Quick take:

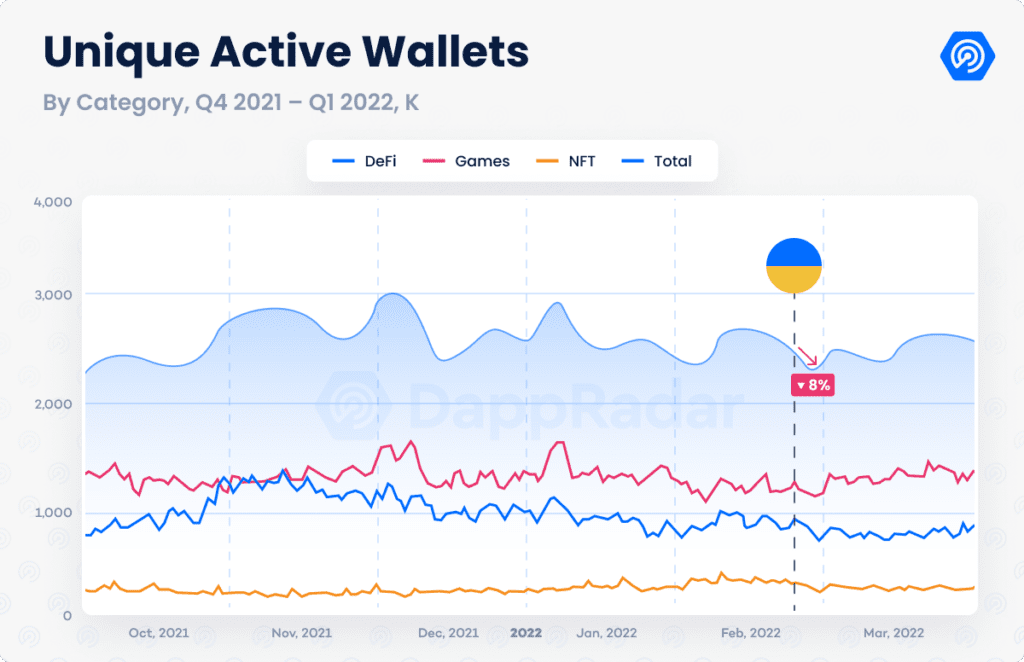

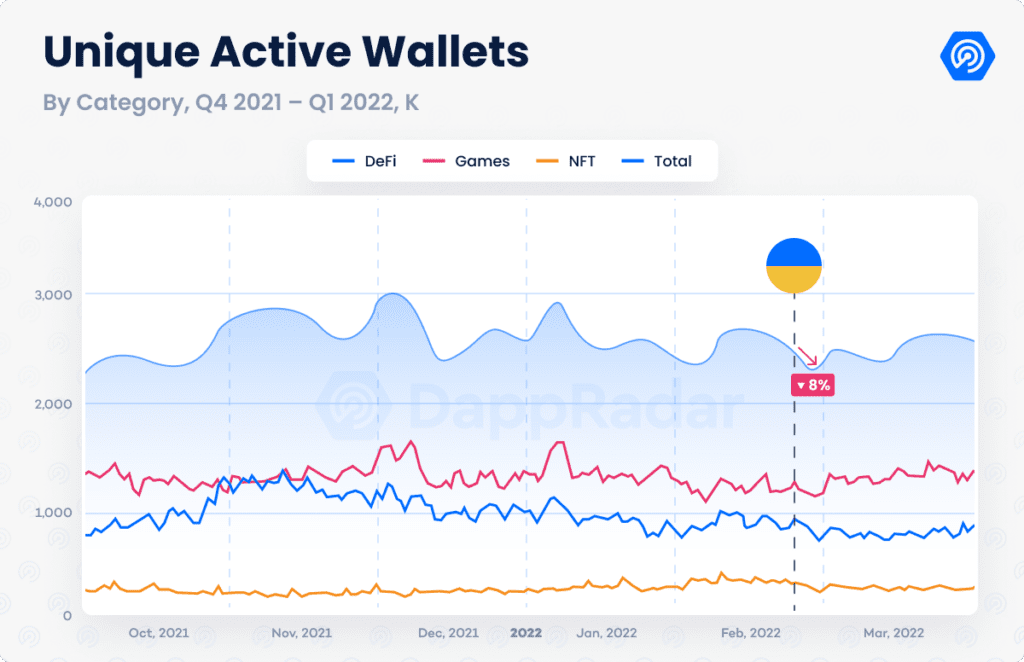

- The blockchain industry user activity increased by 396% in Q1 2022 from Q1 2021.

- However, usage declined sequentially by 5.8% from the October-December boom.

- Analysts at DappRadar attributed the decline to adverse global events and blockchain insecurity concerns.

The blockchain user activity slowed in Q1 2022 compared to figures reported in Q4 2021 due to increased insecurity concerns and unfavourable global events amid Russia’s invasion of Ukraine.

According to a report published by DappRadar on Wednesday, the industry registered 2.38 million daily active developer app users during the January-March quarter.

According to the report, blockchain user activity still registered 396% growth in Q1 from the same quarter a year ago, despite witnessing a slight sequential slowdown of 5.8% from the October-December boom.

Analysts from the blockchain analytics firm attributed the decline to unfavourable global events and a series of blockchain insecurity cases. The industry lost nearly $1.2 billion to hackers over the last three months.

Ronin, the bridging protocol for Sky Mavis’ popular blockchain game Axie Infinity was exploited for a whopping $625 million at the time of the initial report, while Solana’s equivalent Wormhole lost approximately $300 million in a similar incident.

The continued annual growth of the developer apps industry was largely driven by gaming ecosystems, which accounted for more than 1.2 million of the daily active users, an equivalent of 50.5%.

The non-fungible token (NFT) space continued to record huge transaction volume during the quarter, locking $12 billion, which excluded the massively inflated activity from LooksRare.

Venture capital activity also rose to new highs with the leading NFT marketplace raising $300 million at a market value of $13.3 billion. Hong Kong-based blockchain investment firm Animoca Brands also landed a $359 million windfall, valuing Yat Siu’s venture capital company at $5 billion while Bored Apes creator Yuga Labs completed a $450 million funding led by Andreessen Horowitz, giving it a market value of $4 billion.

Overall, venture capital firms poured $2.5 billion into blockchain games and infrastructure in Q1 2021.

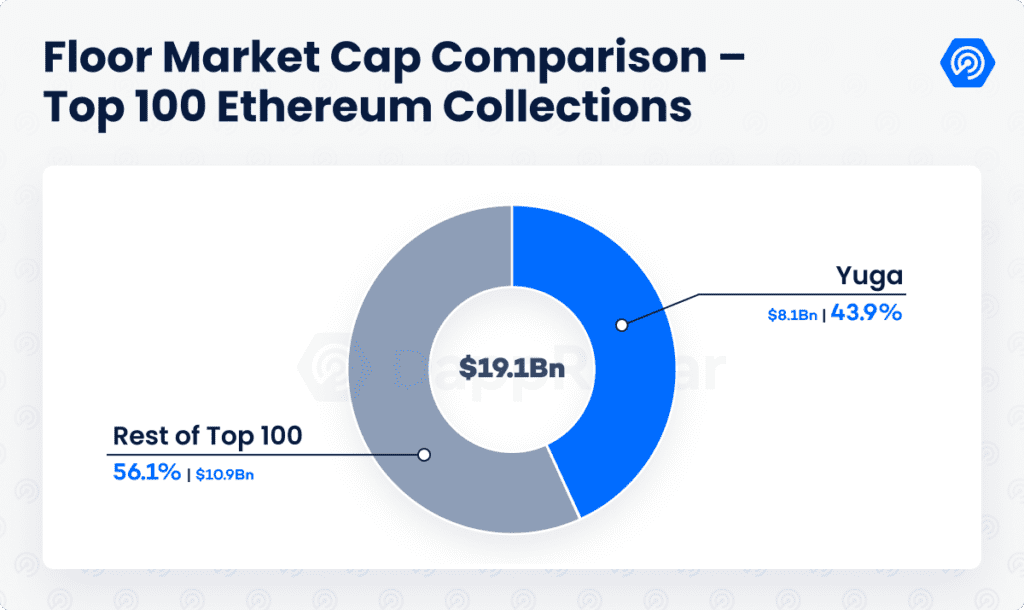

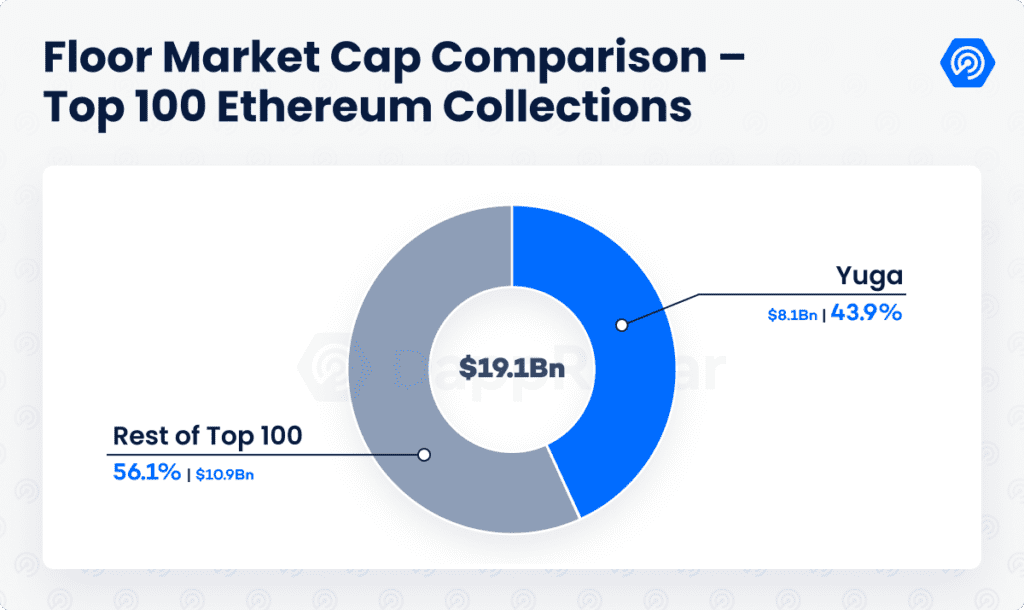

Yuga Labs now accounts for a majority of the industry’s overall floor value market capitalisation following its acquisition of Cryptopunks and Meebits from Larva Labs.

According to the data provided by DappRadar, Yuga contributed 43.9% of the total floor market cap with a value of $8.1 billion.

Commenting on the latest quarterly report on the blockchain industry, Modesta Masoit, Head of Finance and Research at DappRadar said “the industry is under a significant stress test and, so far, is handling things well and showing the true potential of cryptocurrencies and dapps.”

Masoit also highlighted how decentralised finance (DeFi) projects embraced GameFi in an attempt to appeal to a broader audience amid the explosive growth of blockchain gaming and the metaverse.

“NFT collectors have become savvier and seek actual utility as projects look to deliver on promises made and new projects keep emerging,” he said, adding that this is a testing period for GameFi and NFt investors, reminiscent of the post-2017 ICO.

“Now it’s time to see who’s in for the long haul.”

Stay up to date: