Quick take:

- Leading NFT marketplace OpenSea rose to fame whilst being powered by Ethereum before integrating multiple blockchains.

- Polygon powers Reddit’s collectible avatars and NFT marketplace as well as Instagram’s upcoming NFT toolkit.

- Solana commands the second-largest share of the NFT market while Ripple is bringing more creators to the XRP Ledger.

Prior to the market downturn that has affected the NFT space in recent months, the market peaked in January with a global total sales volume of $4.7 billion according to CryptoSlam.

Bearish sentiment aside, there is no doubt that some blockchains are still having a massive impact on the NFT space, namely Ethereum, Polygon, Ripple, and Solana. These four networks have been dominating the NFT news headlines this year for different reasons.

Leading NFT marketplace, OpenSea, which launched in 2017, rose to fame whilst being powered by Ethereum. Last September, the marketplace announced that it will expand onto other blockchains beyond its main network, Ethereum, as well as Polygon and Klaytn the only other integrated networks at the time.

The symbiotic relationship of Ethereum & Polygon

As the NFT market’s blockchain of choice, Ethereum’s impact can’t be ignored as some of the best NFT marketplaces including Rarible, SuperRare, Foundation, and LooksRare were first developed on the Ethereum blockchain, just like OpenSea. With a majority of NFTs minted on Ethereum, the network still dominates the NFT market share.

Prior to Ethereum’s recent switch from a Proof-of-Work to Proof-of-Stake system, drastically reducing its carbon footprint by ~99.95%, Layer-2 networks have emerged to reduce the costly gas fees and speed up transactions on the blockchain as users sometimes faced congested network and exorbitant fees for minting NFTs. As its name suggests, Layer-2 networks are built on top of Ethereum which is a Layer-1 network, ultimately still relying on Ethereum to function.

Speaking of Layer-2 networks, Polygon has emerged as one of the biggest sidechain scaling solutions created not as an “Ethereum killer”, but rather to help Ethereum expand in efficiency, security, size, and usefulness. NFT marketplaces deployed on the Polygon network include OpenSea, Refinable, tofuNFT, and NFTrade, to name a few. It has also inked a high-profile partnership with Starbucks for an NFT loyalty program dubbed “Starbucks Odyssey” that will onboard its customers to Web3.

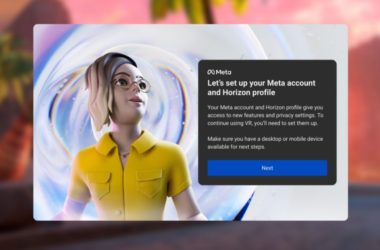

Besides that, Reddit’s successful collectible avatars, which recently passed $10 million in sales volume in three months, are Polygon-based. Today, Meta announced that it will soon allow creators to mint and sell NFTs in-app using the social networking platform’s end-to-end toolkit powered by Polygon, possibly onboarding one billion of Instagram’s active monthly users to Web3.

Solana & Ripple move past their controversial reputations

As for blockchains to rival Ethereum, Solana has been gaining ground in the last couple of months as it recorded higher daily trades volumes than Ethereum in September, according to Delphi Digital. It currently commands the second largest share of the NFT market as NFT sales on Solana surpassed $1 billion in January.

Despite its reputation for outages and network halts, Solana powers several NFT marketplace including the largest marketplace by volume on the network, Magic Eden, as well as SolSea, Fractal, Exchange.Art, Solanart, OpenSea and more. Some of the

Commenting on Solana’s success, Alex Fleseriu, CEO of Exchange.Art said: “Solana really distinguishes itself from other blockchains thanks to the community it’s built. It has one of the fastest developer ecosystems and there have been an onslaught of artists that have joined the Solana NFT community.”

Echoing Fleseriu’s sentiment, Rahul Sood, CEO and Co-Founder of Irreverent Labs added: “Solana built their entire brand around gaming NFTs, and the creator and arts community. Its transaction speeds are excellent, and the cost for transactions are very low as opposed to something like Ethereum whose gas fees can be incredibly high. As a game developer in blockchain, I can say that Solana is one of the more popular blockchains in the space.”

Even though Ripple has been embroiled in a lawsuit with the SEC since late 2020, and is better known for servicing the finances community with remittance and payments, it’s pushing forward with its NFT ambitions. It recently launched a $250 million creator fund with plans to provide creators with the technical and financial support needed to build web3 projects like NFTs and other ecosystem tokens on the XRP Ledger, a decentralised public blockchain.

According to Ripple, NFTs on the XRP Ledger were designed with efficiency in mind. With its XLS-20 (the standard for XRPL NFTs) developers can support more NFTs at lower cost and do things like leverage auction functionality and an efficient storage mechanism, direct a cut of secondary sales to the original minter on the XRPL, or even co-own NFTs.

“Ripple seems to be the preferred future protocol for transactions due to it’s fast speeds and low cost per transaction with minimal energy cost,” said Bob Bilbruck, CEO at Captjur, a consulting and business services firm.

Stay up to date: