Quick take:

- Decentraland rocketed more than 106% towards the end of the week to trim losses.

- PlayDapp and Victoria VR also witnessed significant rebounds.

- Splinterlands and WEMIX were among the best performers in the NFTs and collectibles tokens.

In this edition of the weekly token boom report, metaverse and NFTS & collections tokens extended the previous week’s declines earlier last week, before bouncing back to trim losses.

The market seems to be recovering from the massive plunge it suffered in the previous three weeks, with bears looking for cover and the bulls targeting rebound profits.

From an industry perspective, Flow blockchain launched a $725 million ecosystem fund to scale the product pipeline while KuCoin raised $150 million at a $10 billion valuation, reaching Decacorn status.

On the other hand, fraud detection and analytics firm Chainalyis raised $170 million to scale its fraud detection platform to include NFTs and other crypto assets.

Metaverse tokens

The crypto plunge swept across all segments of the industry pushing the metaverse tokens market cap to lows of about $8 billion earlier in the week before bouncing back to the current level of about $14.68 billion.

In the previous week, the total value of crypto tokens tied to the metaverse was $19 billion.

The industry got a slight boost from a series of fundraisings, including Irrelevant Labs’ $40 million fundraise led by Andreessen Horowitz, while MetaMetaverse launched the MetaShip NFT collection to pioneer cross-metaverse travel.

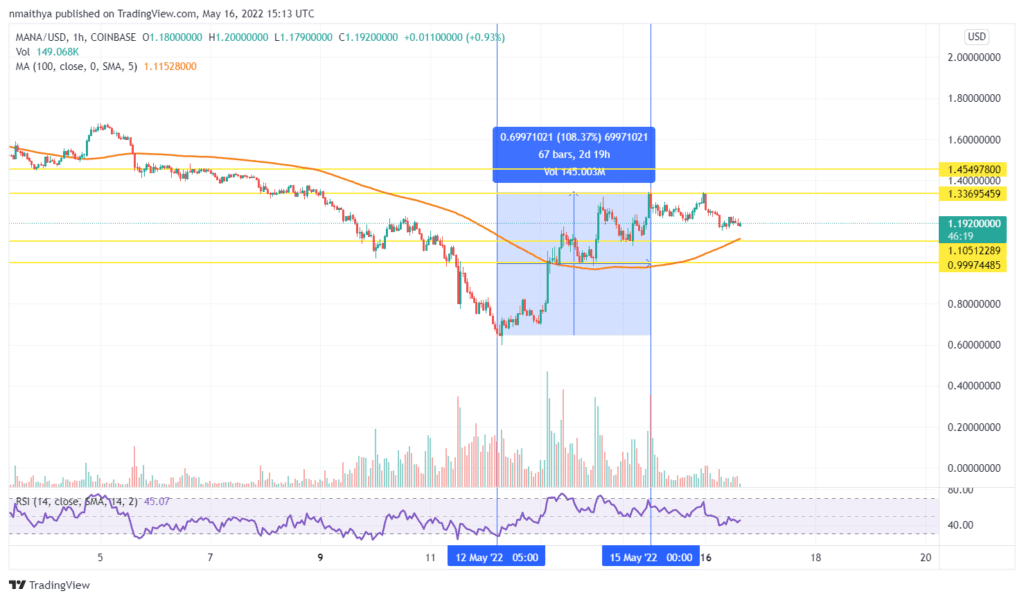

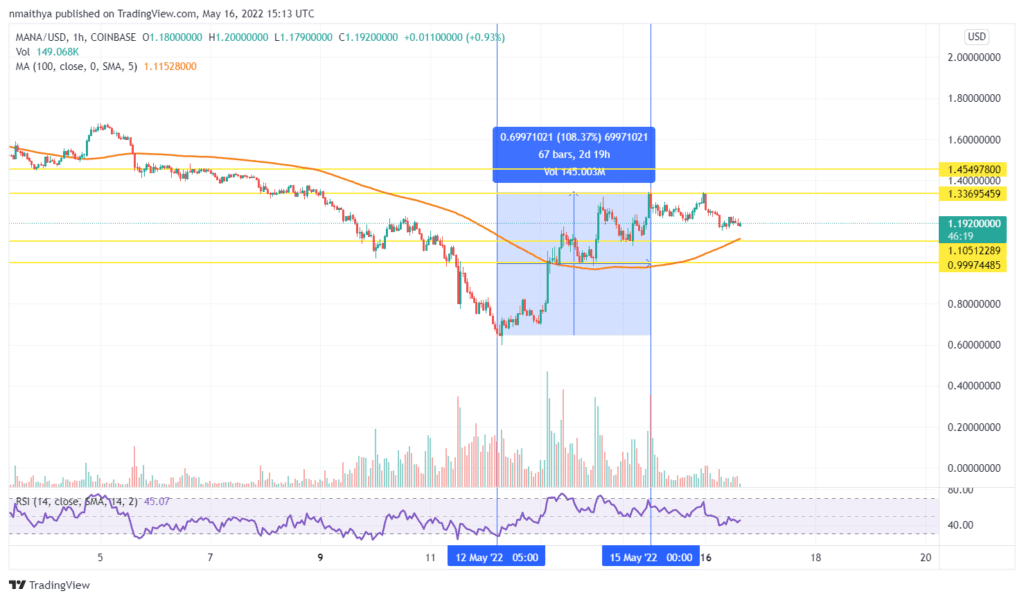

Decentraland token (MANA/USD)

Decentraland is one of the leading metaverse tokens, specialising in digital land sales and hosting experiential events.

Once the most popular token within the metaverse and NFTs and collectibles segments, it has since seeded ground to the new market favourite ApeCoin (APE/USD).

However, after plummeting to a low of about $0.60 on Thursday, $MANA has since rallied more than 106% to recoup losses.

Therefore, traders could target extended rebound profits at about $1.337, or higher ta $1.455. On the other hand, $1.105 and $0.999 are crucial support zones.

PlayDapp (PLA/USD)

PlayDapp $PLA is the utility token of the PlayDapp blockchain gaming ecosystem. PlayDapp users can earn $PLA by completing gaming quests, competing with other gamers or selling in-game assets.

The token is also used to purchase NFTs in the PlayDapp universe. Like most other metaverse and NFTs and collectibles tokens, the $PLA token was not spared by the bearish wave that swept crypto markets.

The $PLA token plummeted to lows of about $0.30 before bouncing back more than 95%. It has since pulled back slightly to halt the rebound.

Technically, $PLA token traders can target extended gains at about $0.60, or higher at $0.65. On the other hand, if the pullback continues, the token could fund support at about $0.51, or lower at $0.47.

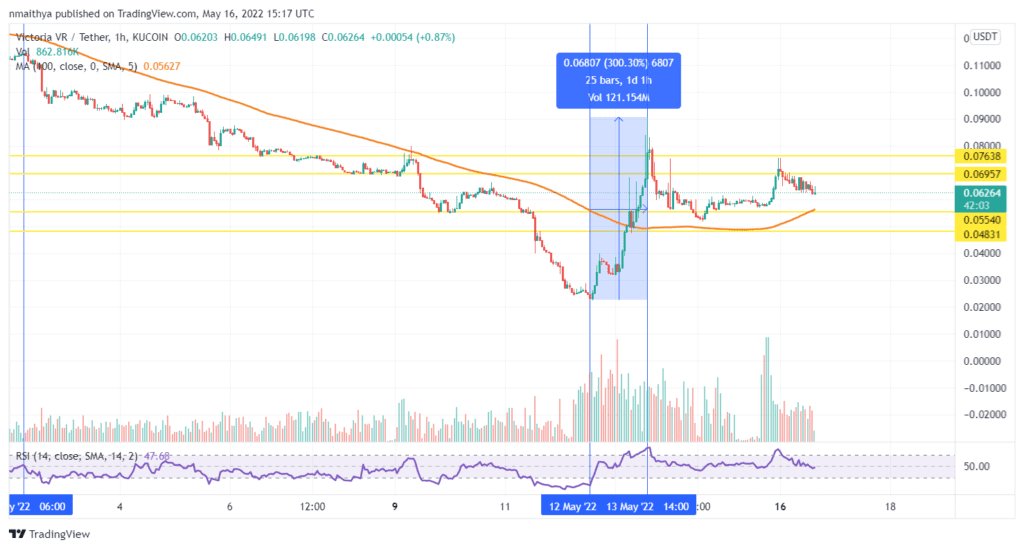

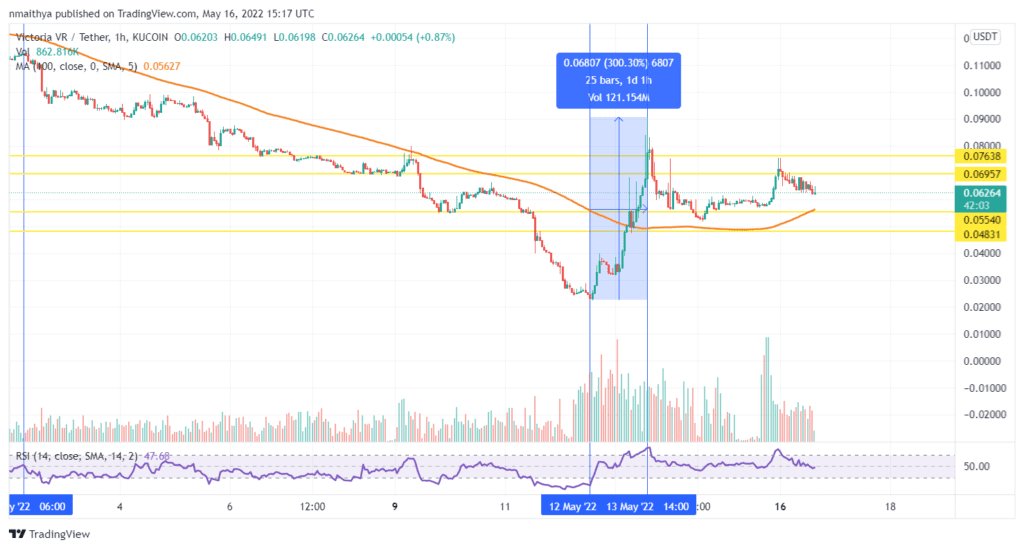

Victoria VR (VR/USDT)

Victoria VR is a Blockchain-based massively multiplayer online role-playing game (MMORPG). The game is built in Virtual Reality (VR) with realistic graphics built on Unreal Engine. It is run by the community through a decentralised autonomous organisation governed by its native token $VR.

The VR token is also used as the utility token enabling users to buy and sell in-game items, as well as, earn rewards.

The token bottomed at about $0.025 on Thursday, before spiking to hit a high of $0.090 on Friday. However, it has since pulled back significantly, creating another window of opportunity.

Technically, traders can target potential rebound profits at about $0.069, or higher at $0.076. On the other hand, $0.055 and $0.048 are crucial support zones.

NFTs and Collectibles tokens

Early last week, NFTs and Collectibles tokens fell to a total market cap of about $18.3 billion before bouncing back mid-week to the current level of about $23.8 billion. The segment maintains a bearish outlook amid the crypto crush, but the rebound towards the end of the week helped to trim the weekly losses.

CounterFind launched the first NFT takedown solution for intellectual property rights owners to help the industry rid of counterfeit NFTs. This is a positive development in an area that has contributed to several lawsuits pitting mainstream brands with digital creators.

Phantasma, Splinterlands and Wemix led gains in the market.

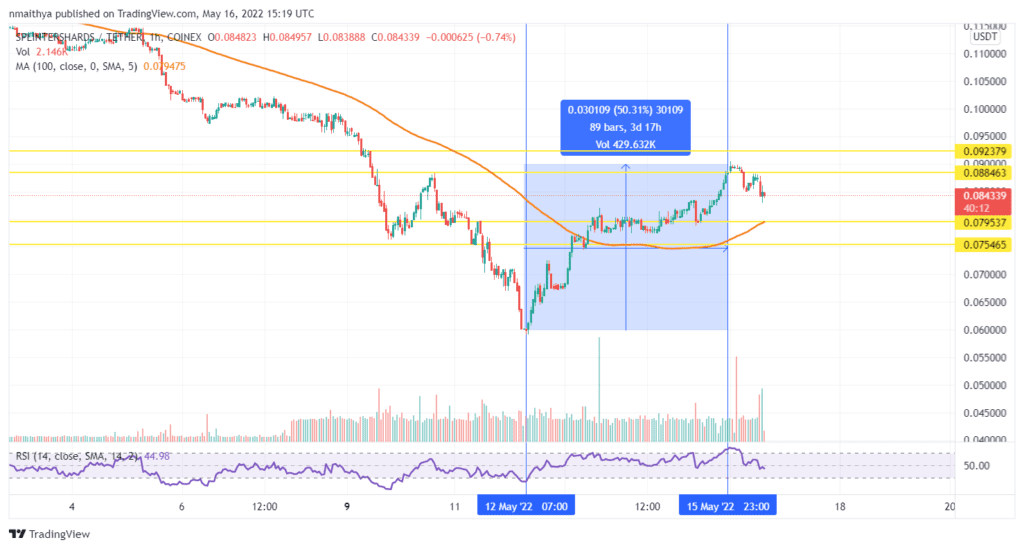

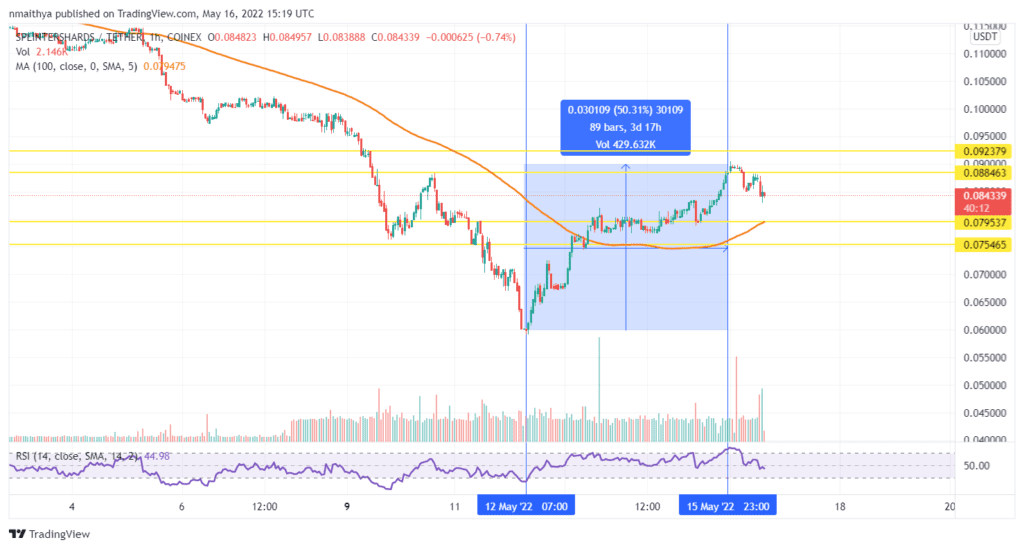

Splinterlands (SPS/USDT)

Splinterlands is one of the most popular NFT-based play-to-earn card games, having already exceeded 2 billion games played earlier this year. Its utility token SPS is used for among other things, buying in-game items.

Launched in 2018, the game has grown to dominate the NFT-gaming space, launching a decentralised autonomous organisation governance system last year. The SPS token can be used to vote on vital matters regarding the development of the game.

After plunging to a low of about $0.060, the $SPS token has since spiked more than 50% to end the 7-day period higher than it opened.

Therefore, traders could target extended gains at about $0.088, or higher at $0.092. On the other hand, $0.079 and $0.075 are crucial support levels.

Phantasma (SOUL/USDT)

Phantasma is a decentralised interoperable blockchain ecosystem with a dual-token mechanism and eco-friendly smart NFTs. The platform launched its mainnet in 2019, allowing blockchain game developers and NFT creators to launch eco-friendly projects.

The platform also allows the creation of time-based NFTs, multi-layered NFTs, and infused NFTs, among others. The $SOUL token bottomed at about $0.24 earlier in the week before spiking more than 114% to end the week higher than it opened.

Technically, the $SOUL token seems to have pulled back as of this writing, creating another entry opportunity. Therefore, traders can target potential rebond profits at about $0.43, or higher at $0.48. On the other hand, $0.36 and $0.32 are crucial support levels.

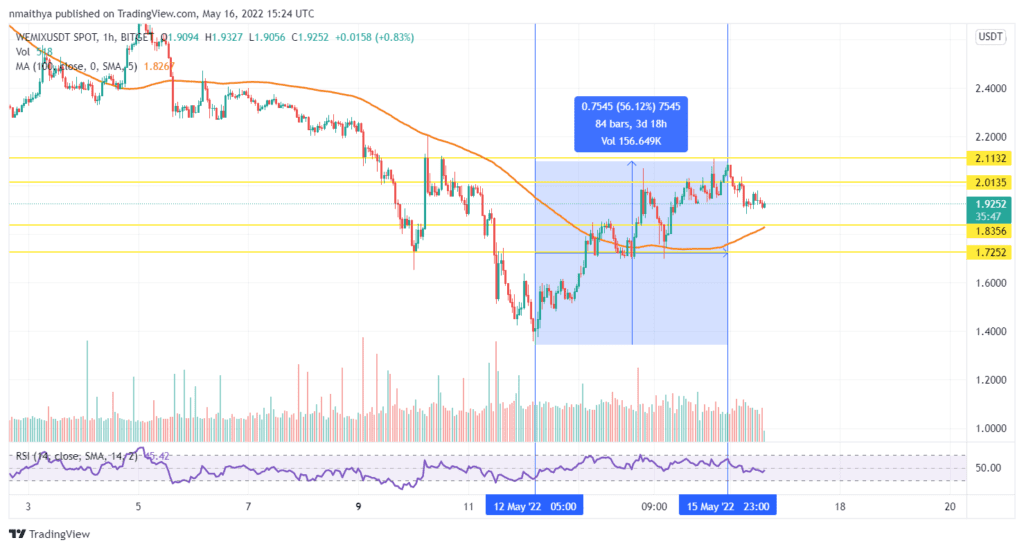

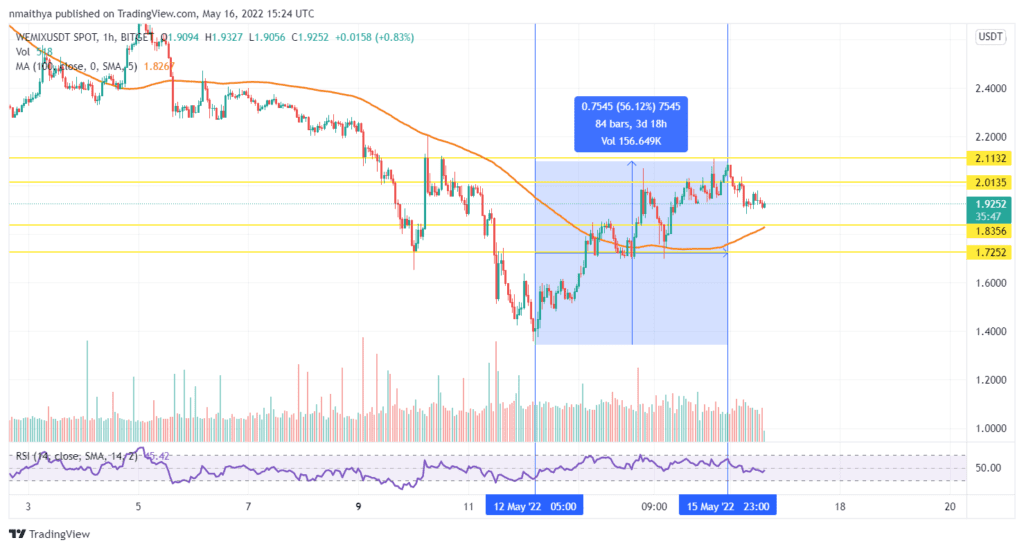

Wemix (WEMIX/USDT)

Wemix is a blockchain ecosystem created to offer seamless gaming experiences. The platform allows the creation of gaming projects that can run at low gas fees and high transaction speeds.

The platform also offers traditional game developers an easier opportunity to transition to blockchain gaming.

Its native token $WEMIX is used for transactions within its gaming ecosystem. After plummeting to about $1.40 earlier in the week, $WEMIX rallied more than 56% later in the week to end the week higher than it opened.

However, it has since pulled back slightly creating another entry opportunity.

Technically, traders can target potential rebound profits at about $2.01, or higher at $2.11. On the other hand, $1.83 and $1.72 are crucial support zones.

Stay up to date: