- January 2023 saw a significant surge in NFT activity on OpenSea, with Polygon NFTs surpassing Ethereum NFTs in the number of NFTs traded for the second consecutive month.

- The NFT lending ecosystem reached an all-time high in terms of monthly loan volume, number of loans, and number of lenders and borrowers.

- BendDAO emerged as the largest NFT lending protocol in January, with a borrowed volume of over $36 million.

Ethereum and Polygon NFT Trading Volume Rises on OpenSea

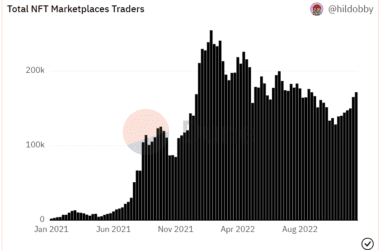

NFT activity on OpenSea, one of the largest NFT marketplaces, saw a significant surge in January 2023. The Ethereum NFTs recorded a trading volume of $444 million, the highest since August 2022, attracting 319,641 traders who sold 1,132,681 Ethereum NFTs on the platform.

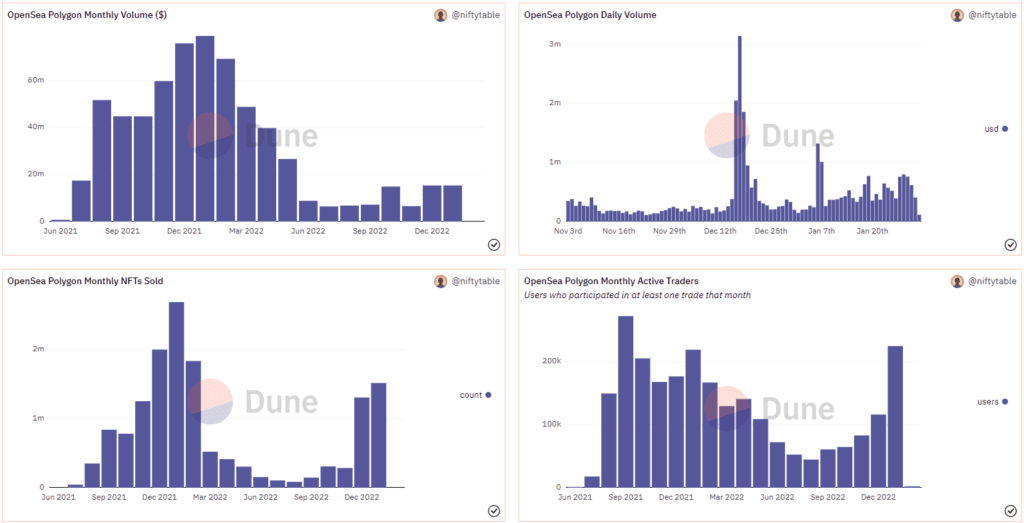

This marks the second consecutive month where the amount of Polygon NFTs traded on OpenSea surpassed Ethereum NFTs, with 1,514,895 NFTs traded in January and 1,305,244 in December 2022. The average Ethereum NFT trader traded $1390 in November and 3.54 NFTs on average.

However, the average Polygon NFT trader traded 7 NFTs, twice as much, but spent only $69. The monthly number of Polygon NFT traders reached an all-time high since September 2021, with 224,719 traders in January 2023.

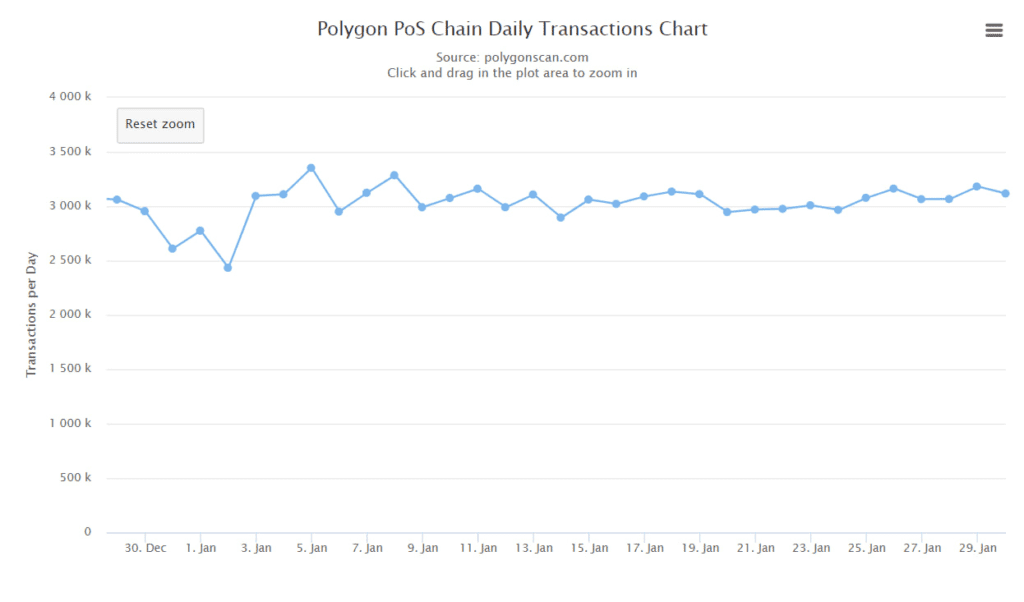

The Polygon PoS chain also recorded an average of 3,022,920 daily transactions in January 2023.

The NFT Lending Ecosystem Experiences Explosive Growth

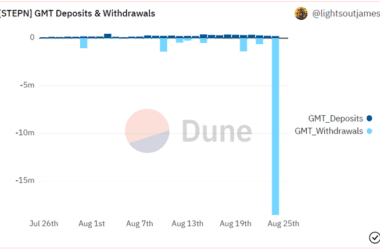

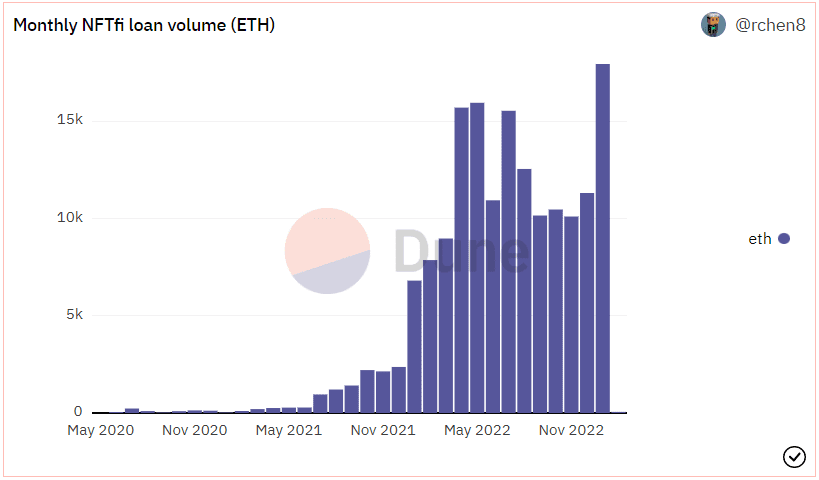

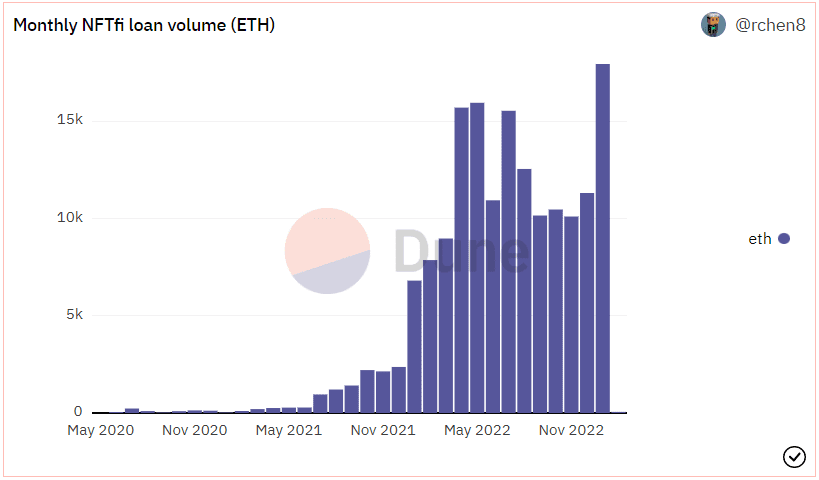

The NFT lending ecosystem also saw a remarkable increase in January, with an all-time high in terms of monthly loan volume and number of loans. A total of 17.9K ETH, worth approximately $28 million, was lent from 4,399 loans, attracting a record number of 616 borrowers and 291 lenders, resulting in a ratio of 2.12 borrowers per lender.

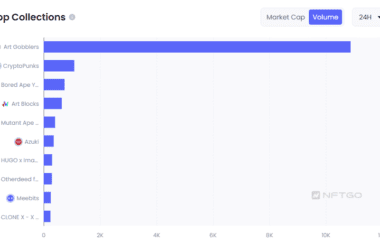

BendDAO emerged as the largest NFT lending protocol, with over $36 million borrowed in January, followed by NFTfi with $25 million, X2Y2 with $12 million, and Arcade with $7.8 million. With the increase in loans, the interest per loan has decreased, with lenders now paying $90 per loan. Wash trading among Ethereum NFTs in January was less than 0.6% of the total trade count.

****

Stay up to date:

Follow our On-Chain NFTs section to get daily NFT insights you won’t get anywhere else.

Subscribe to our newsletter using this link – we won’t spam!