Quick take:

- ApeCoin plunged more than 40% this week amid the crypto crash.

- LooksRare led the NFTs and Collectibles token collapse with a 50% decline.

- Stacks and Tezos were also among the biggest decliners last week.

In this edition of the weekly token boom report, venture capital funding continued to flow in despite the current collapse of the crypto market. The metaverse and NFTs & Collectibles tokens followed bitcoin and ethereum, plummeting by more than 50%.

London’s Felix Capital completed the largest funding round during the week after raising $600 million to invest in Web3 digital lifestyle startups. Solana Ventures also announced a $100 million fund for South Korean Web3 startups, while Ledger and Cathay teamed up to launch a $120 million fund.

Elsewhere, Thailand-based Ancient8 blockchain game raised $8 million, while SuperTeam closed a $10 million fundraising.

Metaverse Tokens

Metaverse tokens have plummeted to a market cap of $9.9 billion since Monday last week amid the current crypto industry crash. That is a significant decline from the previous week’s valuation of $13.22 billion.

While venture funding continued to flow in, this did not prevent leading metaverse tokens like ApeCoin, Stacks, and Render Token from extending declines.

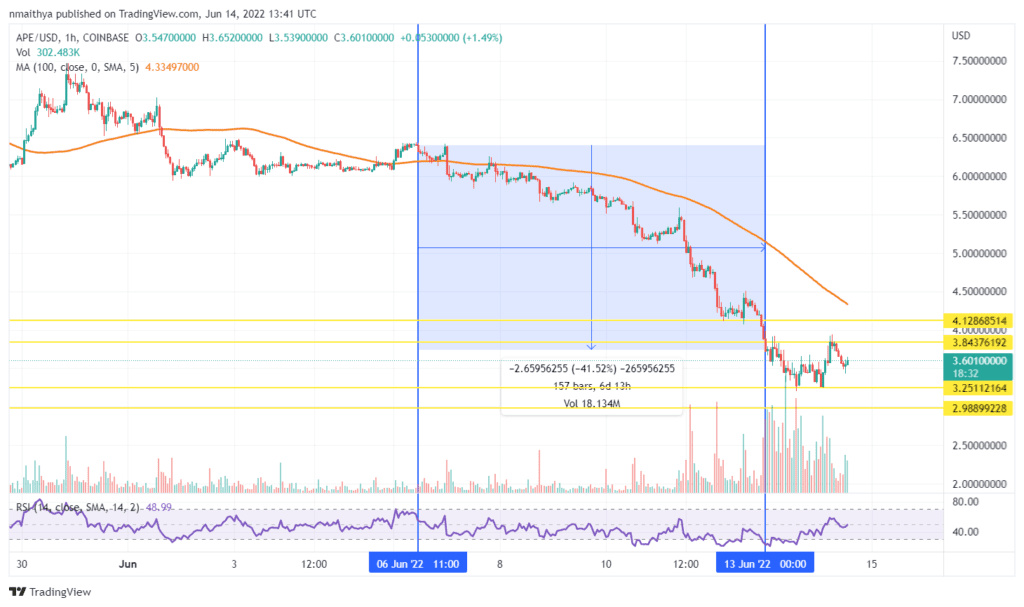

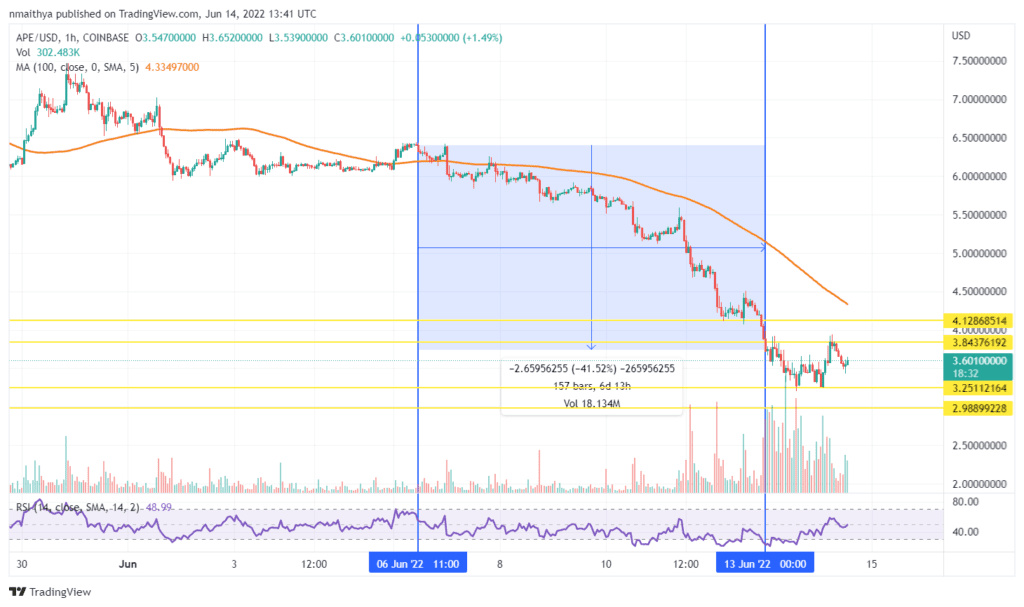

ApeCoin (APE/USD)

ApeCoin DAO last week voted to stay on Ethereum against moving to a Layer1 or Layer 2 blockchain platform. The decision seems to have accelerated the decline in the $APE token price, which fell by 41% during the week.

The organisation behind ApeCoin, Yuga Labs had announced earlier in the week the removal of a code that allowed it to mint an unlimited number of Bored Ape Yacht Club NFTs.

Technically, the $APE token price seems to have pulled back slightly following Monday’s attempted rebound. Therefore, traders could target potential rebond profits at about $3.84, or higher at $4.12. On the other hand, $2.98 and $3.25 are crucial support levels.

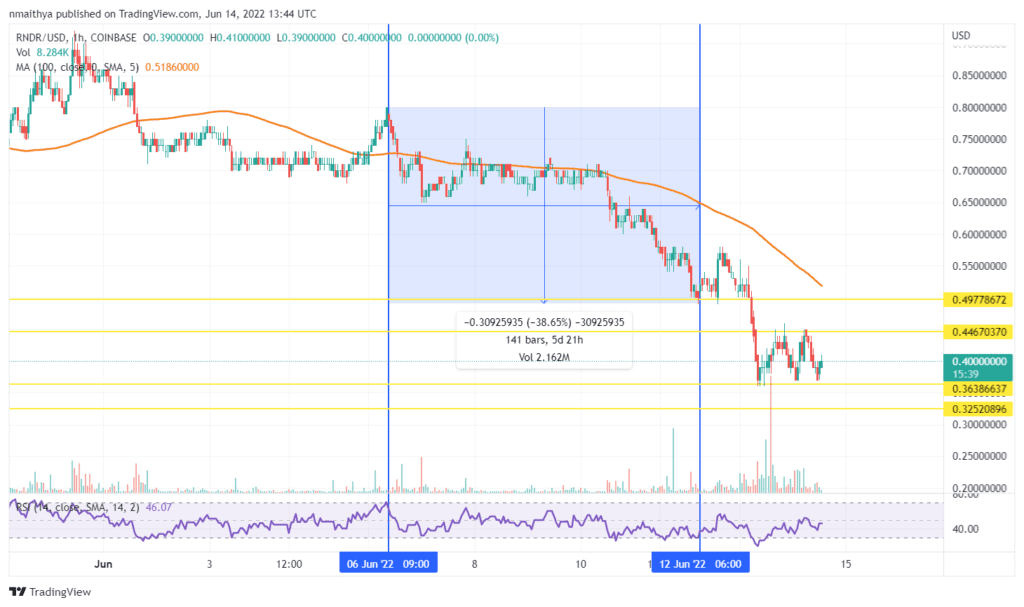

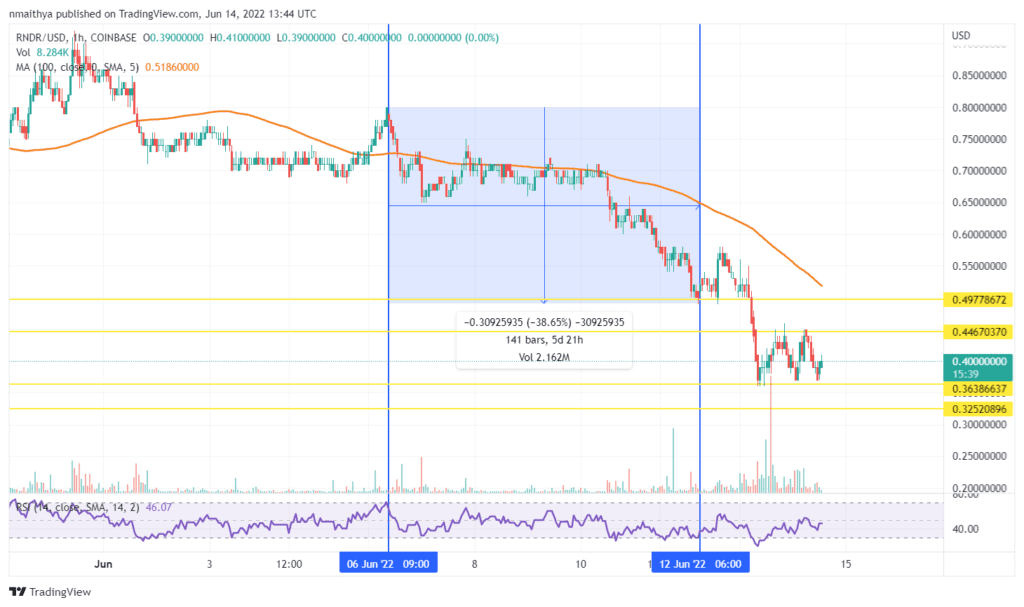

Render Token (RNDR/USD)

Render Token is a distributed Graphics Processing Unit rendering network built on the Ethereum network. The platform aims to link artists and develop studios looking to rent GPU computing power from mining partners willing to rent their GPU capacity out.

The native token $RNDR is used as currency within the ecosystem. Last week, it fell by nearly 40% along with the rest of the crypto industry. It has since extended the declines creating an exciting entry opportunity.

Technically, traders could target potential rebounds at about $0.446, or higher at $0.497. On the other hand, $0.363 and $0.325 are crucial support zones.

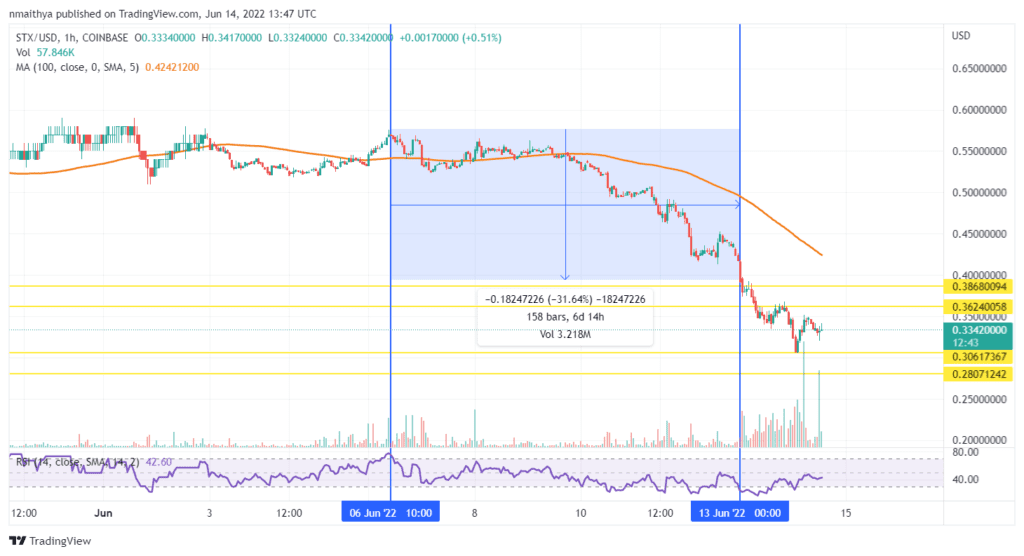

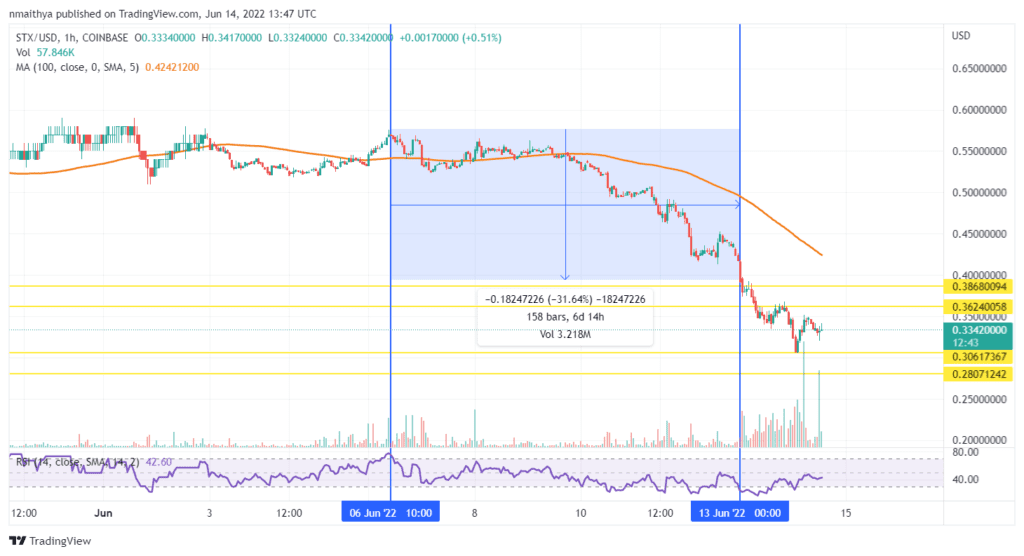

Stacks (STX/USD)

Stacks is a Layer 1 solution created to bring smart contracts and decentralised applications (dApps) to bitcoin. The contracts retain the security and authority of the bitcoin blockchain infrastructure whilst enabling developers to launch fast and low-cost transaction processing.

The $STX is the native token of the platform and is used to facilitate transactions within the ecosystem.

The $STX token last week fell more than 30% before extending declines on Monday.

Technically, traders can target potential rebounds at about $0.362, or higher at $0.386. On the other hand, $0.306 and $0.287 are crucial support levels.

NFTs and Collectibles Tokens

The market cap for non-fungible tokens (NFTs) and collectibles fell to $16.1 billion down from $22.3 billion in the previous week. The decline was led by LooksRare, which continues to face competition from its closest rival X2Y2.

Other tokens experiencing declines in the segment included the leading L1 blockchain developer app platform Tezos and liquidity supply platform SushiSwap.

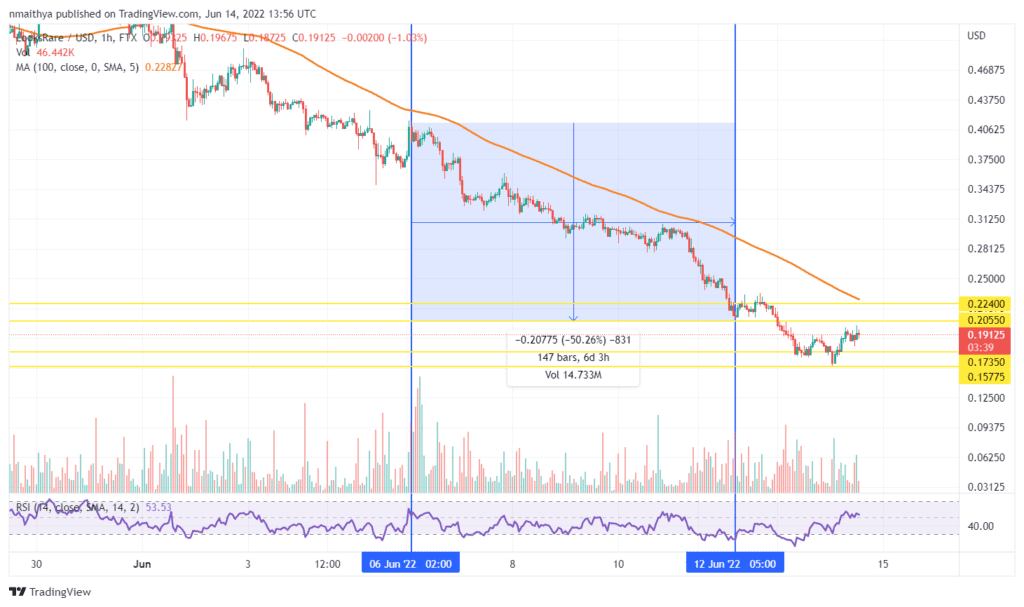

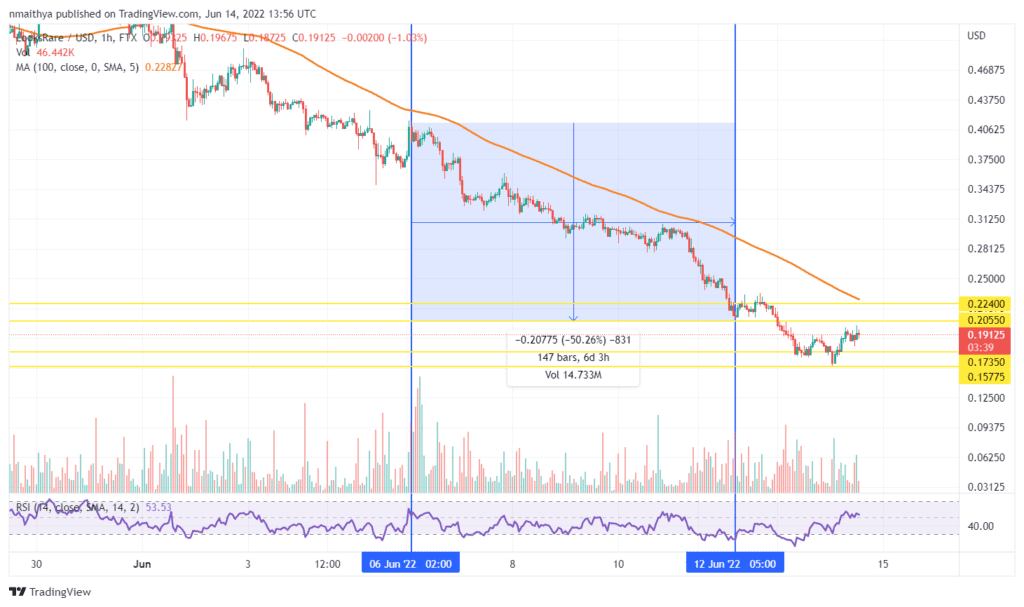

LooksRare (LOOKS/USD)

LooksRare is a highly incentivised NFT marketplace built to rival OpenSea by launching vampire attacks. However, after starting off well, the platform has since lost a significant share of the market back to OpenSea.

It has also recently faced stiff competition from another highly incentivised NFT marketplace called X2Y2. its native token is $LOOKS and is used among other things, to reward traders for their trading activity, as well as yield staking.

The $LOOKS token price plummeted by more than 50% last week. It has since extended declines to new lows.

Technically, traders could target potential rebound profits at about $0.20, or higher at $0.22. On the other hand, if the pullback continues, $LOOKS could find support at about $0.17, or lower at $0.15.

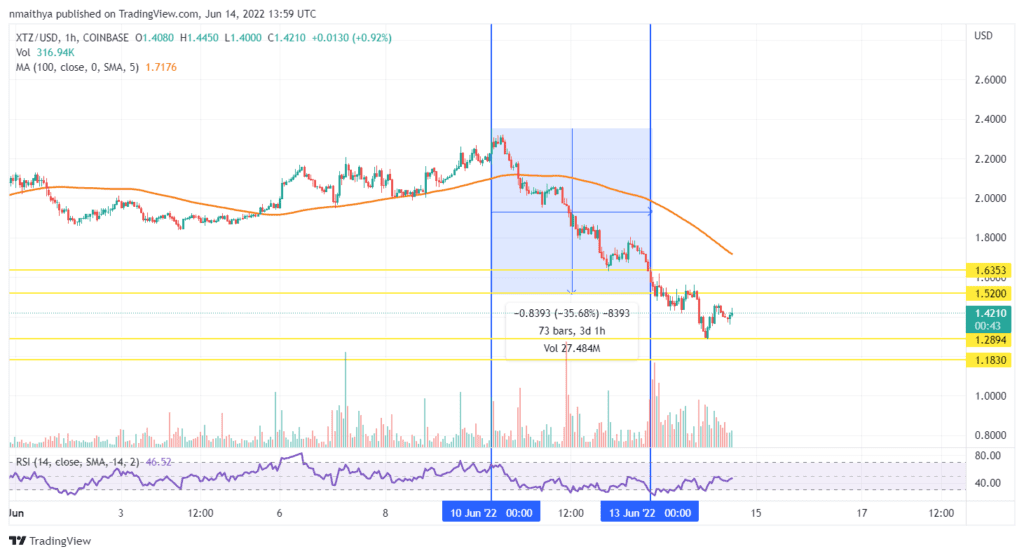

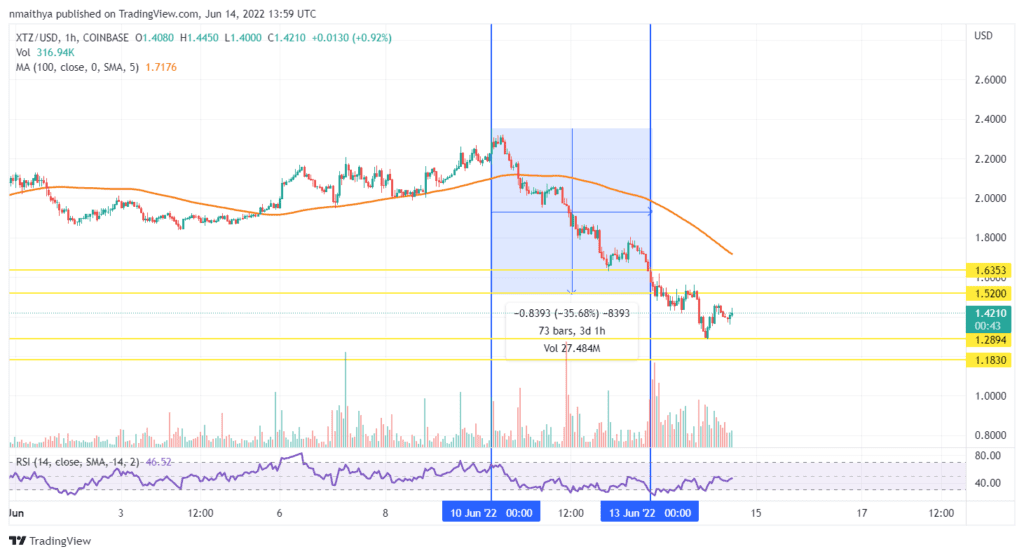

Tezos (XTZ/USD)

Tezos is a Layer 1 blockchain platform created to help developers launch projects with fast transaction speeds and low gas fees.

Tezos has emerged as a preferred choice of environmentally conscious developers looking to pivot into Web3gaming and NFTs.

The $XTZ token price was among the few that posted positive games between Monday and Friday last week. However, the price pulled back more than 35% during the weekend.

Technically, the XTZ token seems to have pulled back significantly to create another opportunity for buyers. Therefore, traders could target potential rebounds at about $1.52, or higher at $1.63. On the other hand, $1.28 and $1.18 are crucial support levels.

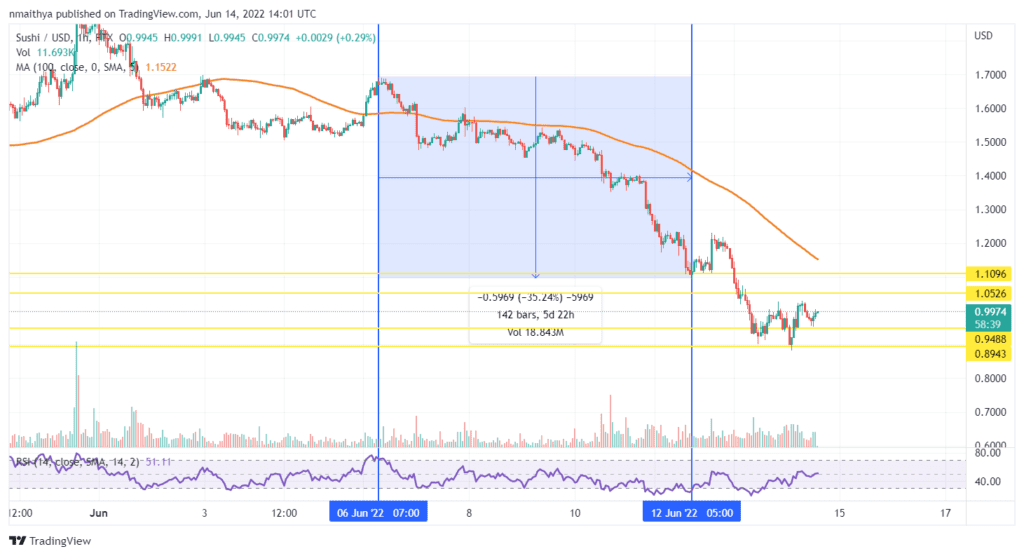

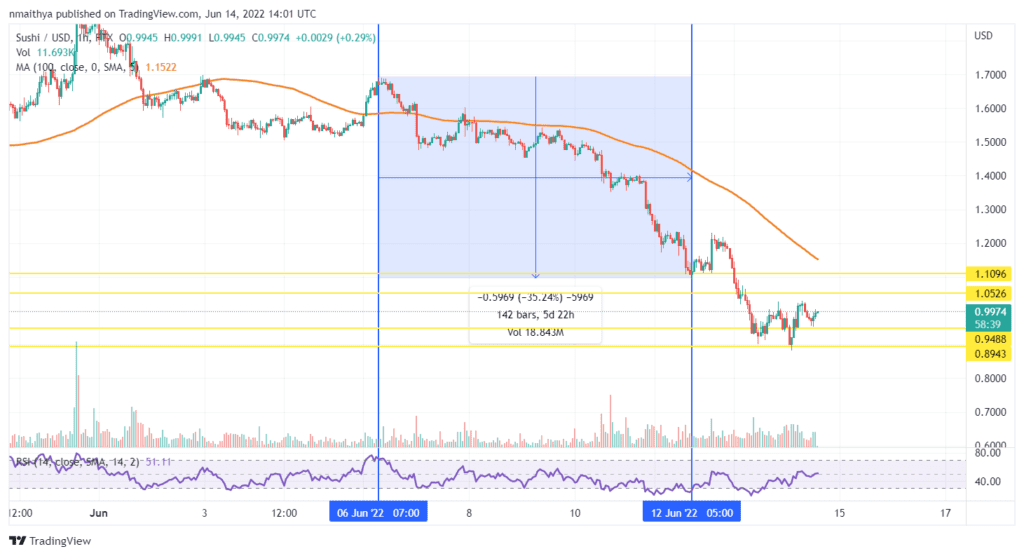

SushiSwap (SUSHI/USD)

SushiSwap is an automated market maker for cryptocurrency exchange platforms. The platform acts as a liquidity provider to smart contract-based tokens like DeFi, NFTs, and gaming utility tokens.

The native token $SUSHI is used to pay for token transaction fees on the SushiSwap platform. $SUSHI plummeted more than 35% last week amid the crypto collapse. It has since extended declines creating a more attractive opportunity to buy.

Technically, traders could target potential rebound profits at about $1.05, or higher at $1.10. On the other hand, if $SUSHI continues to decline, it could find support at about $0.94, or lower at $0.89.

Stay up to date: