Quick take:

- Proven has announced a $15.8 million funding round led by Framework Ventures.

- The company is building a ZK-proof-based trust layer that enables exchanges, stablecoins, asset managers and custodians to safely and efficiently prove their solvency.

- Proven has already onboarded leading web3 companies, including Coinlist, Bitso, TrueUSD, and M11 Credit, among others.

Framework Ventures has invested in web3 startup Proven. The crypto-focused venture capital firm led Proven’s $15.8 million seed round according to a press release on Thursday. Former A16z GP, Balaji Srinivasan was among the angel investors joining the round.

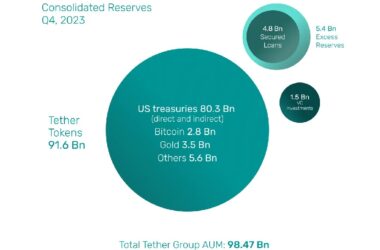

Proven is building a zero-knowledge proof-based trust layer for crypto service providers. The solution enables crypto exchanges, stablecoins, asset managers and custodians to prove their solvency to customers lenders and regulators on a daily basis. The company has already onboarded leading web3 companies, including Coinlist, Bitso, TrueUSD, and M11 Credit, among others.

Crypto companies using Proven’s ZK-proof-based solution can show their asset and liabilities without disclosing their balance sheets or any other sensitive information to the public.

The company’s proof-of-solvency solutions can also be run daily, thus increasing transparency and trust among customers, lenders and regulators.

Proven’s product is being built on the back of one of the biggest sagas in the crypto industry. Last year, popular crypto exchange company FTX collapsed leading to the arrest of founder and CEO Sam Bankman-Fried.

Since then, crypto exchange companies led by Binance have prioritised backing client funds with a dedicated reserve fund.

Proven is developing a solution that will allow companies to prove to their customers and other stakeholders how solvent they are without compromising their privacy.

Richard Dewey, Co-Founder of Proven highlighted the importance of this in the press release saying: “The last few months have highlighted an issue that has long plagued both traditional financial and digital asset firms – efficiently fostering trust with customers while maintaining a necessary level of privacy. The absence of this has led to significant distrust and, of course, contagion.”

According to Dewey, Proven is designed to enable “customers and regulators to have confidence in their exchanges, lenders, asset managers and stablecoins while at the same time protecting sensitive customer information.”

Proven’s team draws experience from some of the leading investment management companies with some of its team leaders having worked at Jane Street, PIMCO, Two Sigma, and Elm Partners.

Roy Learner, Partner at Framework Ventures commented: “Proven’s cutting-edge zero-knowledge approach to proving solvency, combined with the team’s track record in developing technology-based solutions across traditional finance and crypto, positions the company well to help the crypto ecosystem achieve its goal of fostering transparency and privacy simultaneously. We look forward to supporting this innovative team as they execute their mission.”

****

Stay up to date:

Subscribe to our newsletter using this link – we won’t spam!