Last Updated on October 10, 2022

Quick take:

- Binance Labs has completed a $500 million fundraising for its Web3 fund.

- The venture capital arm of the world’s largest crypto exchange platform is looking to capitalise on the current bear market.

- The fund received backing from DST Global Partners and Breyer Capital and a host of undisclosed family offices and corporations.

Leading cryptocurrency exchange platform Binance’s venture arm has launched a $500 million fund to invest in early-stage Web3 startups. The company is taking advantage of the current downturn in the crypto market to broaden its presence in the industry.

The fundraising was backed by top venture capital firms including DST Global Partners and Breyer Capital, as well as, a host of undisclosed family offices and corporations.

Web3 is a term used to describe the next evolution of the internet. Proponents of the term believe that it is the next stage of the internet. Web3 is built on the decentralised ledger technology, blockchain.

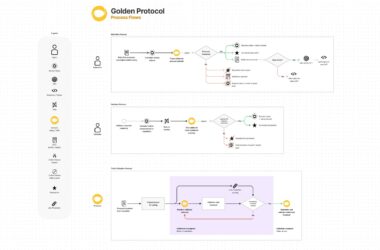

Binance wants to invest in companies dedicated to building the infrastructure and products that will power Web3.

Binance Labs has launched the fund at a time when the crypto market seems to be on a bearish run amid the collapse of cryptocurrency prices.

Experts believe that the crypto decline could filter down to the privately-held Web3 unicorns following its destructive impact on publicly listed crypto companies like Coinbase.

However, early-stage startups are not yet exposed to the potential adverse effects of the market because most of them have no revenue tied to the success of the crypto market.

Their valuation is based on the promise of the revolutionary potential of Web3 technology, which is the underlying technology used to build the metaverse.

Binance said its fund will target three verticals of Web3 investing including pre-seed, early-stage and growth equity. It will also be looking to invest in tokens and shares if it can find bargain opportunities.

Speaking to CNBC, Ken Li, Binance Labs’ executive director of investments and M&A said: “We are looking for projects with the potential to drive the growth of the Web3 ecosystem.”

These projects may include non-fungible tokens (NFTs) and decentralised autonomous organisations (DAOs), among others.

The company is looking to onboard more startups to the next iteration of the web with its new fund. Binance thinks the industry already has 300,000 to 500,000 Web3 startups.

Stay up to date: