Quick take:

- Binance on Thursday launched a lending feature on its NFT marketplace.

- The announcement comes following Blend’s successful debut month with its perpetual NFT loans product.

- Binance’s NFT lending service will initially offer ETH loans against blue-chip NFTs from BAYC, MAYC, Azuki and Doodles.

Binance has added a lending feature to its NFT marketplace. The leading crypto exchange company said on Thursday that it will start offering ETH loans against blue-chip NFTs from the Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), Azuki and Doodles collections. More collections are expected to be added in the near future.

The new feature will allow users to borrow crypto against their NFTs as collateral at competitive interest rates and zero gas fees.

Commenting on the announcement, Binance said that the feature will allow it to introduce the benefits of decentralised finance (DeFi) to its community.

Mayur Kamat, head of product at Binance said: “We’ve added a host of features that make it a one-stop shop for NFT trading and financial services for our community. We already have low fees and the Binance peace of mind, now NFT Loans will add a new form of liquidity for NFT holders, allowing them to participate in the market without having to let go of their precious NFTs.”

This announcement comes amid the rising popularity of crypto loans backed by NFTs as collateral. The buzz has been boosted by the launch of Blur’s perpetual NFT lending product Blend at the beginning of May.

However, while Blend utilises a peer-to-peer platform, allowing both borrowers and lenders to identify and complete a loan transaction, Bianance NFT’s feature utilises a peer-to-pool mechanism, with the crypto exchange platform’s NFT marketplaces acting as a pool for loans, which it says provides an additional layer of security.

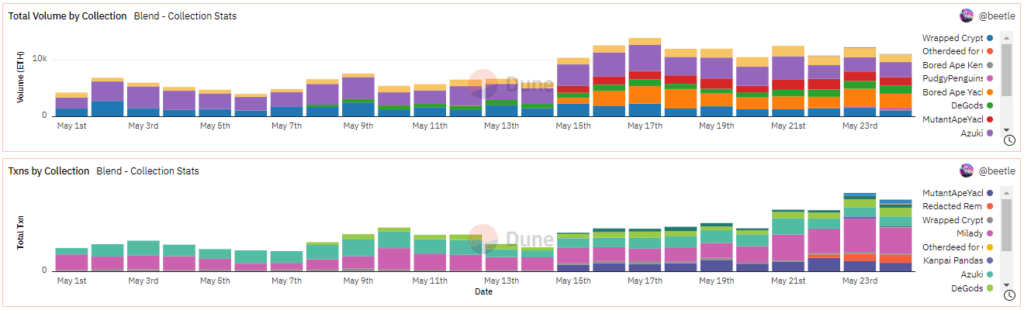

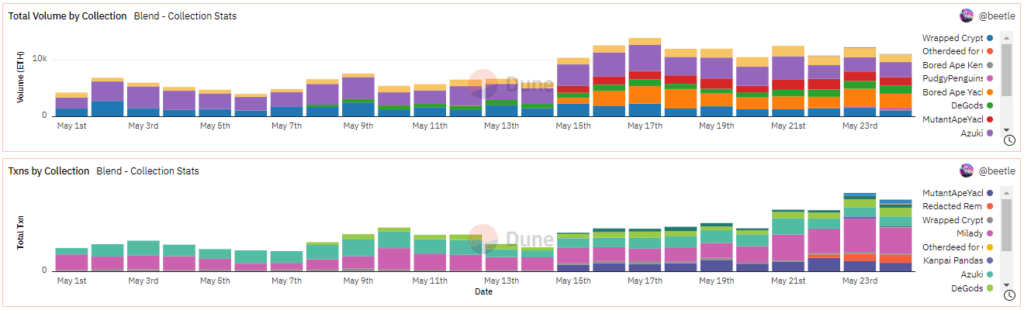

This is the most common type of NFT lending, popularised by platforms like BenDAO. But Blend’s product has recently witnessed increased traction, with more collections being added on a weekly basis according to a Dune Analytics dashboard prepared by on-chain researcher @Beetle.

The platform last week reached a total loan volume of $135 million barely two weeks after launch.

****

Stay up to date:

Subscribe to our newsletter using this link – we won’t spam!