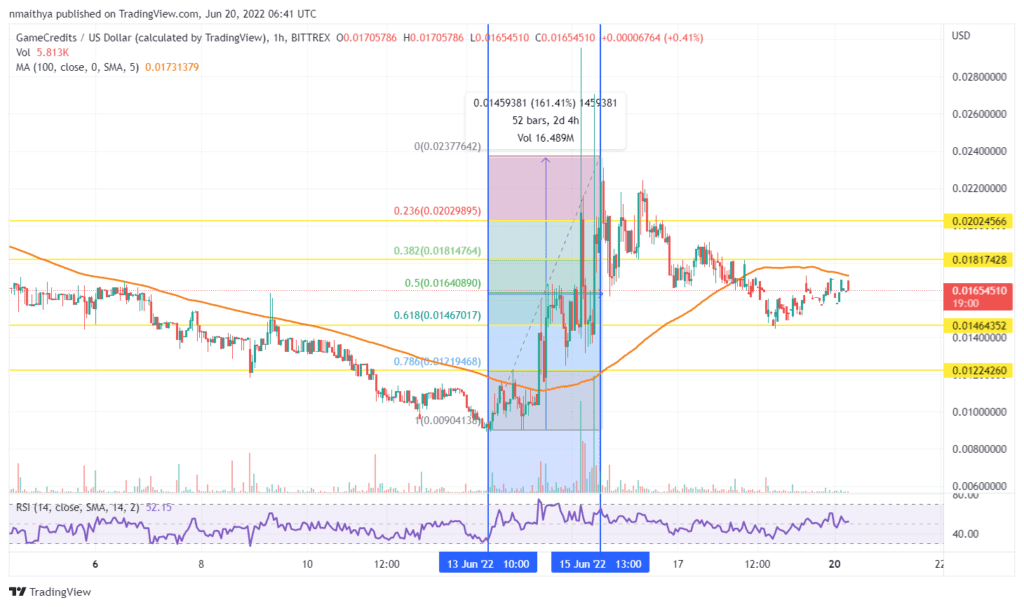

GameCredits (GAME/USD)

GameCredits is a decentralised metaverse game built on the Ethereum scaling protocol Polygon. The game is built by a community of game developers and will be managed by the community through its governance token $GENESIS.

GameCredits $GAME token is the utility token that is used for in-game items and NFTs, with the gaming universe called Genesis Worlds.

The $GAME token spiked more than 160% earlier last week before pulling back towards the end to trim the gains.

Technically, traders can target potential rebound profits at about $0.018, or higher at $0.020. On the other hand, if the pullback continued the $GAME token could find support at about $0.014, or lower at $0.012.

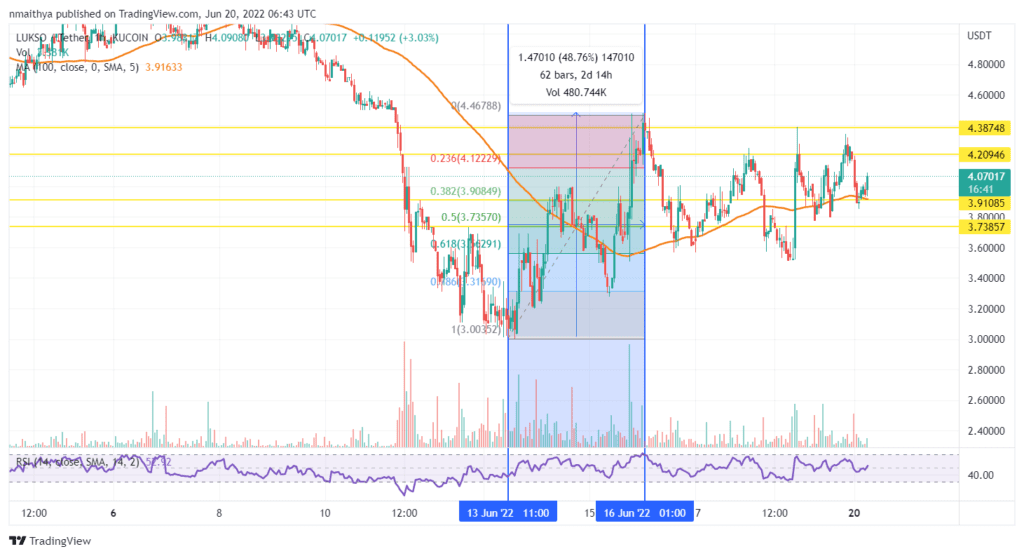

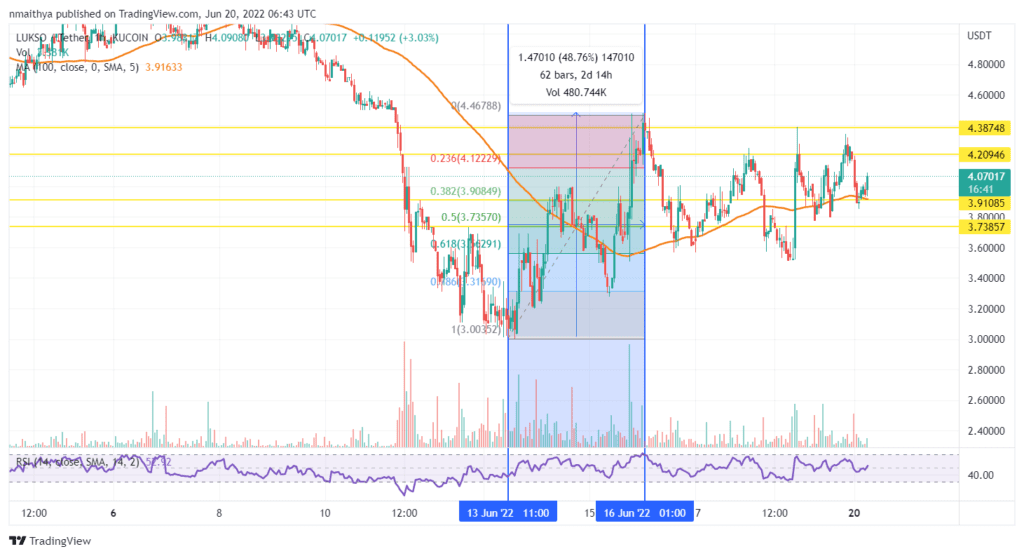

LUKSO (LYXE/USDT)

LUKSO is a multiverse blockchain network created to bring together fashion, gaming, design and social media. The platform is one of the leading proponents of creating an open metaverse to onboard masses to Web3 through smart contract technology.

Its ecosystem token $LXYE is used to make transactions within its expanding multiverse enabling users to buy in-game tokens, purchase fashion and design NFTs among others.

The $LYXE token spiked nearly 49% earlier last week before enduring a choppy period throughout the rest of the week. In the end, it closed slightly below its weekly high set on Tuesday.

Technically, traders could target potential rebounds at about $4.21, or higher at $4.39. On the other hand, $3.91 and $3.74 are crucial support zones.

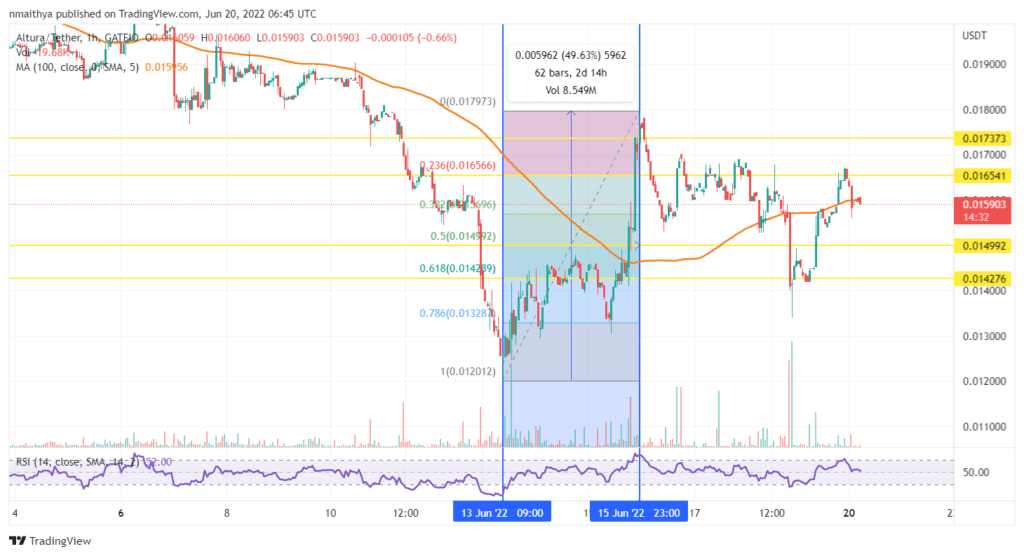

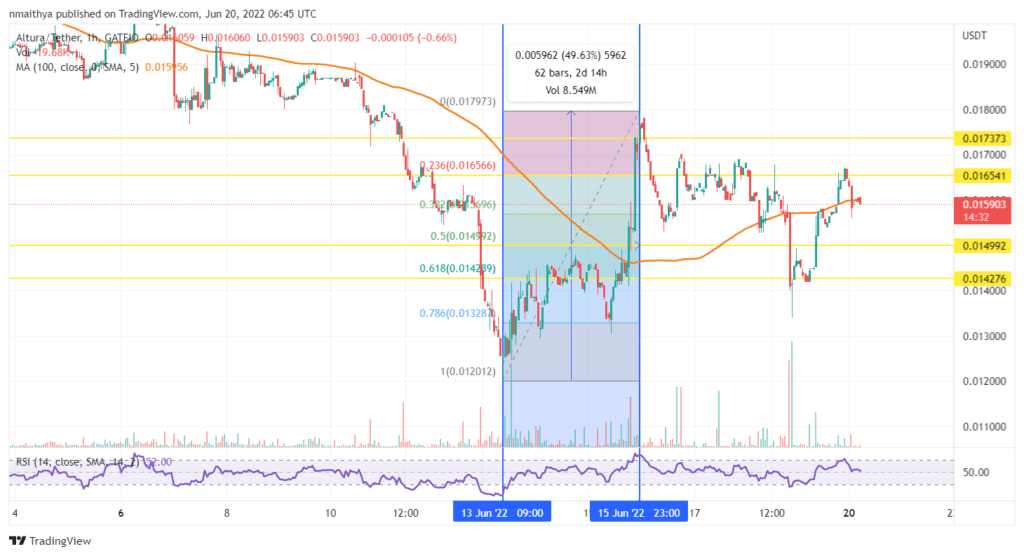

Altura (ALU/USDT)

Altura is a smart contracts platform that allows game developers to mint, distribute and transact smart NFTs for in-game items, allowing players to buy and sell as they wish in video game ecosystems.

Smart NFTs are becoming popular in the metaverse gaming arena because they can evolve with time under certain conditions.

Altura’s ecosystem token $ALU spiked nearly 50% earlier last week before pulling back slightly to trim the gains.It still closed higher than it opened.

Technically, traders could target potential upward profits at about $0.016, or higher at $0.017. On the other hand, $0.015 and $0.014 are crucial support zones.

NFTs and Collectibles tokens

Over the last seven days, NFTs and collectibles tokens experienced a slight decline in the total market cap, falling to $15.9 billion down from the previous week’s market value of $16.1 billion.

The decline in value comes ahead of a major NFT event in New York. The industry also received a boost amid significant venture funding.

Last week also saw the leading NFT marketplace begin its migration to the newly launched and more secure platform Seaport. Its daily translation volume has since fallen below highly incentivise NFT platform X2Y2.

LooksRare, which also overtook OpenSea in daily transaction volume has seen its ecosystem token $LOOKS spike significantly with SwiftCoin and Origin Protocol also rallying to end the week higher than they opened.

SwiftCoin (SWFTC/USDT)

SwiftCoin $SWFTC is the ecosystem cryptocurrency for Swift Blockchain. Swift operates as a cross-chain swap mechanism for DeFi and GameFi, as well as, a multichain wallet app, and an NFT aggregator for third-party platforms.

Swift has been adopted by multiple blockchains including BTC, ETH, Polygon, Arbitrum, Polkadot, BSC, Heco, Solana, Terra, Fantom and many more, as well as, all the leading NFT marketplaces.

SwiftCoin spiked more than 135% last week before pulling back to trim the gains.

Technically, traders could target potential rebound profits at about $0.0013, or higher at $0.0015. On the other hand, $0.0012 and $0.0011 are crucial support levels.

LooksRare (LOOKS/USD)

LooksRare NFT transaction volume has increased significantly over the last seven days. The platform surpassed OpenSea on Thursday to the second spot, behind X2Y2 after launching Spanish and French versions of its platform.

Since then the $LOOKS token has continued to gain, rallying 130% between Tuesday and Sunday.

Technically, traders could target extended gains at about $0.35 or higher at $0.37. On the other hand, if a pullback occurs, the $LOOKS token could find support at about $0.32, or lower at $0.29.

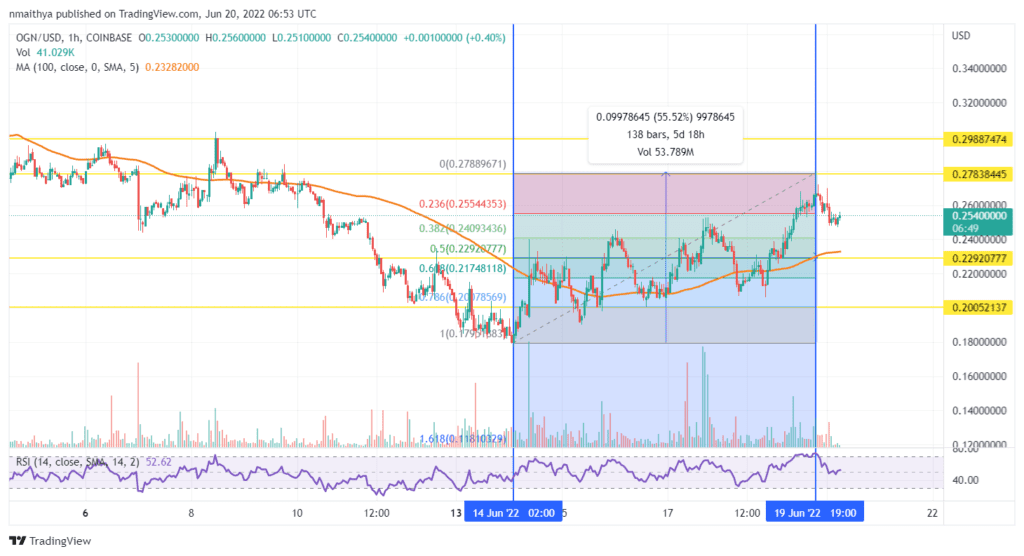

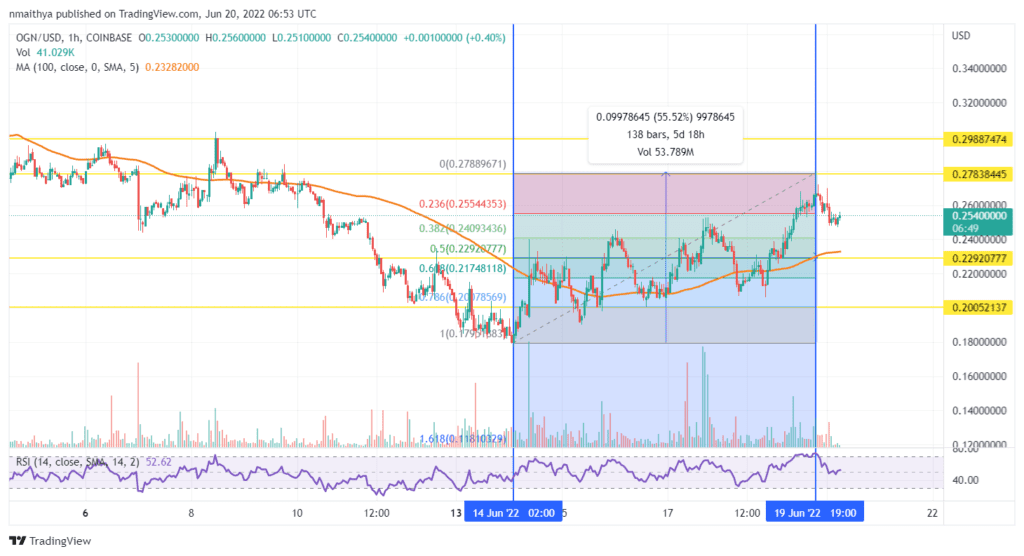

Origin Protocol (OGN/USD)

Origin Protocol is a blockchain platform focused on bringing NFTs and collectibles to the masses.

The platform wants to create Web3 versions of popular e-commerce apps that will rival their Web2 counterparts by providing users with ways to gain more from using the apps through utility NFTs.

Its ecosystem token $OGN is up more than 55% since Tuesday and shows no signs of slowing down.

Technically, traders could target extended gains at about $0.28, or higher at $0.30. On the other hand, if the pullback occurs, the $OGN token could find support at about $0.23, or lower at $0.20.

Stay up to date: